Low Interest Rate Persons She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems. — Donald Trump BALTIMORE – With startling clarity, the presumptive Republican presidential nominee described himself – and Fed chief...

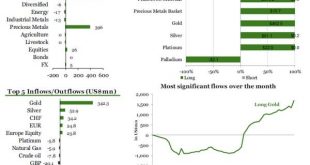

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

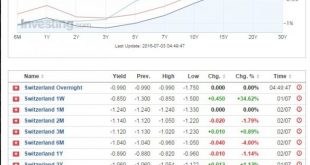

Read More »Swiss Bond Yields all Negative up to 30 years: Greatest Bubble in Financial History

Graham Summers says that central banks have lost control and investors are crazy. They pay the Swiss government for the right to own their bonds. One point is missing: Swiss rates are “more negative than others”, because investors expect a slow appreciation of the Swiss franc. Sometimes it’s critical to look clearly at the big picture. The big picture is that the financial world has allocated capital… trillions of...

Read More »When the Deep State Controls All Wealth

Investors have realized Brexit isn’t the end of the world. First, because they think it won’t really happen. After all, elites can fix elections, buy politicians, and control public policy… surely, they can fix this! A letter in the Financial Times reminds us that Swedish voters cast their ballots against nuclear power in 1980. The government just ignored them, doubling nuclear power generation over the next 36...

Read More »Why the Fed Will Talk Down the Dollar

The Only Move for the Fed is Talking Down the Dollar The Fed has no more maneuvers other than to jawbone the dollar lower. Because for a variety of reasons a strong dollar, in the current market environment, is akin to tighter monetary policy. The Eccles Building US dollar index over the past 2 years And right now, in the wake of Brexit, tighter monetary policy is clearly not an option. Plus, a stronger dollar (by...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »“Brexit Sends A Clear Message To Sick Political Elite” Marc Faber Sees “Only Good Contagion”

“We’re moving into a global recession that has nothing to do with Brexit,” warns Marc Faber stressing that Britain leaving the EU would not be disastrous, saying that if Switzerland can operate in a “single” market and outside of the EU so can Britain. “Brexit is a victory of ordinary people, common sense and people who are prepared to take responsibility for the sake of freedom against a political and...

Read More »Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk

Gold Surges 15% To £968 Per Ounce – BREXIT Creates EU Contagion Risk – Sterling and euro have fallen sharply on fx markets– Gold bullion surged 20% in sterling to £1,015/oz– Gold now 15% in higher in GBP at £967 per ounce– Gold 8% higher in EUR and 5% higher in USD– Stocks globally are down sharply – FTSE down 9%– European stocks down sharply– Euro Stoxx 50 Futures collapsed over 11% at the open– Bank shares are down 20% to 25%– Cameron has resigned – adding to uncertainty in markets–...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal. Jeff Gundlach confirmed as...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org