With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020. Fabian Schnell studied economics at the University of St. Gallen and completed his doctorate there. He is currently a Member of Management at Avenir Suisse and Head of Research in the Smart...

Read More »SNB appoints new delegate Fabian Schnell for regional economic relations for Zurich region

With effect from 1 May 2020, Fabian Schnell will assume the function of Swiss National Bank (SNB) delegate for regional economic relations for the Zurich region. He succeeds Rita Kobel Rohr, who is taking on a new position at the SNB’s General Secretariat on 1 July 2020. Fabian Schnell studied economics at the University of St. Gallen and completed his doctorate there. He is currently a Member of Management at Avenir Suisse and Head of Research in the Smart...

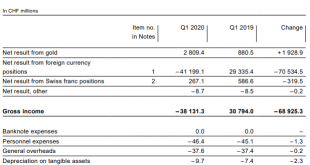

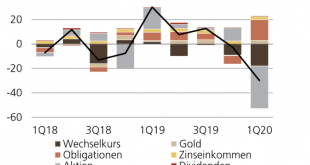

Read More »SNB Interim Results: -38 Billion, An Analysis

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Franc will rise again with crisis or inflation With a new financial crisis or a with a big rise of inflation, the run into the Swiss franc will start again. Deflationary period (e.g. Corona Crisis)...

Read More »SNB dürfte im ersten Quartal 30Milliarden Franken verlieren

Die SNB dürfte im ersten Quartal des laufendenJahres einen Verlust von rund CHF 30 Mrd.ausweisen. Die Coronakrise führte zu einem Kurssturz anden Aktienmärkten und zu einer Aufwertung desFrankens auf breiter Basis, beides schadete demErgebnis der SNB. Tiefere Zinsen und ein stärkererGoldpreis wiederum verhinderten einen nochhöheren Verlust Angesichts einer Ausschüttungsreserve von fast CHF85 Mrd. sind die Auszahlung an Bund und Kantoneselbst nach diesem Rückschlag...

Read More »USD/CHF Price Analysis: Pressured below 100-HMA, short-term resistance line

USD/CHF extends gradual declines from the monthly top marked the last-Monday. A descending trend line support, 61.8% Fibonacci retracement may offer intermediate rests during the downside. 0.9745/50 can act as a buffer resistance beyond 100-HMA. USD/CHF remains under pressure while taking rounds to 0.9655, down 0.05% on a daily, amid the early trading session on Monday. The pair currently tests 50% Fibonacci retracement of its upside from March 27 to April 06....

Read More »FINMA veröffentlicht weitere Aufsichtsmitteilung im Kontext der COVID-19-Krise

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht eine zweite Aufsichtsmitteilung mit Hinweisen für die Beaufsichtigten zu Erleichterungen und Präzisierungen der Aufsichtspraxis im Kontext der COVID-19-Krise. Mit ihrer Aufsichtsmitteilung 03/2020 gibt die FINMA weitere Erleichterungen im Kontext der COVID-19-Krise bekannt. Die Erleichterungen betreffen gewisse Identifikationspflichten der Geldwäschereiregulierung sowie den Versicherungsbereich. Hier ist...

Read More »Negativzinsen verursachen steigende Hypo-Zinsen – erst Recht zur „Corona-Unzeit“

„Ich glaube, dass einige Kommentatoren die Strenge der eingeführten Massnahmen (Einführung der Negativzinsen, Anmerkung des Autors) noch nicht ganz begriffen haben (…).“ „Sollten die Massnahmen nicht den gewünschten Erfolg zeigen, liessen sie sich auch verschärfen (…).“ Und: „Wir werden den Mindestkurs weiterhin mit aller Konsequenz durchzusetzen.“ Das waren die Worte von SNB-Chef Thomas Jordan bei der Einführung der Negativzinsen, kurz vor der Abschaffung des...

Read More »USD/CHF Price Analysis: Technical set-up remains tilted in favour of bullish traders

USD/CHF traded with a positive bias for the sixth consecutive session on Monday. Bulls are likely to wait for a sustained move beyond the very important 200-DMA. The USD/CHF pair built on last week’s goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday. The pair climbed to near two-week tops in the last hour, with bulls now looking to extend the momentum further beyond the 0.9800 round-figure mark. The...

Read More »Devisen: Eurokurs gibt leicht nach – Wenig verändert zum Franken

Gegenüber dem Schweizer Franken notiert der Euro mit 1,0556 ebenfalls wenig verändert. Und der Dollar kostet 0,9777 Franken. Derweil interveniert die Schweizerische Nationalbank (SNB) wohl weiterhin am Devisenmarkt. Denn die erneut kräftige Zunahme der Sichtguthaben – diese Woche um 6,7 Milliarden nach 11,7 Milliarden in der Vorwoche – deutet daraufhin, dass sich die SNB auch in der vergangenen Woche gegen die Aufwertung des Frankens gestemmt hat. An den...

Read More »FINMA veröffentlicht Geschäftsbericht 2019

Die Eidgenössische Finanzmarktaufsicht FINMA veröffentlicht heute ihren Geschäftsbericht 2019. Dieser umfasst neben dem rückblickenden Jahresbericht auch die Jahresrechnung. Weiter stellt die FINMA ab heute neu Angaben zu den Enforcementfällen in einer Datenbank sowie Statistiken als Excel-Dokument auf ihrer Webseite zur Verfügung. “In unsicheren Zeiten auf den internationalen Finanzmärkten braucht die Schweiz stabile Finanzmarktinstitute.” So äussern sich der...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org

-637217795705356366-310x165.png)