USD/CHF is under pressure in Asia as US index futures are flashing red. The pair has created a bear flag or a bearish continuation pattern on the 4-hour chart. USD/CHF is currently trading at 0.9364, representing a 0.38% drop on the day, having failed to chew through offers around 0.94 during the overnight trade. The anti-risk CHF is drawing bids in Asia, possibly tracking the S&P 500 futures, which are currently signaling risk aversion with a 2.25% drop. From a...

Read More »Devisen: Euro mit Abschlägen zu Dollar und Franken

Zum Franken neigt der Euro ebenfalls wieder leicht zur Schwäche. Im asiatischen Handel hatte sich die Gemeinschaftswährung noch oberhalb der 1,06er Marke bewegt, seit dem Vormittag ging es dann aber tendenziell wieder etwas abwärts, so dass aktuell 1,0597 Franken gezahlt werden. Der US-Dollar notiert mit 0,9328 Franken ebenfalls etwas tiefer als noch im frühen Handel. Die generelle Krisenstimmung an den Finanzmärkten hatte dem Schweizer Franken zu Wochenbeginn einen...

Read More »USD/CHF Price Analysis: Bears will keep eyes on support trendline from 2015

USD/CHF remains on the back foot despite recovering off-late. 61.8% of Fibonacci retracement will be on the sellers’ radars. Buyers are less likely to take the risk unless revisiting early-2020 levels. USD/CHF registers 1.36% loss to 0.9260 while heading into the European open on Monday. The pair earlier dropped below the longer-term support line, stretched from May 2015, but fails to stay beneath the same off-late. As a result, the bears will await a sustained fall...

Read More »Will CHF/GBP Be a Good Currency Pair for Investment in the Future?

Sponsored link anchor: transferring money from Switzerland to UK Trade between the UK and Switzerland is robust these days and it’s not going to get any worse for a long time. Even with the economic turmoil resulting from Brexit, the trade between these two countries was set to stay strong due to the special deal signed by them in 2019. As the situation stands now, trade agreements are solid, so these business relationships should only strengthen. Of course, this...

Read More »USD/CHF Price Analysis: 0.9610/15 challenges recovery from multi-month low

USD/CHF bounces off 23-month low amid oversold RSI. January/February bottoms could restrict immediate upside. An eight-day-old falling trend line adds to the resistance. February 2018 top seems to be on the Bears’ radar. USD/CHF recovers 0.11% from the lowest since September 2018 amid the pre-Europe session on Wednesday. With the RSI conditions oversold, the quote seems to extend the pullback towards the lows marked during January and February months of the current...

Read More »Swiss National Bank to distribute 4 billion francs of profit

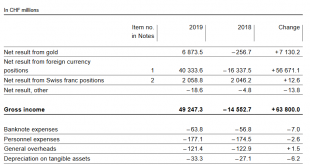

© Michael Müller | Dreamstime.com In 2019, the Swiss National Bank (SNB) made a profit of around CHF 49 billion. These profits came mainly from the rising value of the assets on the bank’s balance sheet. In 2019, the value of its holdings of foreign currency and gold rose substantially. When combined with interest, dividend income and gains on shares total profits for the year were CHF 49 billion. When combined with past retained profits, the SNB’s total accumulated...

Read More »SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was stopped in 2016, even without the need for a cap on the franc. But one should consider that we are in the good years of the credit cycle now. Bad quarters...

Read More »USD/CHF Price Analysis: 17-week-old falling trendline, 61.8 percent Fibonacci on bears’ radar

USD/CHF remains on the back foot near the multi-week low. Bearish MACD signals further downside, key support question the sellers. 200-week SMA acts as the key upside barrier. Despite bouncing off September 2018 lows, USD/CHF stays 0.11% down while trading around 0.9640 during early Monday. Also portraying the pair’s weakness are bearish conditions of MACD. That said, a downward sloping trend line since early October 2019, at 0.9600 now, acts as the immediate...

Read More »USD/CHF Price Analysis: Dollar bouncing after falling to three-week’s lows, trades above 0.9700 figure

USD/CHF is bouncing from daily lows while nearing the 0.9730 resistance. As the bounce can be short-lived, the level to beat for sellers remains the 0.9680 level USD/CHF daily chart USD/CHF is trading below the main daily simple moving averages suggesting an overall bearish bias in the long term. The spot is just below the 50 SMA. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart As expected the spot reached the 0.9680...

Read More »USD/CHF Price Analysis: 50-day SMA challenges further declines

USD/CHF trades near a three-week low. Bearish MACD, failures to carry the latest recovery keep sellers hopeful, 50-day SMA acts as near-term key support. 200-day SMA, 61.8% Fibonacci retracement act as near-term key resistances. USD/CHF remains on the back foot around 0.9740, down 0.25%, during the initial trading session on Thursday. That said, the quote fails to carry the previous day’s recovery gains. Even so, a 50-day SMA level of 0.9737 acts as the near-term key...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637194909152513960-310x165.png)