Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen”? We will return to that question further below, but first a few words on the new Samurai futon. Apparently the Japanese are becoming more than a little antsy about Kuroda-san’s negative interest rate policy (and the threats of more of the same coming down the pike). Bloomberg informs us of the latest developments in this saga: “Manga Worker Stuffs Cash in Futon to Flee Japan’s Negative Rates”: The modern Samurai futon! Stuffing the money at home When the Bank of Japan unexpectedly announced negative interest-rate policies in January, the first thing Tomomi Sato did was withdraw a 10th of the money in her bank account and stash it at home. “It made me think of bank runs and shutdowns like I’ve heard there were in the past,” said the 30-something assistant to manga comic artists, who commutes for two hours from a small apartment in Tokyo’s suburbs. “Eventually, I feel like they’ll start charging me to keep my money there. When I think about that, I begin to worry.

Topics:

Pater Tenebrarum considers the following as important: Central Banks, Debt and the Fallacies of Paper Money, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stuffing the FutonOur friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen”? We will return to that question further below, but first a few words on the new Samurai futon. Apparently the Japanese are becoming more than a little antsy about Kuroda-san’s negative interest rate policy (and the threats of more of the same coming down the pike). Bloomberg informs us of the latest developments in this saga: “Manga Worker Stuffs Cash in Futon to Flee Japan’s Negative Rates”: |

|

Stuffing the money at home

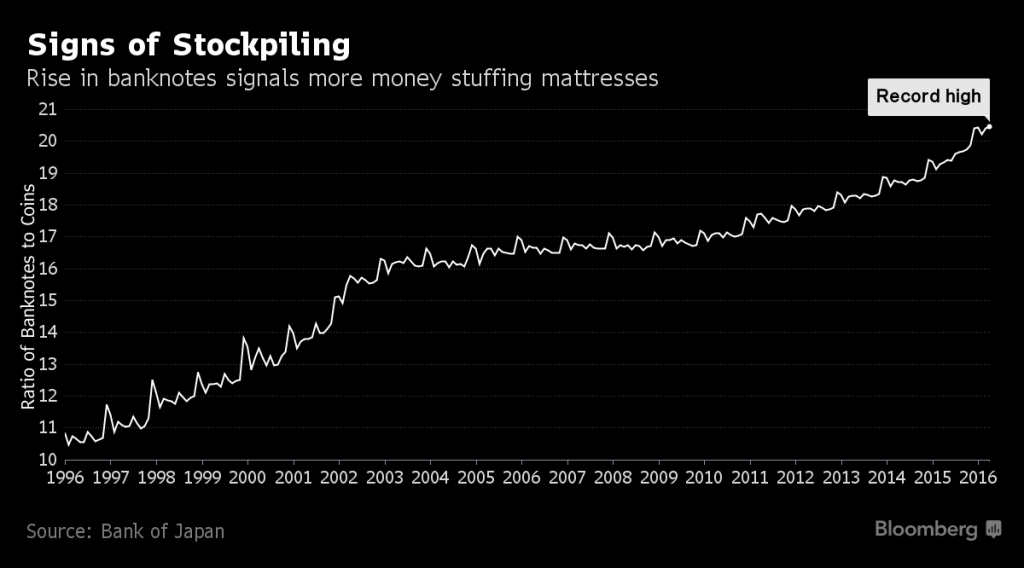

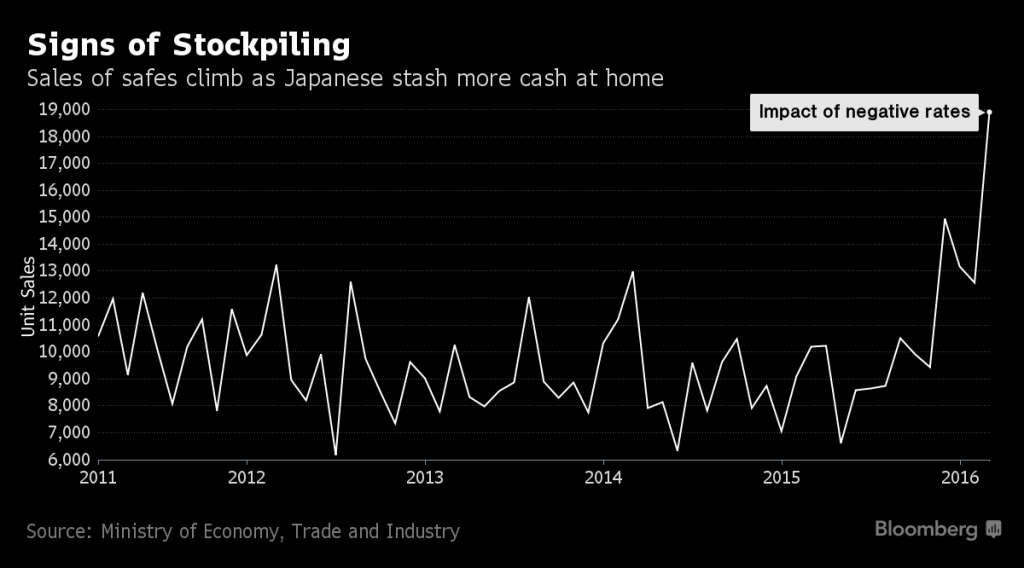

Newsflash to Bloomberg: Japan is already drowning in debt. The banks wouldn’t “lend the money on” even if it were deposited with them. They have been doing the opposite for years and years. No-one wants to borrow more, and no-one in his right mind wants to lend out money for zilch. . (emphasis added) |

|

Sales of Safes Climb

A far greater danger though is that the Japanese authorities will eventually answer Ramsey’s above question in the affirmative. |

|

Stones Into Bread

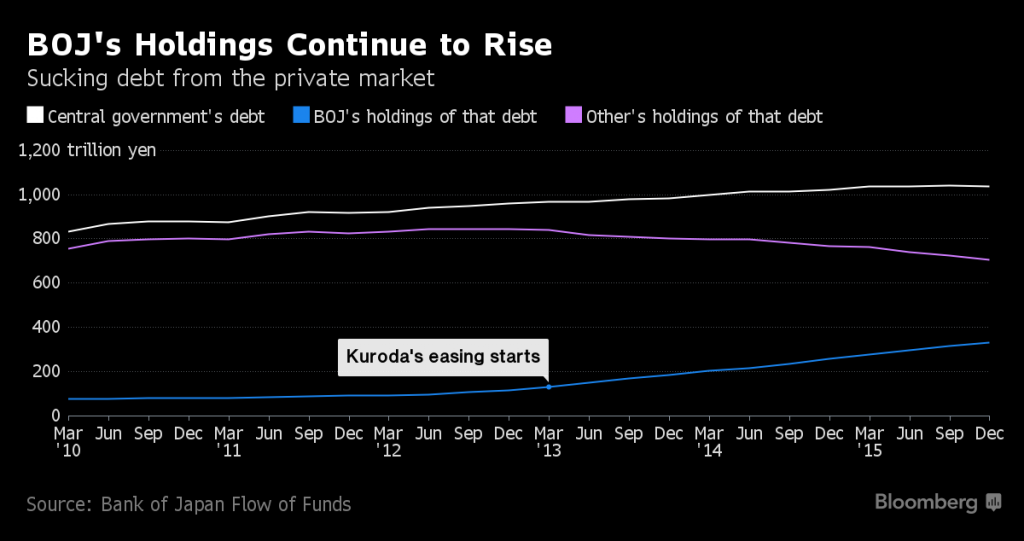

While Japan’s citizens are worrying about Kuroda-san’s assaults on market interest rates, Bloomberg also tells us that a miracle is currently performed in Japan. It seems Japanese policymakers have finally discovered the financial equivalent of the perpetuum mobile. If the British government can “turn stones into bread”, surely the Japanese government can as well! According to Bloomberg, Japan’s huge public debtberg is now disappearing at record rates – and it is actually disappearing into itself, so to speak. |

Japan’s public debtberg gets shifted around…. – click to enlarge. |

Abe Spending like a drunken SailorIs it because Shinzo Abe’s government has stopped spending like a drunken sailor? Not quite:

|

|

| Hallelujah! A luxury miracle in the making! It’s definitely stones-into-bread time in Nippon! Why has no-one ever thought of that trick? Wait a minute…someone actually has. Here is a picture of him:

For once we actually find ourselves agreeing with Adair Turner, if only in terms of his analysis of the situation:

He’s undoubtedly right about that. Mises knew it in 1949 already, when he noted:

However, Adair Turner immediately lets his inner Silvio Gesell (the prototypical monetary crank) hang out again by adding:

Useful for whom? We doubt it would make holders of the yen happy. They would probably find the yen suddenly beginning to eerily resemble those Reichsmarks issued by Havenstein’s central bank. |

Effective ways of making paper currency suddenly worthless, part 3: hire madmen with face paint who hate the Batman. |

|

To be sure, things can chug along just fine for quite some time – but as noted above, once confidence in a currency is lost, these situations tend to go haywire in a non-linear manner. Go beyond the unknowable threshold, and what used to be money will quite suddenly become toilet paper. When confidence in a fiat money goes, it tends to do so rapidly and irretrievably. Oh well, at least no-one will have to worry anymore about people “saving too much” in that case, or about the Japanese stuffing yen into futons. They will probably make pyres out of them instead. Perhaps the BoJ should hire this guy: At least Bloomberg mentions the view of a skeptic as well, who reminds us that there is actually such a thing as an “endgame”. He rightly notes that Turner’s prescription would in the end amount to a “suicide policy”:

This is certainly true – but on the other hand, what other way out is there? In spite of not lacking in imagination, we can no longer really see one. We find it quite amusing though that as long as everybody manages to pretend that everything is still normal, the yen is actually strong like an ox (as an aside to this, we remain bullish on the yen short to medium term on technical grounds – even though it is probably ultimately a lost cause): |

Conclusion

It is well known that Japan is about a decade ahead of the rest of the developed world in the Keynesian Endgame sweepstakes. We may well get the opportunity to experience very interesting times (in the Chinese curse sense) in the not-too-distant future.

Stay tuned, and be prepared.

Charts by: Bloomberg, BarChart

Previous post Next post