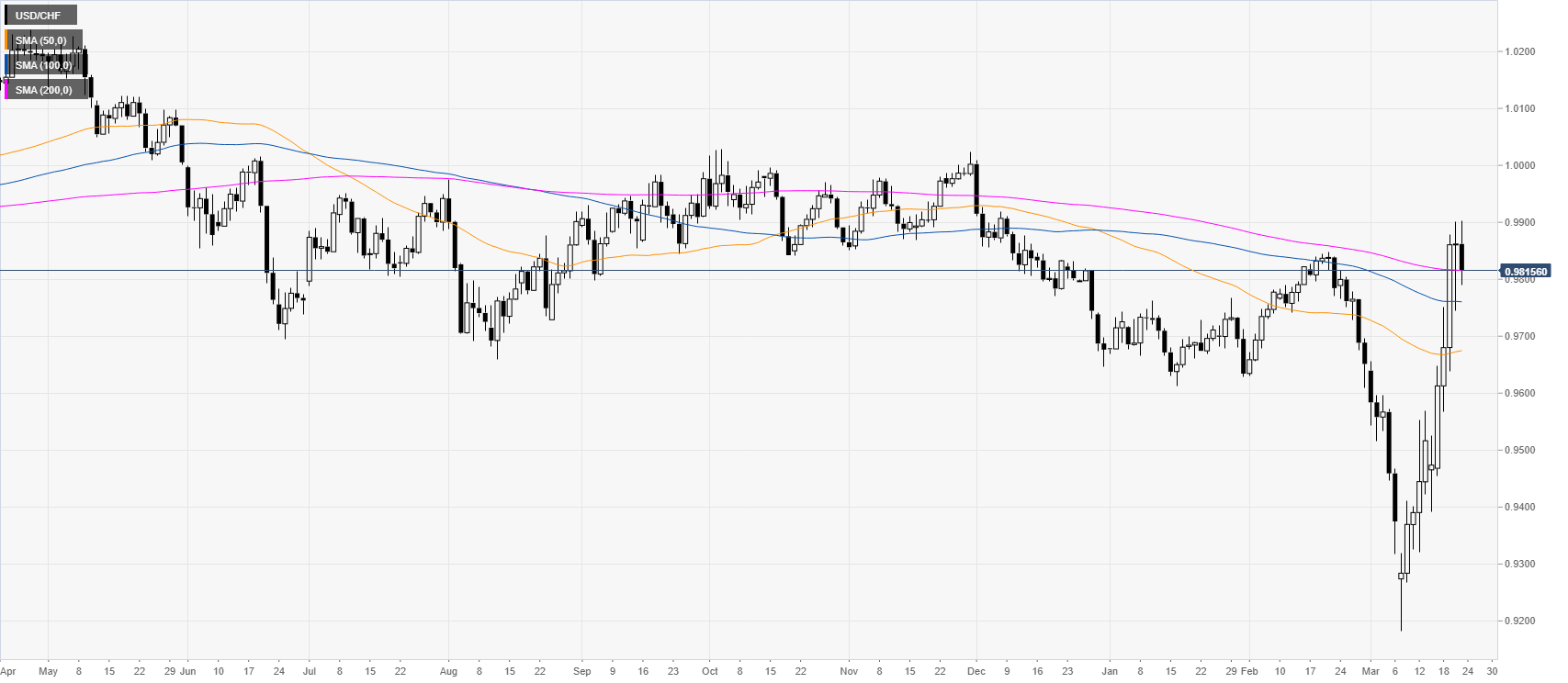

USD/CHF consolidates gains for the second consecutive day. The level to beat for bulls is the 0.9900 resistance. The parity level might be on the bulls’ radar. USD/CHF daily chart USD/CHF is retreating slightly this Monday while the currency pair is consolidating gains for the second consecutive day above the main SMAs. The Fed extended its Quantitative Easing program with an initial reaction down on the US dollar which was relatively limited on USD/CHF and across the board. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart The uptrend remains intact as the spot is trading above the main SMAs. Bulls are looking for a break above the 0.9900 figure for a potential run to the parity level (1.0000) followed by the

Topics:

Flavio Tosti considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

USD/CHF daily chartUSD/CHF is retreating slightly this Monday while the currency pair is consolidating gains for the second consecutive day above the main SMAs. The Fed extended its Quantitative Easing program with an initial reaction down on the US dollar which was relatively limited on USD/CHF and across the board. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

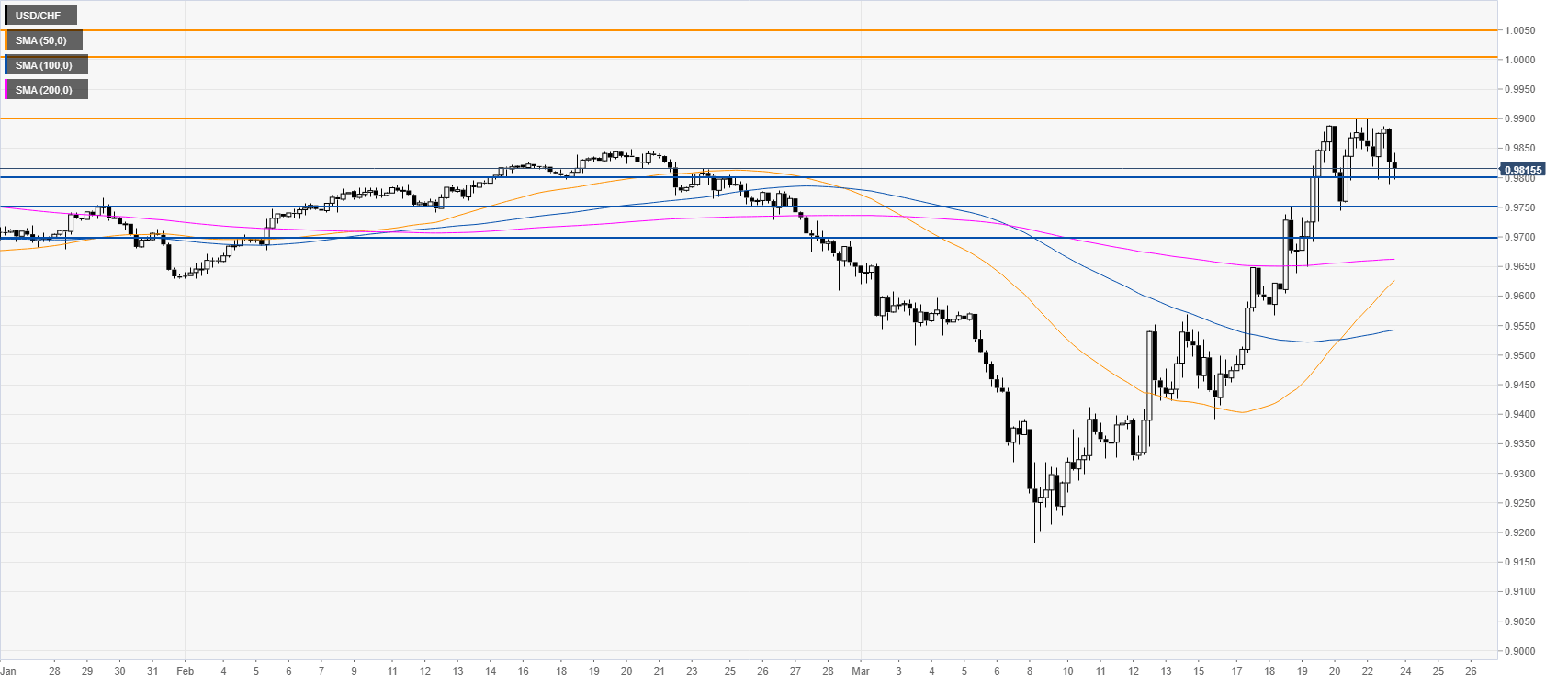

USD/CHF four-hour chartThe uptrend remains intact as the spot is trading above the main SMAs. Bulls are looking for a break above the 0.9900 figure for a potential run to the parity level (1.0000) followed by the 1.0050 level on the way up. The market is expected to find support near 0.9800, 0.9750 and 0.9700 levels in the medium term. |

USD/CHF four-hour chart(see more posts on USD/CHF, ) |

Tags: Featured,newsletter