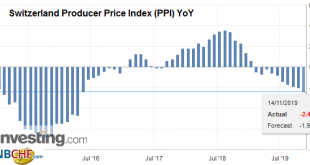

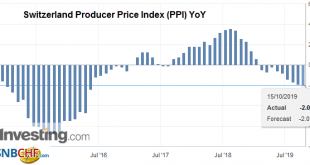

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

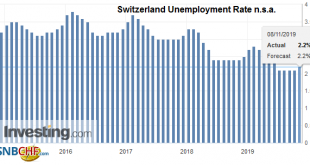

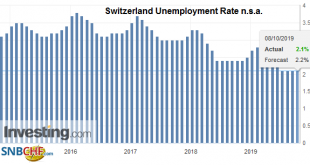

Read More »Switzerland Unemployment in October 2019: Up to 2.2 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Unemployment registered in October 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of October 2019, 101’684 unemployed were registered at the regional employment agencies (RAV), 2 586 more than in the previous month. The unemployment rate rose from 2.1% in September 2019 to 2.2% in the month under review. Compared to the same month of the previous year, unemployment fell by...

Read More »Steady euro area growth and rise in core inflation

According to Eurostat’s preliminary figures, euro area GDP grew by 0.2% quarter on quarter in Q3, the same pace as in Q2 and in line with our expectations. Country wise, France, Italy and Spain grew at the same pace in Q3 as in Q2. In particular, household and investment spending grew at a solid pace in both France and Spain. The preliminary GDP figure for Germany will not be released until 14 November. But based on the country data released so far and assuming...

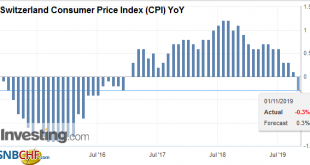

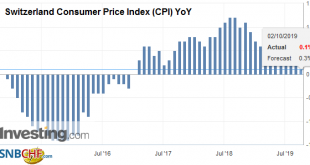

Read More »Swiss Consumer Price Index in October 2019: -0.3 percent YoY, -0.2 percent MoM

01.11.2019 – The consumer price index (CPI) fell by 0.2% in October 2019 compared with the previous month, reaching 101.8 points (December 2015 = 100). Inflation was –0.3% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.2% compared with the previous month can be explained by several factors including falling prices for international package holidays and hotel accommodation. The prices...

Read More »Swiss Retail Sales, August 2019: +0.6 percent Nominal and +0.9 percent Real

01.11.2019 – Turnover adjusted for sales days and holidays rose in the retail sector by 0.6% in nominal terms in September 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.5% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 0.9% in September 2019 compared with the previous year. Real growth...

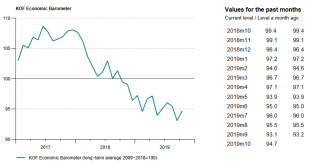

Read More »KOF Economic Barometer: Stabilization at a low level

The KOF Economic Barometer has halted its downward movement, at least for the time being. At 94.7 points, however, the barometer is still well below its long-term average. The Swiss economy is therefore likely to grow with below-average rates in the upcoming months. In October, the KOF Economic Barometer rose by 1.6 points, from 93.1 points in September (revised from 93.2 points) to 94.7 points. This increase is attributable in particular to bundles of...

Read More »Swiss Trade Balance Q3 2019: exports still rising thanks to chemistry-pharma

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Swiss Producer and Import Price Index in September 2019: -2.0 percent YoY, -0,3 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »Switzerland Unemployment in September 2019: Unchanged at 2.1 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Registered unemployment in September 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of September 2019, 99’098 unemployed people were enrolled in the Regional Employment Centers (RAV), 454 less than in the previous month. The unemployment rate remained at 2.1% in the month under review. Compared with the same month of the previous year, unemployment fell by 7,488 people...

Read More »Swiss Consumer Price Index in September 2019: +0.1 percent YoY, -0.1 percent MoM

02.10.2019 – The consumer price index (CPI) fell by 0.1% in September 2019 compared with the previous month, reaching 102.0 points (December 2015 = 100). Inflation was +0.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The decrease of 0.1% compared with the previous month can be explained by several factors including falling prices for foreign package holidays and petrol. The prices of airfares and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org