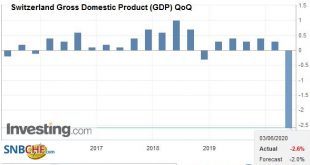

Switzerland’s GDP fell by –2.6 % in the 1st quarter of 2020, after rising by +0.3% in the previous quarter. Due to the coronavirus pandemic and the measures to contain it, economic activity in March was severely restricted. The international economic slump also slowed down exports. Switzerland Gross Domestic Product (GDP) QoQ, Q1 2020(see more posts on Switzerland Gross Domestic Product, ) Source: investing.com - Click to enlarge Switzerland Gross Domestic...

Read More »Weekly View – One country, two systems at risk

Last week, German chancellor Merkel delivered a surprise about-face when she and French president Macron announced a proposal for a EUR 500bn recovery fund in the wake of the coronavirus crisis. The unprecedented plan involves the distribution of grants, rather than loans, to member states in economic need. The deal is far from done, however, as it is currently opposed by the EU ‘frugal four’, who insist on loans rather than grants, which would over-indebt...

Read More »Swiss Trade Balance April 2020: foreign trade collapses

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »Modern Monetary Theory makes inroads following coronavirus crisis

US policymakers’ bold actions in response to the coronavirus bear some traces of the free-wheeling deficits, repressed interest rates and central bank activism (money creation) that form the cornerstones of the Modern Monetary Theory (MMT) playbook. MMT’s popularity is likely to persist, gaining converts among those who previously supported classic assumptions about budget constraints or the ‘crowding out’ of private investment by growing government indebtedness....

Read More »House View, May 2020

Macroeconomy With leading economies likely facing double-digit declines in GDP in Q1 and Q2, we expect Brent oil in the USD10–20 range in Q2 before reaching a long-term equilibrium of USD18 at year’s end. With consumers tempted to remain cautious, the oil sector in deep difficulty and a big rise in unemployment, we expect dire Q2 GDP figures for the US. We have reduced our GDP forecast for 2020 as a whole to -7.7%. Likewise, we expect the biggest hit to euro area...

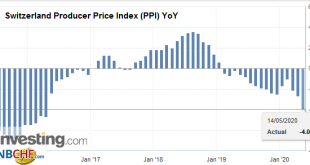

Read More »Swiss Producer and Import Price Index in April 2020: -4.0 percent YoY, -1.3 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

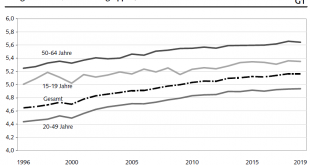

Read More »7.9 billion hours worked in 2019

12.05.2020 – In 2019, people spent 7.929 billion hours working. Between 2014 and 2019, the actual weekly hours worked by full-time employees fell by 15 minutes on average, reaching 41 hours and 2 minutes. At the same time, the number of weeks of annual holiday continued its gradual increase to 5.2 weeks, according to the latest results from the Federal Statistical Office (FSO). The results in this press release concern the hours worked in 2019. The effects of the...

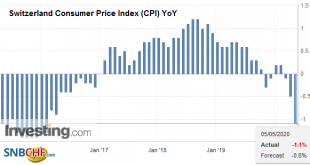

Read More »Swiss Consumer Price Index in April 2020: -1.1 percent YoY, -0.4 percent MoM

05.05.2020 – The consumer price index (CPI) fell by 0.4% in April 2020 compared with the previous month, reaching 101.3 points (December 2015 = 100). Inflation was –1.1% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The 0.4% decrease compared with the previous month can be explained by several factors including falling prices for air transport. Hotel accommodation also recorded a price decrease, as...

Read More »Swiss Retail Sales, March 2020: -6.2 percent Nominal and -5.6 percent Real

30.04.2020 – Turnover adjusted for sales days and holidays fell in the retail sector by 6.2% in nominal terms in March 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 6.0% compared with the previous month. Following the COVID-19 pandemic, turnover slumped markedly in some sectors. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays fell in the retail sector...

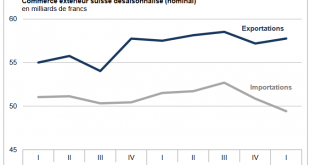

Read More »Swiss Trade Balance Q1 2020 : chemistry-pharma keeps exports in black numbers

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org