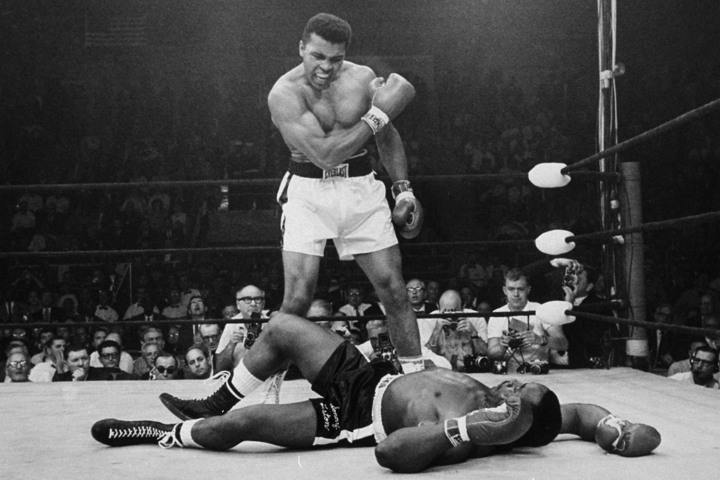

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used his famous “rope-a-dope” technique. He let the feds wear themselves out punching him until he was ready to fight again. Ali could have joined the army. He would have been a celebrity in uniform, like Elvis, doing PR work for the Pentagon. Far from the hot sweats of Da Nang and the Mekong Delta, he would have been a cool spokesman and ambassador for the emerging empire… helping the U.S. military gin up support for its dead-head war in Southeast Asia. By refusing to go along, Ali, the world boxing champ, had everything to lose and nothing to gain. It was just a matter of principle. “I ain’t got no quarrel with the Viet Cong,” he said. The blabbagentsia back home accused him of being unpatriotic. The feds said he was a lawbreaker. But coming into focus is a different picture of what heroism is all about.

Topics:

Bill Bonner considers the following as important: Alan Greenspan, Ben Bernanke, Bill Clinton, Central Banks, Debt and the Fallacies of Paper Money, Dick Cheney, Donald Trump, Featured, George Bush, Janet Yellen, Muhammad Ali, newsletter, Sonny Liston, Viet Cong

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Muhammad Ali Could Take a PunchBALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather than dodging them. And when the feds walloped him as a criminal draft resister, Ali didn’t throw in the towel in a whimpering surrender to superior force. Instead, he used his famous “rope-a-dope” technique. He let the feds wear themselves out punching him until he was ready to fight again. Ali could have joined the army. He would have been a celebrity in uniform, like Elvis, doing PR work for the Pentagon. Far from the hot sweats of Da Nang and the Mekong Delta, he would have been a cool spokesman and ambassador for the emerging empire… helping the U.S. military gin up support for its dead-head war in Southeast Asia. By refusing to go along, Ali, the world boxing champ, had everything to lose and nothing to gain. It was just a matter of principle. “I ain’t got no quarrel with the Viet Cong,” he said. The blabbagentsia back home accused him of being unpatriotic. The feds said he was a lawbreaker. But coming into focus is a different picture of what heroism is all about. And it calls into question whether patriotism and do-goodism are just forms of cowardice – and whether Bernie Sanders is a sanctimonious grump. But this is a deeper subject than we manage today. Besides, we won’t have time to read all the howls of protest from readers. Instead, we jump for solid ground… |

|

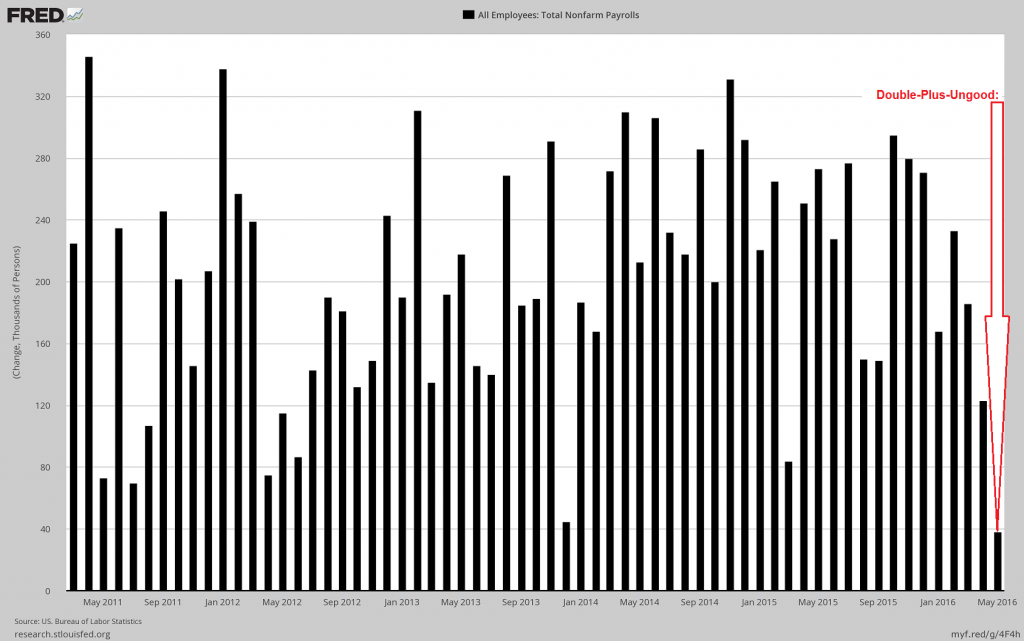

Smack in the FaceAs you recall, dear reader, we believe the Fed will never “normalize” interest rates. We got a quarter-point bump in December. Then nothing. Fed chair Janet Yellen had let it be known that another rate hike might be coming this month. But then, on Friday, the big U.S. jobs report came out. Reported the Financial Times: “Weak jobs growth is ‘smack in the face’ for U.S. economy and Fed rate increase.” All Employees: Total Nonfarm PayrollsGains in non-farm payrolls are in shrinking mode. Last month’s report was especially weak. However, these reports are really meaningless, as they tend to get revised umpteen times. By the time the real numbers are finally known, no-one really cares anymore. And yet, the Fed actually partly determines its policy decisions on the basis of these unreliable data (which represent a lagging economic indicator to boot!). Instead of the 160,000 new jobs that were widely expected in May, non-farm payrolls rose by a seasonally adjusted 38,000. Plus, the Bureau of Labor Statistics revised the figures down for March and April, too, dealing another blow to the optimists at the Fed. When you don’t want to do something, you find plenty of reasons not to do it. In the present case, the Fed doesn’t want to normalize interest rates. Under a classic gold standard, interest rates go up and down depending on supply and demand. When the supply of savings goes up, and other things remain as they were, interest rates should go down. Then when the lower interest rates do their work and economy heats up, the demand for credit increases, too. Again, assuming other things remain as they were, the price of credit – interest rates – should go up along with it. Supply and demand move in cycles. High interest rates encourage savings, which add to the amount of available credit, which depresses interest rates. Then the lower interest rates discourage saving, until the price of credit goes back up. Up, down, constantly correcting on both sides. That’s the way it’s supposed to work. No need to remind us that it hasn’t worked that way for a long time. The Fed and its banking system now create credit (money) out of thin air; savings have nothing to do with it. The corrective feedback loop we have just described no longer works. Not only can the feds manipulate the price of credit, but also they can do it for a long time, severely distorting the whole system. Then, blind and crippled, the economy barely limps along…always in danger of tripping and falling. No way is Ms. Yellen going to stick out her foot. |

|

Yellen’s BacktrackHere’s the Fed chief, speaking yesterday, as reported by Bloomberg:

Ms. Yellen and her predecessors have conducted the largest experiment ever in monetary central planning. Since 1998, central banks have increased their balance sheets (which serve as the world’s monetary footings) by 1,600%. And last week, the total amount of debt trading at negative yields went over $10 trillion. We sit on the edge of our seats and wonder what will happen next. Normalization? Nah… Janet Yellen, Ben Bernanke, Alan Greenspan – they have been called the “heroes” of the world monetary system. Are they really? Did they face up to the debt problem? Or dodge it? More to come… |

Chart by: St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared as “Sorry, Janet… But You’re No Hero“ at the Diary of a Rogue Economist, written for Bonner & Partners. books, Financial Reckoning Day, Empire of Debt and Mobs, Messiahs and Markets.

Previous post Next post