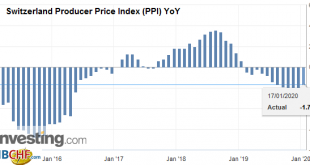

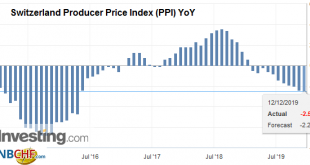

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »House View, January 2020

Asset Allocation Our asset allocation is dominated by a wish to stay diversified in a fragile environment. Continued ‘noise’ around trade is likely to leave markets alternating between disappointment and hope. With this in mind, we have a neutral stance on government bonds and developed-market equities alike, although we still see select opportunities in equities and appreciate the protective function of safe-haven bonds. Geopolitical events such as the tensions...

Read More »Pension funds have absorbed 2018 fall in stock market values

16.12.2019 – Overall, the pension funds survived the weak stock markets in 2018. By dissolving 40% of the existing fluctuation reserves, the negative net result from investments was largely offset. The shortage increased by 20%. This emerges from the definitive results of the Pension Fund Statistics 2018 of the Federal Statistical Office (FSO). The correction on the financial markets, especially towards the end of 2018, left its mark on the investment side of the...

Read More »Swiss Retail Sales, November 2019: -0.7 percent Nominal and 0.0 percent Real

09.01.2020 – Turnover adjusted for sales days and holidays fell in the retail sector by 0.7% in nominal terms in November 2019 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays remained stable in the retail sector in November 2019 compared with the previous year. Real growth...

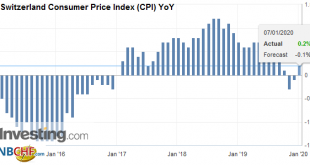

Read More »Swiss Consumer Price Index in December 2019: +0.2 percent YoY, +0.4 percent MoM

07.01.2020 – The consumer price index (CPI) remained stable in December 2019 compared with the previous month, remaining at 101.7 points (December 2015 = 100). Inflation was +0.2% compared with the same month of the previous year. The average annual inflation reached +0.4% in 2019.These are the results of the Federal Statistical Office (FSO). The average annual inflation for 2019 corresponds to the rate of change between the annual average of the CPI for 2019 and...

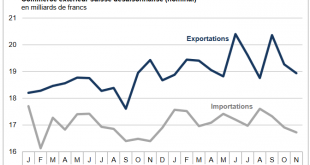

Read More »Swiss Trade Balance November 2019: Foreign trade continues to contract

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »ECB: Preview of the review

We see the ECB remaining on hold throughout next year although we believe it could tweak some of the technical parameters of its toolkit. The first press conference of any new ECB President is an event in itself, and this time will be no different. Christine Lagarde’s debut this week will understandably attract a lot of attention as the media and market participants scrutinise both form and substance. Indeed, the ECB’s ‘transition’ goes beyond the change in...

Read More »Swiss Producer and Import Price Index in November 2019: -2.5 percent YoY, -0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

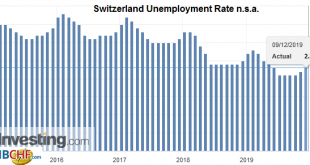

Read More »Switzerland Unemployment in November 2019: Up to 2.3 percent, seasonally adjusted unchanged at 2.3 percent

Unemployment Rate (not seasonally adjusted) Unemployment registered in November 2019 – According to surveys by the State Secretariat for Economic Affairs (SECO), at the end of November 2019, 106,330 unemployed were registered at the regional employment agencies (RAV), 4,646 more than in the previous month. The unemployment rate rose from 2.2% in October 2019 to 2.3% in the month under review. Compared to the same month last year, unemployment fell by 4,144 people...

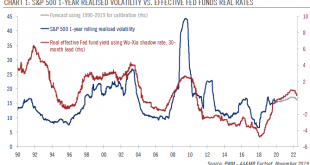

Read More »Upward pressure on equity volatility mitigated by fund flows

Whereas inflation is expected to be dormant next year, our expectation of real GDP growth of just 1.3% in the US in 2020 could put upward pressure on equity volatility. Since monetary policy tends to lead volatility by two and a half years, the Fed’s turn toward quantitative tightening in 2017 is also continuing to exert upward pressure on volatility levels for now. But there are also countervailing forces at work. Although there is not a perfect correlation,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org