Overview: The back-to-back surprise rate hikes by the Australia and Canada spurred speculation that the Fed could hike next week, and this lifted US rates and helped the dollar recover. The odds of a hike increased, according to the indicative pricing in the Fed funds futures market from about a 20% chance to a little above 35%. now. At yesterday's high, the two-year yield was up a little more than 25 bp since the low before the US employment data last Friday. It is little changed today near 4.55%. Still, the greenback is softer against all the G10 currencies, but is mostly consolidating in narrow ranges. Emerging market currencies are more mixed. Of note the Chinese yuan is snapping a four-day fall, and after plummeting 7% yesterday, the Turkish lira steadied,

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Bank of Canada, China, Currency Movement, ECB, EMU, Featured, Japan, Mexico, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Overview: The back-to-back surprise rate hikes by the Australia and Canada spurred speculation that the Fed could hike next week, and this lifted US rates and helped the dollar recover. The odds of a hike increased, according to the indicative pricing in the Fed funds futures market from about a 20% chance to a little above 35%. now. At yesterday's high, the two-year yield was up a little more than 25 bp since the low before the US employment data last Friday. It is little changed today near 4.55%. Still, the greenback is softer against all the G10 currencies, but is mostly consolidating in narrow ranges. Emerging market currencies are more mixed. Of note the Chinese yuan is snapping a four-day fall, and after plummeting 7% yesterday, the Turkish lira steadied, but is off about 0.6%.

While most large equity markets in the Asia Pacific region fell today, Hong Kong and China's CSI 300 rose. The Stoxx 600 in Europe has drifted a little lower. If sustained, it would be the third loss this week. US equity futures are steady to slightly firmer. Benchmark 10-year yield are mixed in Europe. Peripheral yields are 1-3 bp lower while the core is flattish. UK Gilts and Swedish bonds are under more pressure and yields are 3-4 bp higher. The softer US dollar is helping gold stabilize after recording a bearish outside down day yesterday. It closed on its lows near $1940 but has not taken it out, and it is held slightly below $1950. July WTI reached $75 on Monday following the Saudi's unilateral cut of an additional 1 mln barrels a day in output (starting next month). However, it fell back to $70 on Tuesday and is in near the middle of that $5-range today.

Asia Pacific

Japan revised Q1 GDP to 2.7% annualized from 1.6%. The revision was driven by stronger business spending (1.4% vs. 0.9% initially), which was signaled by the stronger than expected capital spending (11% year-over-year vs median forecast in Bloomberg's survey for 6.0%). The other notable revision was with inventory accumulation. They boosted GDP by 0.4% percentage points rather than 0.1%. Nevertheless, a poll by Bloomberg found only 3 of 47 economists now expect a tightening move next week, down from 18 in last month's survey. Now, a little more than a third of the respondents see July as the more likely timeframe. A fifth look for a change after the summer, up from 10% in the previous survey. Meanwhile, foreign investors continue their buying spree of Japanese equities for the 10th consecutive week. Japanese investor sales of foreign bonds last year were thought to be strategic, but it looks increasing tactical. Last year, they sold about JPY21.7 trillion (~$165 bln). In the first 22 weeks of the year, Japanese investors have bought about JPY12.1 trillion back.

The decline in China's May exports and imports underscored concern about the world's second-largest economy. After banks cut deposit rates at the request of Beijing, the market was already primed for a likely cut next week in the benchmark 1-year medium-term lending facility (2.75%). Tomorrow's inflation data will likely confirm what we already know. Consumer inflation is amazingly low (0.1% year-over-year in April) and producer price deflation (-3.6% in April). May will be the eighth consecutive month of negative year-over-year PPI. China's discount to the US on 10-year yields widened to almost 108 bp yesterday. The low for the year was set in early April near 114 bp. Last year, it reached almost 153 bp, the most since 2007.

Australia reported a 5% fall in exports in April, the largest monthly fall since last July. Imports rose 1.6%, half of the March pace. The net result was a smaller than expected trade surplus of A$11.16 bln. Last April, Australia recorded a trade surplus of A$12.95 bln. Still, the trade surplus has grown this year, from A$41.7 bln in the first four months of 2022 to A$51.1 bln this year. Of note, Australian exports of iron ore and other metals fell in April (-10.4%). Canberra's trade relationship with China, its biggest partner has improved and exports to China are up about 13.6% in the January-April period. Inbound tourism, which has also been an important component of Japanese consumption, rose by nearly 14% in April (travel exports).

The 12 bp increase in the US 10-year yield yesterday helped the dollar post an outside up day against the yen. After trading below Tuesday's low, the dollar reversed and closed above its high. It held below Monday's high (~JPY140.45). Yet, despite the bullish price action, there has been no follow-through dollar buying. The greenback is trading quietly in a roughly JPY139.65-JPY140.25 range. Watch US 10-year yields for the direction cue in the North American session today. It is nearly flat just below 3.80%. The Australian dollar was sold yesterday after popping above $0.7000 but reversed lower. Here, too, there has been no follow-through US dollar buying, and the Aussie is consolidating in the $0.6650-$0.6690 range. Options for nearly A$710 mln expire today at $0.6950. A close above $0.7000 lifts the technical tone. We had thought the CNY7.07-CNY7.11 was a reasonable target, but it has surpassed it. The next nearby chart of note is around CNY7.16-CNY7.20. Recall that last year's high (November 4) was near CNY7.3120. The dollar is snapping a four-day advance today. Since May 5, it is only the fifth losing session. And even it is minimal. The dollar settled near CNY7.1350 yesterday and held CNY7.1260 today. The reference rate was set at CNY7.1280 today, a smidgeon below the CNY7.1282 median forecast in Bloomberg's survey.

Europe

The downward revision in the eurozone's Q1 GDP to -0.1% from +0.1% doses not really change anything. The ECB meets next week and there is little doubt in the market's mind about the outcome. A quarter-point hike will bring the deposit rate to 3.25%. The swaps market fully prices in another hike in Q3. The ECB will update its forecasts next week too. In March, it had forecast this year's growth at 1.0% year-over-year. The median in Bloomberg's survey is 0.6%. The World Bank is even more pessimistic with a forecast of 0.4%. The IMF and OECD are closer to the ECB at 0.8% and 0.9%, respectively.

The ECB published the results of its April survey of consumer expectations yesterday. The 12-month outlook fell to 4.1% from 5.0% in March. The three-year expectation eased to 2.5% from 2.9%. The ECB's March forecasts had CPI rising 5.3% this year and 2.9% next year. The median forecast in Bloomberg's survey is for CPI to be at 5.6% at the end of this year and 2.5% at the end of 2024.

So far this week the euro has chopped inside the range set last Thursday, before the US jobs report (~$1.0660-$1.0770). More pointedly, the euro has held below $1.0740, which was about the (38.2%) retracement of the rally from the March 15 low near $1.0515. Although it enjoys a firmer today, it is inside yesterday's range. There is greater uncertainty around the Fed meeting and than the ECB meeting next week. There may be little incentive ahead of the FOMC meeting (and CPI) for speculators to make a big push in either direction. We note that after rising from below 120 bp in early May to around 170 bp earlier this week, the US premium over Germany on two-year money appears to be stabilizing. Except for spending Monday morning on its back foot in Europe, sterling too is mostly consolidating within the range set last Thursday (~$1.2400-$1.2540). It is enjoying a firmer bias today, has held below yesterday's high near $1.25. Also, sterling's five- and 20-day moving averages crossed higher for the for the first time in three weeks. Still, unless it can rise above the $1.2500-40 area, sterling may be vulnerable. Sterling has fared better than the euro, which had fallen from GBP0.8835 in early May to about GBP0.8565 last week, the low for the year. It is straddling the GBP0.8600 area today.

America

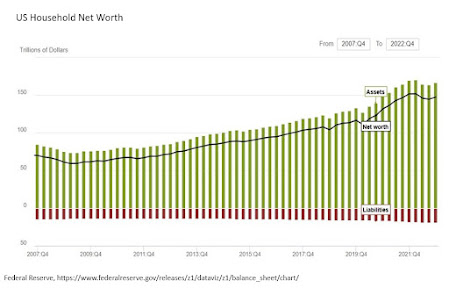

Today's US data, which includes weekly jobless claims and wholesale inventories, are unlikely to have much impact. The US also sees the Q1 household net worth report. It does not move the market, but it is important. Last year was the first year since 2008 that household net worth did not increase. On the other hand, over the past five years (20 quarters), US household net worth has risen by $44.2 trillion. Over the last ten years (40 quarters), it has risen by $75.8 trillion.

The market pushed the dollar to a new seven-year low against the high-flying Mexican peso ahead today's CPI report. Mexico reports CPI for the second half of May as well as for the whole month. The headline rate is expected to fall below 6% for the first time in nearly two years. In the first four months of the year, Mexico's CPI has risen at an annualized rate of almost 4.5%. The core rate is running nearly twice as hot. The central bank is done raising rates and the swaps market is pricing in a cut before the end of the year.

The Bank of Canada's hike saw a quick drop in the greenback from around CAD1.3400 to CAD1.3320. Its lowest level in a month and the US dollar has not traded below CAD1.33 since mid-February. However, the heavier tone in S&P 500 and broadly firmer US dollar saw it recover to almost CAD1.3400. Both ends of the recent range (~CAD1.33-CAD1.3650) have recently been tested and they held. Prudence dictates that we assume the range holds until proven otherwise and that means opportunities exist as the range extreme is approached. The US dollar recorded today's low so far in the European morning near CAD1.3335. Initial resistance is seen in the CAD1.3360-80 area. The greenback was sold to nearly MXN17.3055 yesterday and recovered to settle around MXN17.3650. It has not been above MXN17.37 today. Although the exchange rate is at levels not seen since 2016, as the dollar has fallen, volatility has eased. One-month implied vol is near 9.7% now and is approaching the low for the year set in early February closer to 9.3%, which matches the 2022 low. The relatively low volatility is an important consideration for carry-trade strategies. By comparison, one-month BRL vol is almost 13% and around 15.2% for the COP.

Tags: #USD,Australia,Bank of Canada,China,Currency Movement,ECB,EMU,Featured,Japan,Mexico,newsletter