Donald Trump’s poll numbers were looking increasingly unhealthy at the time of writing, but at least the cocktail of drugs administered to the coronavirus-stricken President appears to have worked. This is encouraging news in the fight against the virus and a considerable achievement for Regeneron, whose founders increased their stake in the company after a French pharma group pulled back earlier this year. At this point, markets are increasingly taking on board...

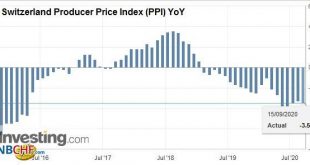

Read More »Swiss Producer and Import Price Index in September 2020: -3.1 percent YoY, +0.1 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

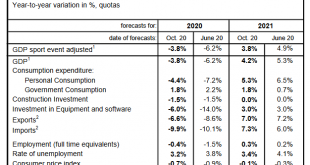

Read More »Forecast: 2020 economic slump less serious than feared

The Expert Group is expecting GDP adjusted for sporting events to fall by 3.8 % in 2020 and unemployment to average 3.2 % over the year as a whole. Prospects for 2020 are therefore less negative than feared in the middle of the year. The momentum is likely to weaken as time goes on. Due to the relaxation of the health policy measures, the Swiss economy started to swiftly make up lost ground at the end of April, with both consumerand investment demandex-ceeding...

Read More »House View, October 2020

Asset Allocation Rising coronavirus cases accompanied by flagging recovery momentum and a fractious run-up to the US elections make prospects for equities highly reliant on 3Q results and further policy stimulus. Against this background we have downgraded our stance on euro area equities from neutral to underweight, following a similar downgrade for US equities in August. We continue to like structural growth drivers and select, high-quality cyclical stocks. We...

Read More »Swiss Retail Sales, August 2020: 1.6 percent Nominal and 2.5 percent Real

01.10.2020 – Turnover adjusted for sales days and holidays rose in the retail sector by 1.6% in nominal terms in August 2020 compared with the previous year. Seasonally adjusted, nominal turnover fell by 2.1% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover adjusted for sales days and holidays rose in the retail sector by 2.5% in August 2020 compared with the previous year. Real growth takes...

Read More »Swiss Consumer Price Index in September 2020: -0.8 percent YoY, 0.0 percent MoM

01.10.2020 – The consumer price index (CPI) remained stable in September 2020 compared with the previous month, reaching 101.2 points (December 2015 = 100). Inflation was –0.8% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). The stability of the index compared with the previous month is the result of opposing trends that counterbalanced each other overall. Prices for international package holidays...

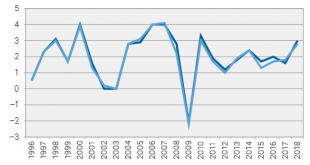

Read More »GDP level corrected from 2.8 percent to 3.6 percent between 1995 and 2017 following revision of the national accounts

28.09.2020 – The results of the national accounts published by the Federal Statistical Office (FSO) have been revised upwards. New data series are available for the period 1995 to 2019. This revision was carried out in collaboration with the sector responsible for quarterly estimates at SECO, provides methodological improvements and takes into consideration new data. It was carried out in coordination with European countries and results in a gross domestic product...

Read More »Weekly View – No breakfast at Tiffany’s

The impact of political tensions on business is ever more apparent: LVMH of France will not, after all, proceed with the purchase of Tiffany of the US. If, as seems likely, the hand of the French government was involved, this is solid evidence that political sensitivities are increasingly influencing cross-border deals – something that is likely to remain the case just as M&A in general has been declining. Volatility is on the rise across most assets,...

Read More »Swiss Producer and Import Price Index in August 2020: -3.5 percent YoY, -0.4 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More »House View, September 2020

Macroeconomy A surge in new covid-19 cases in a number of countries has interrupted progress towards normality, yet the effects of the virus are becoming more manageable and positive world H2 growth is achievable. Prospects for the US economy hinge on the ability of Washington to agree a new fiscal support package. While we have raised out 2020 GDP projection for the US we remain prudent. We expect the Fed to provide more stimulus via increased asset purchases,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org