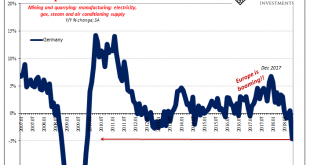

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009. While some idiosyncratic factors were likely at play, such as below-average water levels on...

Read More »…And Get Bigger

Just as there is gradation for positive numbers, there is color to negative ones, too. On the plus side, consistently small increments marked by the infrequent jump is never to be associated with a healthy economy let alone one that is booming. A truly booming economy is one in which the small positive numbers are rare. The recovery phase preceding the boom takes that to an extreme. If conditions swing the other way,...

Read More »Euro Credit: 2019 Outlook

After a negative 2018, developments in Italy and indirect ECB support will help define the road ahead for European corporate bonds. Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell...

Read More »Swiss Consumer Price Index in December 2018: +0.7 percent YoY, -0.3 percent MoM

09.01.2019 – The consumer price index (CPI) fell by 0.3% in December 2018 compared with the previous month, reaching 101.5 points (December 2015 = 100). Inflation was 0.7% compared with the same month of the previous year. The average annual inflation reached 0.9% in 2018. These are the results of the Federal Statistical Office (FSO). The average annual inflation for 2018 corresponds to the rate of change between the...

Read More »Swiss Retail Sales, November 2018: -0.2 percent Nominal and -0.5 percent Real

08.01.2019 – Turnover in the retail sector fell by 0.2% in nominal terms in November 2018 compared with the previous year. Seasonally adjusted, nominal turnover rose by 0.2% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for sales days and holidays fell by 0.5% in November 2018 compared with the previous year....

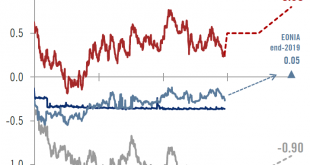

Read More »Core Euro Sovereign Bonds 2019 Outlook

It’s all about the European Central Bank’s hiking cycle. In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps. The euro area economic activity has been decelerating...

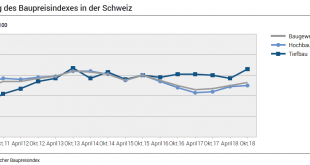

Read More »Construction prices rose by 0.3 percent in October 2018

20.12.2018 – The construction price index recorded a rise of 0.3% between April and October 2018, reaching 99.3 points (October 2015 = 100). This result reflects a greater increase in civil engineering prices than in building prices. Year on year, construction prices increased by 0.6%. These are the results of the Federal Statistical Office (FSO). Development of the construction price index in Switzerland Source:...

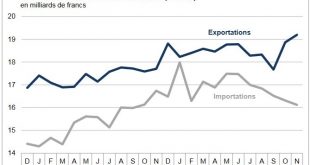

Read More »Swiss Trade Balance November 2018: Exports pass for the first time the bar of 19 billion francs

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Pension fund statistics 2017: definitive results

Pension funds strengthen their reserves in 2017 17.12.2018 – The pension funds can look back on a positive investment year: The net result from investments doubled in 2017. Thus, the reserves could be strengthened and any shortfalls could be reduced. This is evident from the definitive results of the Pension Fund Statistics 2017 of the Federal Statistical Office (FSO). Net investment income increased to 64.1 billion...

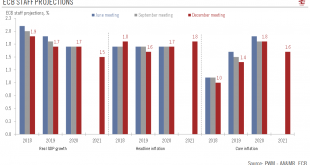

Read More »ECB: Still Broadly Confident, but Caution Increasing

First rate hike still expected in September 2019, although downside risks are growing. The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org