Within the world of central bank and government gold reserves, there is often an assumption that these gold holdings consist entirely of gold bullion bars. While this is true in some cases, it is not the fully story because many central banks and governments, such as the US, France, Italy, Switzerland, the UK and Venezuela, all hold an element of gold bullion coins as part of their official monetary gold reserves. These...

Read More »A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. Quite frankly, keeping tabs on it all is beyond human capacity. This also goes for the federal government. Even with all their data gatherers and number crunchers they are incapable of...

Read More »Need Safe havens: CHF or Gold?

A warped manifestation of the fear and greed trade-off that used to characterize investor behavior has developed, according to Bloomberg’s Richard Breslow. Asset managers are exhibiting the manic depressive drive to simultaneously throw caution to the wind, ignoring all risk metrics while plaintively bemoaning the lack of safe havens. S&P 500, 2016 EPS Expectations Fear and greed was a continuum, allowing for an...

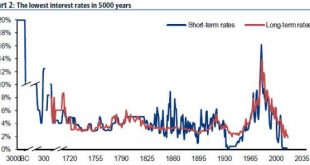

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Janet Yellen – Backtracking Again

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used...

Read More »Turning Stones Into Bread – The Japanese Miracle

Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen”? We will return to that question further below, but first a few words on the new Samurai futon. Apparently the Japanese are becoming more than a little antsy about Kuroda-san’s negative interest rate policy (and the threats of more of the...

Read More »Guided By Nonsense

Seven Year Achievement “Read the directions and directly you will be directed in the right direction.” — Lewis Carroll U.S. consumers are at it again. After a seven year hiatus they’re once again doing what they do best. They’re buying stuff. PCE: personal consumption expenditures up 1% According to the Commerce Department, personal consumption expenditures (PCE), which is the primary measure of consumer spending on goods and services in the U.S. economy, increased $119.2 billion in...

Read More »Notes from ECB Press Conference

ECB press conference June 2 2016 Held in Vienna with Governor Nowotny Keep key ECB interest rates unchanged Will be kept at present or lower for an extended period of time, exceeding asset purchase program (80bn per month) which will end March 2017 sector program will start June 8 TLTRO start in June New measures will strengthen growth in euro area through credit expansion Very low inflation must not become entrenched in second round effects through effects on wages and prices. ECB...

Read More »On the Road to Panicville

An Alert for the Global Posse of Liquidity Junkies In the summer of 2015 and again in December-February this year, global stock markets were rattled by weakness in the yuan’s exchange rate vs. the US dollar. Yuan weakness is widely held to exacerbate pressures on other (already weak) emerging market currencies, but more importantly, it is seen as a symptom of accelerating capital flight from China. USD-CNY, daily; onshore yuan rate USD-CNY, daily (a rising price denotes yuan weakness)...

Read More »Nigeria Currency Devaluation Looms As FX Forwards Crash To Record Lows

Despite US equity investors’ exuberance over bouncing crude oil prices, the world’s crude producers continue to suffer and while Venezuela is in the headlines every day (having already collapsed into chaos), Nigeria appears the nearest to that abyss next. Having urged investors “don’t panic” last year, and seeing dollar reserves drying up rapidly earlier this year, recent “lies” about the nation’s statistics have raised fears of a looming devaluation as FX forwards have crashed to 291...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org