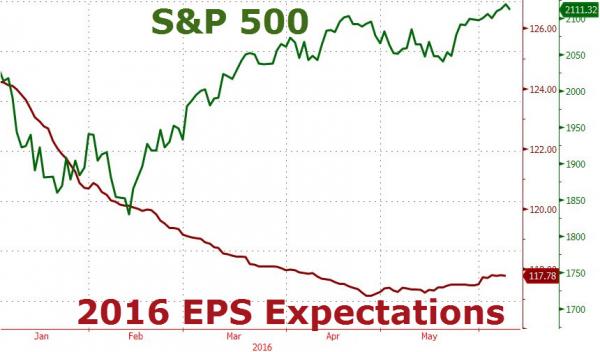

A warped manifestation of the fear and greed trade-off that used to characterize investor behavior has developed, according to Bloomberg’s Richard Breslow. Asset managers are exhibiting the manic depressive drive to simultaneously throw caution to the wind, ignoring all risk metrics while plaintively bemoaning the lack of safe havens. S&P 500, 2016 EPS Expectations Fear and greed was a continuum, allowing for an ebb and flow with continuous price discovery and availability. What we have now is pedal to the metal front-running of central banks and the nagging fear that when the fun ends there won’t be a bid anyway, so why bother being prudent. S&P 500, 2016 EPS Expectations A big part of this problem is investors have fooled themselves into believing there are desperately few viable answers to, “where else is there to invest?” Switzerland has always been the go-to option, but they’ve lost tolerance for hot money. Negative rates, too. The train wreck that’s Japan really only works if you’re Japanese. And no one can be sure what they’ll look like at the end of this tunnel. Gold is the capitulation choice. Performance since December 2015 Normalizad As Of 12/16/2015 – click to enlarge. There are good alternatives right under our noses, or in the case of the U.S.

Topics:

Tyler Durden considers the following as important: 2016 EPS Expectations, Canadian Dollar, Central Banks, CHF, Featured, Japan, Monetary Policy, newsletter, Real estate, S&P 500, Switzerland, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

A warped manifestation of the fear and greed trade-off that used to characterize investor behavior has developed, according to Bloomberg’s Richard Breslow. Asset managers are exhibiting the manic depressive drive to simultaneously throw caution to the wind, ignoring all risk metrics while plaintively bemoaning the lack of safe havens.

S&P 500, 2016 EPS ExpectationsFear and greed was a continuum, allowing for an ebb and flow with continuous price discovery and availability. What we have now is pedal to the metal front-running of central banks and the nagging fear that when the fun ends there won’t be a bid anyway, so why bother being prudent. |

A big part of this problem is investors have fooled themselves into believing there are desperately few viable answers to, “where else is there to invest?”

Switzerland has always been the go-to option, but they’ve lost tolerance for hot money. Negative rates, too.

The train wreck that’s Japan really only works if you’re Japanese. And no one can be sure what they’ll look like at the end of this tunnel.

Gold is the capitulation choice.

Performance since December 2015

There are good alternatives right under our noses, or in the case of the U.S., right above our heads, that deserve a lot more consideration.

O Canada, where have you been all of my life?

Stable, democratic government with a popular premier. A real fiscal policy that’s beginning to be implemented. Stable monetary policy. A yield curve that has positive rates over its entire length.

Too much reliance on energy, but oil’s looking pretty healthy on the charts, folks. As is the Canadian dollar, now back through 1.30.

Throw in a solid banking system, freely tradable markets and no capital controls in or out. Hint, hint, look who are the buyers of Vancouver real estate.

In truth, there are plenty of prudent places to invest if you look in the right places. And countries doing sensible things, too

Previous post Next post