The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates.

We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have to subtract inflation from the nominal rate, so to speak remove the illusion of inflation.

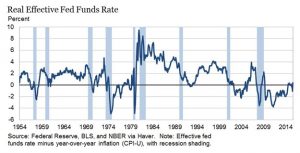

The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change)

Real interest rates have been negative fairly often, including for most of the period since 2009. The main problem consists of choosing the appropriate measure of inflation.

The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change)

Nominal vs. gold-adjusted treasury yields (actually, the calculation of “price inflation” or a “general level of prices” is not merely subjective – it is literally impossible)

Since the calculation of price inflation is highly subjective and easy to manipulate, one possibility is to adjust nominal prices to gold to calculate real interest rates. In the chart below you can see nominal U.S. 10-year Treasury rates versus gold-adjusted rates since 1962.

Nominal vs.

Read More »