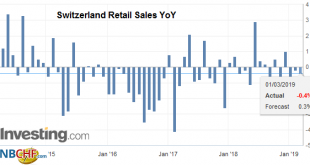

01.03.2019 – Turnover in the retail sector fell by 0.3% in nominal terms in January 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.4% in January 2019 compared with the previous year....

Read More »Switzerland GDP Q4 2018: +0.2 percent QoQ, +1.4 percent YoY

Switzerland’s GDP rose by 0.2% in the 4th quarter of 2018. Manufacturing saw dynamic growth. Concurrently, exports of goods increased significantly. In contrast, domestic demand stagnated. GDP growth was 2.5% for 2018 as a whole. Switzerland’s GDP rose by 0.2% in the 4th quarter of 2018.1 As in other European countries, this confirms a slowdown of the economy compared to the first half of the year. Switzerland Gross...

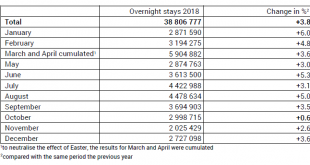

Read More »The Swiss hotel sector saw a new record number of overnight stays in 2018

26.02.2019 – The hotel sector in Switzerland registered 38.8 million overnight stays in 2018, i.e. the best result to date. This represented a growth of 3.8% (+1.4 million) compared with 2017. Foreign demand totalled 21.4 million units, an increase of 4.5% (+921 000) and its best performance in 10 years. Swiss overnight stays increased by 2.9% (+493 000), thus reaching the record value of 17.4 million overnight stays....

Read More »ECB: running out of runway – Part I

At the end of January, only a month after the official end of the QE program of the European Central Bank (ECB), its President Mario Draghi told the European Parliament’s committee that the central bank could resume its bond purchasing, in a questionable effort to assuage concerns over the impact of the policy change. As Europe’s economy flashes increasingly bright warning signs, doubts are multiplying over the...

Read More »GERMANY: ECONOMY & SOVEREIGN BOND

After a difficult second half of 2018, the outlook for Germany’s economy and sovereign bonds turns brighter. A host of factors weighed on German growth in H2 2018: a sharp slowdown in global demand on the external side and several transitory factors on the domestic side impacted industrial activity. At the same time, the 10-year German Bund yield has been trending downward. The steep fall in the oil price in late 2018,...

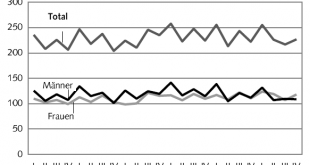

Read More »Employment Barometer in the Q4 2018: Situation Sustained

25.02.2019 – In the 4th quarter 2018, total employment (number of jobs) rose by 1.3% in comparison with the same quarter a year earlier (+0.2% with previous quarter; seasonally adjusted figures). In full-time equivalents, employment in the same period rose by 1.6%. The Swiss economy counted 12 200 more vacancies than in the corresponding quarter of the previous year (+19.6%) and the employment outlook indicator is also...

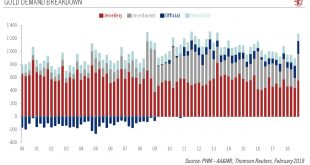

Read More »Gold to consolidate before further leg up

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better. Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4). There was also a sharp increase in central bank demand in 2018,...

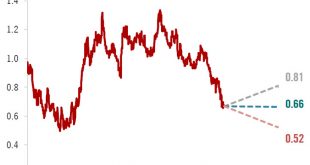

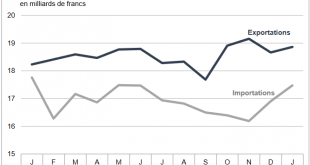

Read More »Swiss Trade Balance January 2019: Start of a Positive year

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

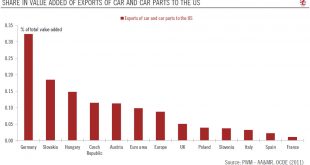

Read More »Euro area : What if car tariffs lie ahead ?

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium. Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance. The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February. Given the complexity of the global auto supply chain, it is very complicated...

Read More »Swiss Labour Force Survey in 4th quarter 2018: 0.8percent increase in number of employed persons; unemployment rate based on ILO definition at 4.6percent

14.02.2019 – The number of employed persons in Switzerland rose by 0.8% between the 4th quarter 2017 and the 4th quarter 2018. During the same period, the unemployment rate as defined by the International Labour Organisation (ILO) increased slightly by 0.1 percentage points to 4.6%. The EU’s unemployment rate decreased from 7.3% to 6.6%. These are some of the results from the Swiss Labour Force Survey (SLFS). Download...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org