The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates. We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have to subtract inflation from the nominal rate, so to speak remove the illusion of inflation. The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change) Real interest rates have been negative fairly often, including for most of the period since 2009. The main problem consists of choosing the appropriate measure of inflation. The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change) Nominal vs. gold-adjusted treasury yields (actually, the calculation of “price inflation” or a “general level of prices” is not merely subjective – it is literally impossible) Since the calculation of price inflation is highly subjective and easy to manipulate, one possibility is to adjust nominal prices to gold to calculate real interest rates. In the chart below you can see nominal U.S. 10-year Treasury rates versus gold-adjusted rates since 1962. Nominal vs.

Topics:

Dan Popescu considers the following as important: Central Banks, Chart Update, Featured, Gold and its price, negative rates, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discusses the use of negative rates.

We first have to define what we mean by negative interest rates. For nominal rates it’s simple. When the interest rate charged goes negative we have negative nominal rates. To get the real rate of interest we have to subtract inflation from the nominal rate, so to speak remove the illusion of inflation.

The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change)Real interest rates have been negative fairly often, including for most of the period since 2009. The main problem consists of choosing the appropriate measure of inflation. |

The “real” federal funds rate (effective FF rate minus CPI-U y/y rate of change) |

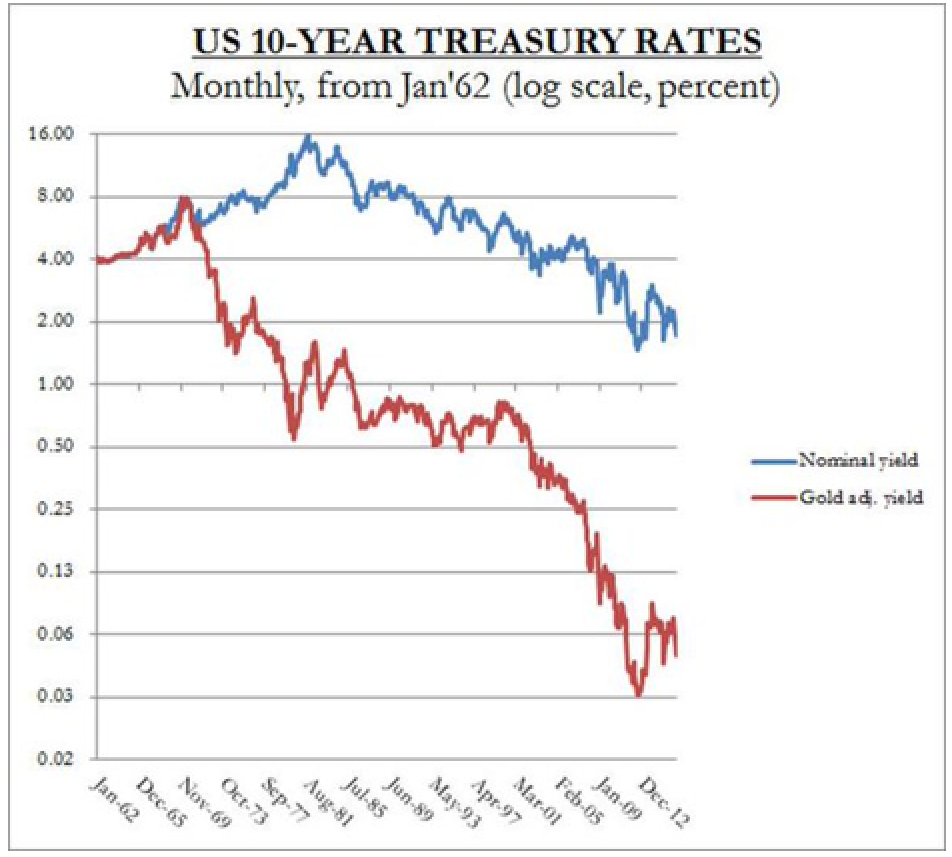

Nominal vs. gold-adjusted treasury yields (actually, the calculation of “price inflation” or a “general level of prices” is not merely subjective – it is literally impossible)Since the calculation of price inflation is highly subjective and easy to manipulate, one possibility is to adjust nominal prices to gold to calculate real interest rates. In the chart below you can see nominal U.S. 10-year Treasury rates versus gold-adjusted rates since 1962. |

Ben Bernanke says in his article:

“The fundamental economic constraint on how negative interest rates can go is that, beyond a certain point, people will just choose to hold currency, which pays zero interest. (It’s not convenient or safe for most people to hold large amounts of currency, but at a sufficiently negative interest rate, banks or other institutions could profit from holding cash, for a fee, on behalf of customers). Based on calculations of how much it would cost banks to store large quantities of currency in their vaults, the Fed staff concluded in 2010 that the interest rate paid on bank reserves in the U.S. could not practically be brought lower than about -0.35 percent.”

Well-known monetary quack Ben Bernanke, who in a way is the John Law of our times. He actually seems to think he knows something (no-one has told him differently, but they should), but if one looks closely at what he is writing and saying, it soon becomes clear how utterly simplistic and superficial his theoretical thinking really is. Moreover, he and his counterparts elsewhere couldn’t even forecast their way out of a paper bag, i.e., they are completely useless in practice as well. Bernanke e.g. denied for years that there was a housing bubble in the US, a bubble that was so glaringly obvious even blind Freddie and his dog (h/t JD) could see it. It is rather astonishing that people like him not only seem to believe they should manipulate the economy, but actually expect something good to come of it! One might be tempted to call this the triumph of hope over experience, but in reality it is simply incredible and unwarranted arrogance.

Well-known monetary quack Ben Bernanke, who in a way is the John Law of our times. He actually seems to think he knows something (no-one has told him differently, but they should), but if one looks closely at what he is writing and saying, it soon becomes clear how utterly simplistic and superficial his theoretical thinking really is. Moreover, he and his counterparts elsewhere couldn’t even forecast their way out of a paper bag, i.e., they are completely useless in practice as well. Bernanke e.g. denied for years that there was a housing bubble in the US, a bubble that was so glaringly obvious even blind Freddie and his dog (h/t JD) could see it. It is rather astonishing that people like him not only seem to believe they should manipulate the economy, but actually expect something good to come of it! One might be tempted to call this the triumph of hope over experience, but in reality it is simply incredible and unwarranted arrogance.

Photo credit: Getty Images

Rising Demand for Safes, Cash and Gold

In Japan, the European Union and Switzerland, where negative nominal interest rates have already been adopted, it was observed that demand for safes and cash increased. When negative rates took effect in mid-February in Japan, queries about home safes surged, especially from customers aged 50 and over. Sales of safes are now running some 40 to 50 percent above this time last year, according to a Reuters article.

In the European Union Reuters reports the same trend. The European Central Bank’s negative interest rates are sparking demand for safe deposit boxes, where bank customers can store cash to avoid the prospect of eventually having to pay interest on their account balances, German bankers told Reuters. The same trend was observed recently in Switzerland as well, not only with private investors but also with pension fund managers (see: “The War on Cash Migrates to Switzerland” for details).

At the same time, we learn that negative rates have boosted demand for gold in Japan. According to Takahiro Ito, chief manager at Tanaka Kikinzoku Kogyo K.K.’s store in Tokyo’s Ginza shopping district, “Many customers are wagering that it’s better to turn their savings to gold as a safe asset rather than deposit money at banks that offer low interest rates,” reports Bloomberg.

Sales of gold to Japanese consumers rose to 32.8 metric tonnes in 2015 from 17.9 tonnes a year earlier, Bloomberg reports in the same article. Gold bar sales climbed by 35 percent to 8,192 kilograms in the three months ended March 31 from a year earlier, according to Tanaka Kikinzoku Kogyo K.K., the country’s biggest bullion retailer.

A boom in safe-deposit-box companies was also observed in Switzerland in the canton of Ticino. The rising popularity of safe-deposit boxes has created a boom for jewelers along Lugano’s Via Nassa, home to Cartier, Bulgari, and Bucherer boutiques, as people race to convert cash into assets they can lock away. Bloomberg reports:

“Investors are buying more gold as an alternative to holding Swiss franc cash deposits, according to Vontobel Holding AG, a Swiss bank and wealth manager… “We keep noticing that gold is coming back into favour with investors,” said Vontobel’s Chief Executive Officer Zeno Staub.”

In a negative interest environment, gold is the best way to store large amounts of cash. A gold coin of 1 troy ounce (31.1 grams) stores about $1,250 while a one-kilogram bar of gold stores about $39,620 today and is just about the size of your palm.

With the looming threat of cash bans and with the one-hundred-dollar bill the largest denomination both in the U.S. and Canada, one can easily see the advantage of holding gold in a safe or under the mattress. In the European Union there is also talk of banning large euro denominations like the 500-euro bill. The largest denomination in the UK is just 50 pounds.

$40,000 in gold – the fact that gold doesn’t take up much space and that no government can actually order humanity to forget that it is the money of the free market, are among the many reasons that make it an ideal store of value.

$40,000 in gold – the fact that gold doesn’t take up much space and that no government can actually order humanity to forget that it is the money of the free market, are among the many reasons that make it an ideal store of value.

Negative Rates and Cash Bans

But negative interest rates also increase the cost of doing business for banks, which find it hard to pass these costs on to borrowers. They are therefore weakening the banking system. This also encourages people to buy gold and hold it outside the banking system, despite the inconveniences.

It is for this reason some economists are associating negative interest rates with a ban on physical currency. In order to impose negative rates effectively, the government must have control of people’s cash. The State can easily control access to electronic money by limiting the amount of withdrawals from the banking system just with a small adjustment in the software.

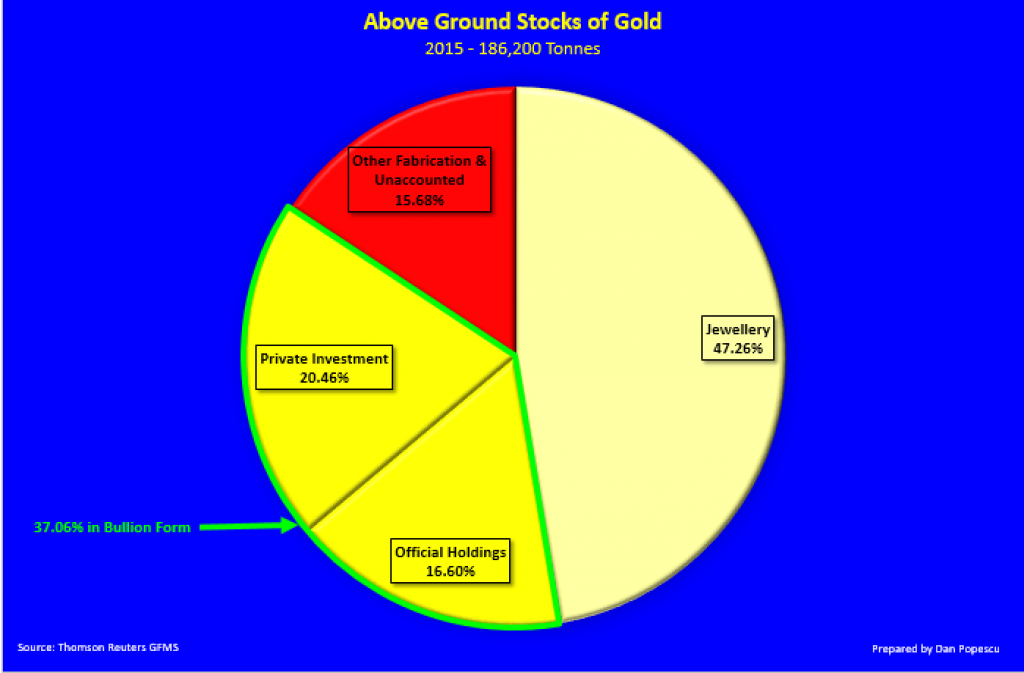

Estimates of who holds gold and in what formThe State can stop printing fiat money but it can’t easily ban physical currency like gold and silver. It is estimated that approximately 20% of the above-ground gold is in private hands in the form of pure bullion. A large part of the jewelry stock could also be used as cash if necessary. |

Conclusion

In today’s negative interest rate environment one should definitely be more concerned about the return of one’s money, than the return on one’s money. Considering the threat of negative interest rates it is obvious why people are rediscovering the value of holding gold.

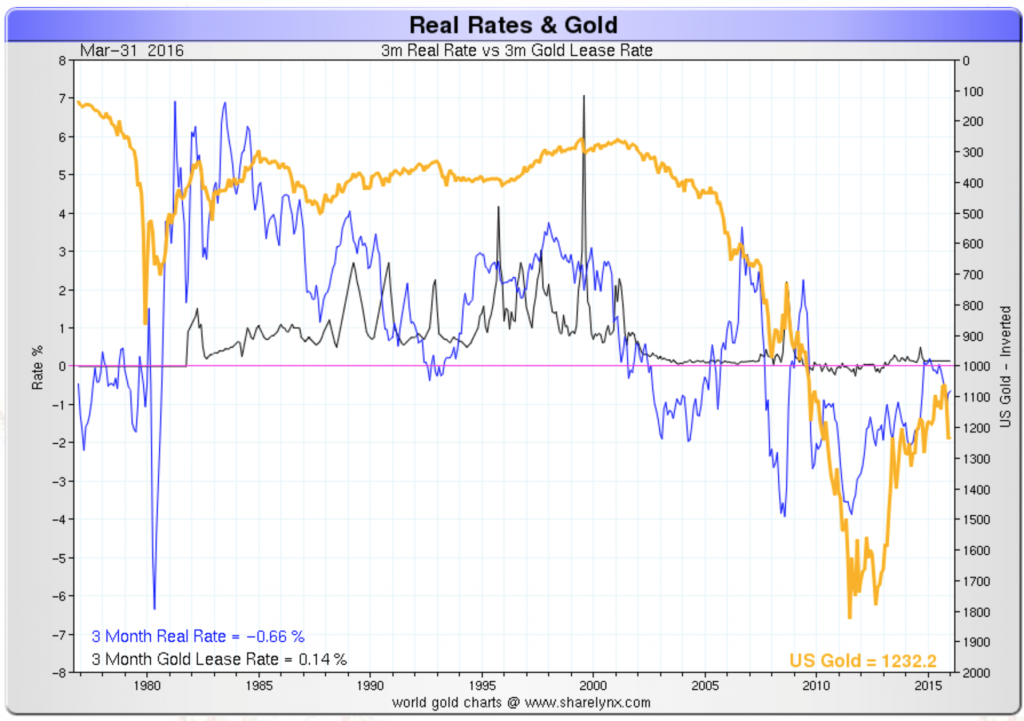

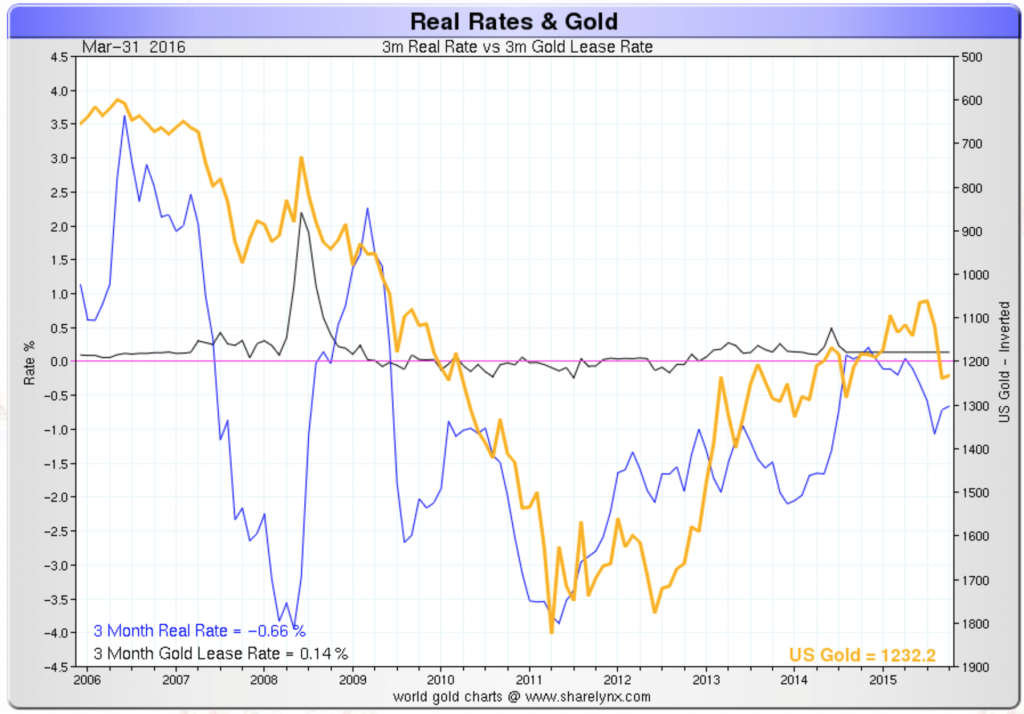

Gold tends to perform well in declining or negative real interest-rate environments. The deeper central banks move into negative rate territory, the more gold is going to be supported, as the cost of carry disappears. High real rates are bad for gold but negative real rates are quite good for it (see also “Gold and the Federal Funds Rate” for some additional color on this).

Addendum: A Few Charts on Real Rates vs. the Gold Price

Real rates and gold: US treasury bond yields less CPI vs. the gold price (inverted) |

Real rates and gold: 3 month real interest rate, 3 months gold lease rate and the gold price (inverted), 1975 – 2016 |

Real rates and gold: 3 month real interest rate, 3 months gold lease rate and the gold price (inverted), 2006 – 2016 |

Charts by: Haver, Sandeep Jaitly, Dan Popescu, Sharelynx.

Chart and image captions by PT

The above article has originally been published here.

Previous post