A Witless Tool of the Deep State? Finance or politics? We don’t know which is jollier. The Republican presidential primary and Fed monetary policies seem to compete for headlines. Which can be most absurd? Which can be most outrageous? Which can get more page views? Politics, led by Donald J. Trump, was clearly in the lead… until Wednesday. Then, the money world, with Janet L. Yellen wearing the yellow jersey, spurted ahead in the Hilarity Run. A coo-coo for the stock market…...

Read More »Mossack Fonseca: The Nazi, CIA And Nevada Connections… And Why It’s Now Rothschild’s Turn

For all the media excitement about the disclosed names in the "Panama Papers" leak, in this case represented by the extensive list of Mossack Fonseca clients, this is not a story about which super wealthy individuals did everything in their power, both legal and illegal, to avoid taxes, preserve their financial anonymity, and generally preserve their wealth. After all, that's what they do, and it should not come as a surprise that they will always do that, especially following last year's...

Read More »Federal Devolution

Leaning Into the Wind BALTIMORE – During our lifetime, three Fed chiefs have faced a similar challenge. Each occupied the chairman’s seat at a time when “normalization” of interest rates was in order. Recently, we remembered William McChesney Martin, head of the U.S. Fed under the Truman, Eisenhower, Kennedy, Johnson, and Nixon administrations. Today, we compare Martin with two of his successors, Mr. Paul Volcker and Ms. Janet Yellen. We allow you to draw your own conclusion. Punchbowl...

Read More »The Path to the Final Crisis

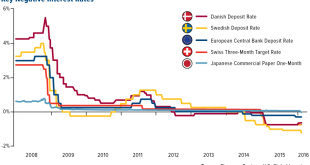

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided to reply to them in this post. The NIRP club – negative central bank deposit rates – click to enlarge. Before we get to the questions, a few general remarks: negative interest rates could not exist in an unhampered free market. They are an...

Read More »The Pitfalls of Currency Manipulation – A History of Interventionist Failure

The G-20 and Policy Coordination Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 plans” which were supposedly going to create “economic growth” by government decree seemed to have disappeared into the memory hole. These busybodies deciding to do nothing, is obviously the best thing that can possibly happen. Yuan, weekly –...

Read More »The Forex Rigging Irony

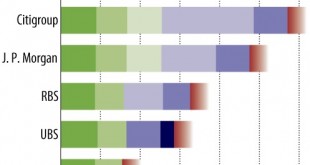

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it's economic data. That's because the vast majority don't understand how the Forex markets work. It's not insulting - it's a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions - but none against a central bank. Of...

Read More »The SNB and the Forex Rigging Irony

While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

Read More »Is the Dollar Bull Market Over?

Even in the fast-changing world of foreign exchange, investors have been able to count on one thing for the last two years – that the interest rate policies of central banks would be the primary driver of currency movements. The so-called divergence trade hinged on the Federal Reserve’s tightening bias relative to the easing bias of the European Central Bank and Bank of Japan and was a fairly reliable organizing principle for foreign-exchange investors. On a trade-weighted basis, the...

Read More »Gold Silver Ratio Says It’s Time to Buy Silver, Sell Gold

Gold Silver Ratio Says It’s Time to Buy Silver, Sell Gold Silver remains undervalued versus gold and the gold silver ratio suggests “selling the former” and “buying the latter” according to a Bloomberg article published today. “When the head of one of the world’s biggest silver streaming companies says he’s more bullish on his metal than gold, don’t dismiss him just for talking his own book. This chart suggests Silver Wheaton Corp. Chief Executive Officer Randy Smallwood may be right....

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org