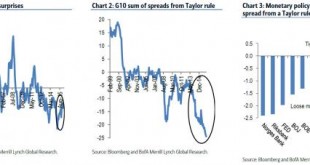

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as the market reaction to central bank policies this year reflects transition to a new regime, in which investors start speculating which central bank will have to give up easing policies first. The market has started testing the central banks In...

Read More »Yes, the Dollar Should Be Backed by Gold…

A Return to Gold Sorry boys and girls, you’ll have to start without us… Photo credit: Susan Candelario BUENOS AIRES, Argentina – “What if you were appointed to head the Fed? In your first week on the job, what would you do?” The question was not exactly serious. Neither was the answer. “We’d call in sick.” Drought, old age, traffic congestion, meanness, purple drink, bad taste, rap, suburbs, cancer, government, Hillary Clinton, restaurant music, shorts, Facebook, obesity – there are a...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It's official, I'm calling a banking crisis in Europe. Things didn't go well the last time I did this. Of course, many will say, "But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!". Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first...

Read More »ZIRP, NIRP, QE, Bank Collapse and Helicopters Coming Too Late – The Lehman Effect Hits Europe – Hard!

It’s official, I’m calling a banking crisis in Europe. Things didn’t go well the last time I did this. Of course, many will say, “But the rating agencies have learned their collective lessons. They would most assuredely warn us if the European banks are close to going bust, right?!!!”. Yeah, right! Reference our past research note on so-called trusted parties in private blockchains for banks. Those interested in purchasing the 22 page report on what is likely the first major bank to fall...

Read More »A Fatal Flaw in the System

The Hard Rocks of Real Life Photo credit: Andrei Shumskiy BALTIMORE – The Dow dropped 174 points on Thursday, the biggest fall in six weeks. Not the end of the world. Maybe not even the end of this year’s bounce-back bull run. As you’ll recall, stocks sold off at the beginning of the year, too. Then, investors were buoyed up after central banks got to work – jimmying the credit market on their behalf. The Fed swore off any further “normalization” until later in the year. Central banks...

Read More »Why Janet Yellen Can Never Normalize Interest Rates

No Return to Normal BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015. Economists at JPMorgan Chase put the U.S....

Read More »Why Janet Yellen Can Never Normalize Interest Rates

BALTIMORE – On Tuesday, the Dow sold off – down 133 points. Oil traded in the $36 range. And Donald J. Trump lost the Wisconsin primary to Ted Cruz. Overall, world stocks have held up well, despite cascading evidence of impending doom. With higher rates, Yellen risks corporate profits and bond defaults U.S. corporate profits have been in decline since the second quarter of 2015. Globally, 36 corporate bond issues have defaulted so far this year – up from 25 during the same period of 2015....

Read More »Big Players (Read: Governments) Make Markets Unsafe

Authored by Steve H. Hanke of the Johns Hopkins University. Follow him on Twitter @Steve_Hanke. Reportage in The Wall Street Journal on April 4th states that “A fund owned by China’s foreign-exchange regulator has been taking stakes in some of the country’s biggest banks, raising speculation that it may be a new member of the so-called ‘national team’ of investors the Chinese government unleashes to support its stock market.” Statists and interventionists around the world (read: `those who...

Read More »Frisky Yen Upsets Japan’s GOSPLAN

It Wasn’t Supposed to Do That… When you’re a central banker in a pure fiat money system and even your ability to print your own currency into oblivion is questioned by the markets, you really have a problem. This is actually funny on quite a number of levels if one thinks about it a bit… Haruhiko Kuroda (a.k.a. Kamikaze) is such a central banker. His valiant attempts to make Japan richer by making its citizens poorer is beginning to be rejected by Mr. Market: Kuroda-san’s latest monetary...

Read More »Rotten to the Core

Poison Money BALTIMORE – We live in a world of sin and sorrow, infected by a fraudulent democracy, Facebook, and a corrupt money system. Wheezing, weak, and weary from the exertion of trying to appear “normal,” the economy staggers on. Staggering on…. Image credit: David Sidmond Last week, we gained some insight into the ailment. Something in the diagnosis has puzzled us for years: How is it possible for the most advanced economy in the history of the world to make such a mess of its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org