Den Wert des Vorjahres übertraf er sogar um gut 11 Milliarden. Der Anstieg sei vor allem auf den grösseren Einnahmeüberschuss bei den Kapitaleinkommen und beim Warenhandel zurückzuführen, teilte die Schweizerische Nationalbank (SNB) am Montag mit. Insgesamt erhöhten sich die Einnahmen der Schweizer Volkswirtschaft von Oktober bis Dezember auf knapp 173,4 Milliarden Franken, während die Ausgaben gut 147,5 Milliarden Franken betrugen. Die Zahlen sind allerdings...

Read More »USD/CHF Price Analysis: US dollar eases from 2020 highs, stabilizes near 0.9800 figure

USD/CHF consolidates gains for the second consecutive day. The level to beat for bulls is the 0.9900 resistance. The parity level might be on the bulls’ radar. USD/CHF daily chart USD/CHF is retreating slightly this Monday while the currency pair is consolidating gains for the second consecutive day above the main SMAs. The Fed extended its Quantitative Easing program with an initial reaction down on the US dollar which was relatively limited on USD/CHF and across...

Read More »Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

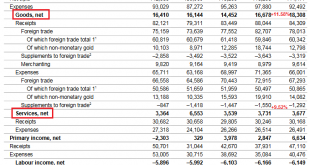

Key developments in 2019 The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had...

Read More »SNB belässt Leitzins unverändert und stärkt die Banken

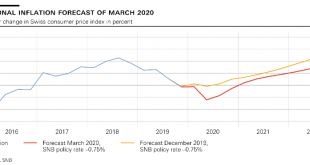

Die SNB steht bereit, bei Bedarf zusätzliche Massnahmen zur Sicherung der Liquidität zu treffen. (Bild: Shutterstock.com/Distinctive Shots) Die Schweizerische Nationalbank (SNB) belässt ihren Leitzins sowie den Zins auf Sichtguthaben bei -0,75%, wie sie am Donnerstag im Rahmen der geldpolitischen Lagebeurteilung mitteilte. Sie interveniert verstärkt am Devisenmarkt, um zur Stabilisierung der Lage beizutragen. Dabei betrachtet sie die gesamte Währungssituation....

Read More »Swiss central bank resists temptation to reduce interest rates

[caption id="attachment_439311" align="alignleft" width="400"] SNB chairman Thomas Jordan said the central bank will continue to defend the franc. (Keystone / Marcel Bieri)[/caption] The Swiss National Bank (SNB) has kept interest rates unchanged at -0.75% but is easing the burden on commercial banks. The SNB said on Thursday that it is also intervening on the foreign exchange markets to keep the franc from appreciating too far, too fast. The SNB’s...

Read More »Monetary policy assessment of 19 March 2020

Swiss National Bank maintains expansionary monetary policy, raises negative interest exemption threshold, and is examining additional steps Coronavirus is posing exceptionally large challenges for Switzerland, both socially and economically. Uncertainty has risen considerably worldwide, and the outlook both for the global economy and for Switzerland has worsened markedly. The Swiss franc is even more highly valued, and the world’s financial markets are under strong...

Read More »Geldpolitik – Trotz Corona-Krise: Schweizerische Nationalbank lässt Leitzins unverändert

Die Schweizerische Nationalbank belässt den Leitzins auf dem seit mehr fünf Jahren geltenden Rekordtief von minus 0,75 Prozent. Das gab die SNB am Donnerstag nach ihrer geldpolitischen Lagebeurteilung bekannt. Das dreiköpfige SNB-Direktorium um Notenbankchef Thomas Jordan setzt neben den Negativzinsen auf Eingriffe am Devisenmarkt, um einer starken Aufwertung des Franken entgegenzusteuern. Auf diese Interventionen will die SNB verstärkt setzen. Der Franken gilt unter...

Read More »SNB hat 2019 wieder stärker am Devisenmarkt interveniert

Die SNB hat 2019 wieder mehr Fremdwährungen gekauft. Die Schweizerische Nationalbank (SNB) hat im vergangen Jahr Fremdwährungen im Gegenwert von insgesamt 13,2 Mrd. Franken gekauft, wie sie in ihrem am Donnerstag veröffentlichten Geschäftsbericht 2019 schreibt. Das ist eine deutliche Zunahme gegenüber dem Vorjahr, in dem lediglich 2,3 Mrd. Franken für Devisenkäufe aufgewendet wurden. Grund für die verstärkte Intervention war der sich ab Mai 2019 wieder deutlich...

Read More »112th Annual Report Swiss National Bank 2019

The 2019 Annual Report of the Swiss National Bank is published on the SNB website. Download PDF Related posts: Swiss National Bank expects annual profit of 49 billion francs 2019-10-22 – Swiss National Bank opens SNB Forum for interested expert audience The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019 Swiss National Bank expects profit of CHF49 billion for 2019...

Read More »USD/CHF Price Analysis: Follows rising channel on H4 ahead of SNB

USD/CHF stays positive near a three-week high. The resistance line of an eight-day-old rising trend channel limits the immediate upside. 200-bar SMA offers immediate support, SNB in the spotlight. USD/CHF pulls back from the resistance line of a short-term rising trend channel while taking rounds to 0.9695, up 0.16%, during the early Thursday. In addition to the channel’s resistance, nearly overbought RSI conditions also challenge the pair’s further upside. However,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org