Reuters The Swiss National Bank (SNB) will make a loss of CHF132 billion in 2022, and distribution of profits to the confederation and the cantons will be suspended. What does this mean for the stability of the SNB and what would happen if it faces another large loss? The SNB still has money. However, not quite as much as at the beginning of last year. Because of last year’s loss, its equity capital has fallen from CHF198 billion to CHF66 billion. In the event of...

Read More »Swiss-Life-Ökonomen erwarten nur noch wenige Zinsschritte

Federal-Reserve-Gebäude im April 2022. Den Notenbankern gehen allmählich die Argumente für weitere Zinsschritte aus. Das meinen die Ökonomen des Versicherungskonzerns Swiss Life und sagen deshalb für die USA, die Eurozone und die Schweiz nur noch leichte Zinserhöhungen voraus. Konkret erwartet Swiss-Life-Asset-Managers-Chefökonom Marc Brütsch von der Schweizerischen Nationalbank (SNB) im Frühling nur noch eine Erhöhung des Leitzinses um 0,25 Prozentpunkte auf 1,25...

Read More »Swiss central bank posts record CHF132 billion loss for 2022

The Swiss National Bank (SNB) has posted an annual loss of CHF132 billion ($143 billion) for 2022, the biggest in its 115-year history. “The loss on foreign currency positions amounted to around CHF131 billion and the loss on Swiss franc positions was around CHF1 billion. A valuation gain of CHF400 million was recorded on gold holdings,” the SNB said in a statement on Monday. The 2022 loss means the SNB will not make its usual payout to the Swiss federal and cantonal...

Read More »Forex Trading to Beat Inflation? The Key Considerations

Inflation rates are continuing to rise across the globe, with the UK arguably leading this trend. More specifically, the UK inflation rate hit 10.7% in November, and while it dipped slightly from a peak of 11.1% in October, it remained considerably higher than the Bank of England’s target of 2%. This is impacting the cost of energy and food items markedly, creating a cost-of-living crisis as inflation continues to outstrip earnings across multiple industries. With...

Read More »Swiss balance of payments and international investment position: Q3 2022

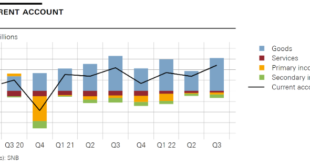

Overview In the third quarter of 2022, the current account surplus amounted to CHF 24 billion – a very high figure from a long-term perspective. This was attributable to the high surplus in goods trade and the relatively low deficits in services trade and in primary income. Compared to the same quarter of 2021, however, the increase in the current account balance (CHF 2 billion) was moderate because the basis for comparison was also high. In the financial account,...

Read More »Quarterly Bulletin Q4/2022

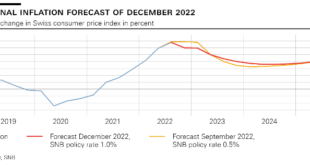

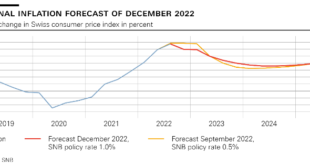

Monetary policy report Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of December 2022 The report describes economic and monetary developments in Switzerland and explains the inflation forecast. It shows how the SNB views the economic situation and the implications for monetary policy it draws from this assessment. The first section (‘Monetary policy decision of 15 December 2022’) is an excerpt from the press...

Read More »Thomas Jordan: Introductory remarks, news conference

Ladies and gentlemen It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual. Monetary policy decision I will begin with our monetary policy decision. We have decided to tighten our monetary policy further and to raise the SNB policy rate by 0.5 percentage...

Read More »Martin Schlegel: Introductory remarks, news conference

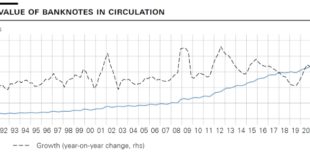

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years. In the period since the 2008 financial crisis, the value of banknotes in circulation grew, on average, more than twice as fast as in the two...

Read More »Andréa M. Maechler: Introductory remarks, news conference

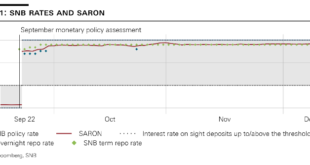

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September. The switch from a negative to a positive SNB policy rate required us to make an adjustment to the implementation of our monetary policy in the money market. The new approach...

Read More »Monetary policy assessment of 15 December 2022

Swiss National Bank tightens monetary policy further and raises SNB policy rate to 1.0% The SNB is tightening its monetary policy further and is raising the SNB policy rate by 0.5 percentage points to 1.0%. In doing so, it is countering increased inflationary pressure and a further spread of inflation. It cannot be ruled out that additional rises in the SNB policy rate will be necessary to ensure price stability over the medium term. To provide appropriate monetary...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org