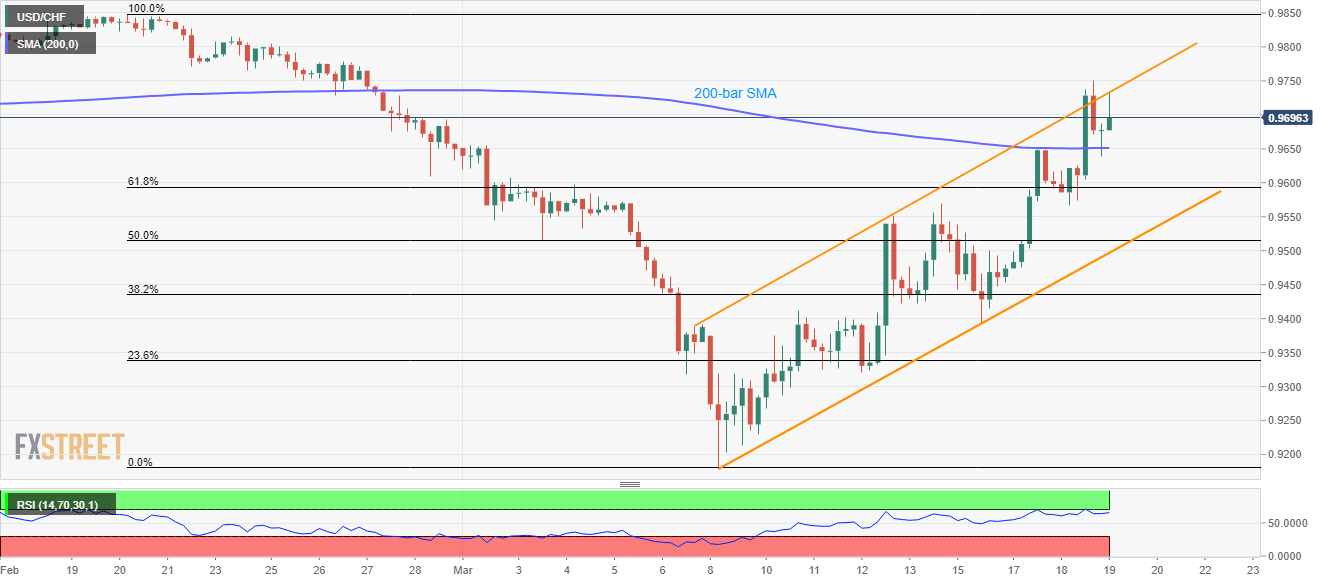

USD/CHF stays positive near a three-week high. The resistance line of an eight-day-old rising trend channel limits the immediate upside. 200-bar SMA offers immediate support, SNB in the spotlight. USD/CHF pulls back from the resistance line of a short-term rising trend channel while taking rounds to 0.9695, up 0.16%, during the early Thursday. In addition to the channel’s resistance, nearly overbought RSI conditions also challenge the pair’s further upside. However, sellers will wait for the entry below 200-bar SMA level of 0.9650 while targeting 61.8% Fibonacci retracement level of February 20 to March 09 fall, at 0.9590. During the pair’s additional weakness past-0.9590, the said channel’s support line near 0.9490 will be the key to watch. On the upside, a

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF stays positive near a three-week high.

- The resistance line of an eight-day-old rising trend channel limits the immediate upside.

- 200-bar SMA offers immediate support, SNB in the spotlight.

| USD/CHF pulls back from the resistance line of a short-term rising trend channel while taking rounds to 0.9695, up 0.16%, during the early Thursday.

In addition to the channel’s resistance, nearly overbought RSI conditions also challenge the pair’s further upside. However, sellers will wait for the entry below 200-bar SMA level of 0.9650 while targeting 61.8% Fibonacci retracement level of February 20 to March 09 fall, at 0.9590. During the pair’s additional weakness past-0.9590, the said channel’s support line near 0.9490 will be the key to watch. On the upside, a sustained break of 0.9740 can propel the USD/CHF prices further towards late-February highs surrounding 0.9850. It should also be noted that the Swiss National Bank (SNB) is up for a monetary policy meeting decision at 08:30 GMT. While the Swiss central bank isn’t expected to announce any rate changes, a surprise moves can’t be ruled out amid the present rush to combat the coronavirus (COVID-19) fears. |

USD/CHF four-hour (H4) chart(see more posts on USD/CHF, ) |

Trend: Bullish

Tags: Featured,newsletter,USD/CHF