In the spring of 2015 we showed something unexpected: one of the biggest buyers, and holders, of AAPL stock was none other than the already quite troubled – in the aftermath of its disastrous Swiss Franc peg which ended up costing it tens of billions in losses – largest hedge fund in Switzerland, its central bank, the Swiss National Bank. What is curious is that unlike the Fed, the hedge fund also known as the Swiss National Bank not only proudly admits it purchases stocks, ETFs and...

Read More »How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Panic, desperately tried to pull of his best "Draghi", up to and even stealing the ECB's trademark catch phrase, to wit: KURODA: POSSIBLE TO CUT NEGATIVE RATE FURTHER IF NEEDED KURODA: NO LIMIT TO MONETARY EASING MEASURES KURODA: WILL EXPAND EASING...

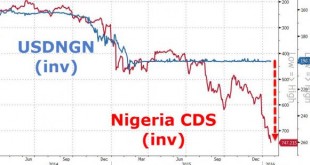

Read More »“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3.5bn in emergency loans to help fund a $15bn deficit in a budget heavy on public spending amid collapsing oil revenues. Just as we warned in December, the dollar shortage has arrived, perhaps now is time to panic after all. In September,...

Read More »BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is no ammo to lift stocks. An almost 200 point surge in Dow futures has been erased and Nikkei 225 has dropped 1000 points from its post BOJ highs... Dow futures have plunged... What a mess... And Nikkei has crashed over 1000 points... And...

Read More »Reserved: What Next for the Renminbi?

On November 30, the International Monetary Fund invited the renminbi to join the pound, euro, U.S. dollar, and yen in an exclusive club of international reserve currencies starting in October 2016. China has been working to make its currency a credible global player for at least two decades, and the nod from the IMF is a significant symbolic victory. Still, don’t expect central banks to scoop up mass quantities of renminbi just yet. Central banks currently hold only about one percent...

Read More »Diverging Toward Europe and Switzerland

December could be a big month for central bankers. The Federal Reserve is expected to make its first rate hike in nine years on December 16, while the European Central Bank is expected to announce further easing measures on December 3. The Swiss National Bank is likely to follow the ECB’s footsteps, sending deposit rates in the country even further into negative territory. Those moves, particularly combined with the divergence from American monetary policy, should provide a boost to European...

Read More »The markets’ pole star is fading

Published: 11th November 2015 Download issue: Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as...

Read More »Central banks are running out of steam

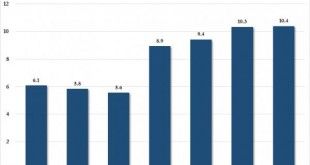

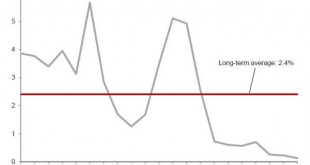

“After a long period when market volatility was relatively subdued, it has risen sharply this year. ” The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still […]

Read More »Higher market volatility should not preclude a rebound in DM equities

Published: 15th October 2015 Download issue: The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still represents a marked change from very subdued conditions in the previous two years. What explains the change? Higher market volatility at present...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org