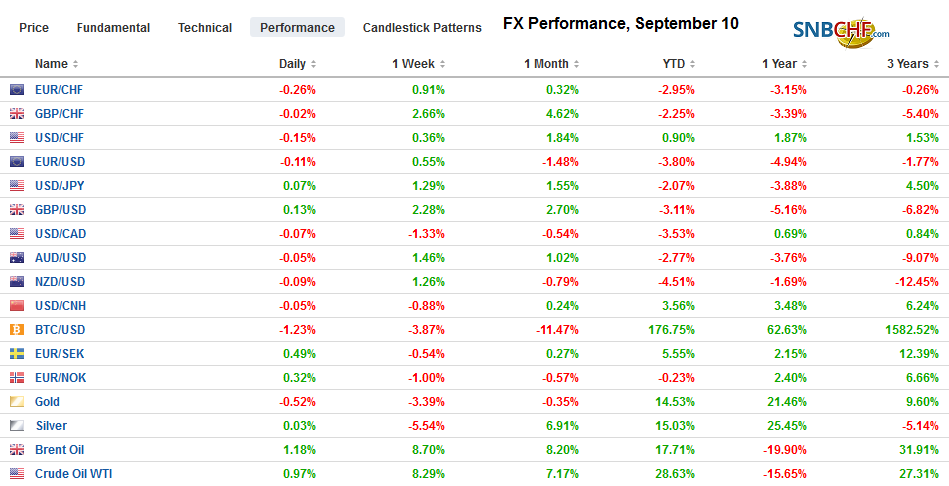

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at the open. US 10-year yields are a little softer after reaching one-month highs near 1.65%, but most European benchmark yields are one-two basis points higher. The dollar is also finding new bids after being sold in recent sessions. The dollar reached JPY107.50, its highest level since August 2. The euro

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China, China Consumer Price Index, China Producer Price Index, Currency Movement, EUR/CHF, Featured, FX Daily, Mexico, newsletter, SEK, Sweden, U.K. Unemployment Rate, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.22% to 1.0933 |

EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at the open. US 10-year yields are a little softer after reaching one-month highs near 1.65%, but most European benchmark yields are one-two basis points higher. The dollar is also finding new bids after being sold in recent sessions. The dollar reached JPY107.50, its highest level since August 2. The euro remains mired within the range set last Thursday, September 5th of roughly $1.1015-$1.1085. The Chinese yuan firmed to its best level in more than two weeks. A weaker than expected CPI reported pushed the Swedish krona nearly 1% lower to lead the majors lower. Two recent trends are intact still today. Crude oil is firmer for the fifth session, aided by Saudi Arabia signaling that despite a change in oil ministers, the national strategy is unchanged. Gold is lower for a fourth session. It peaked a week ago near $1557. It fell to $1486.5 today before stabilizing. |

FX Performance, September 10 |

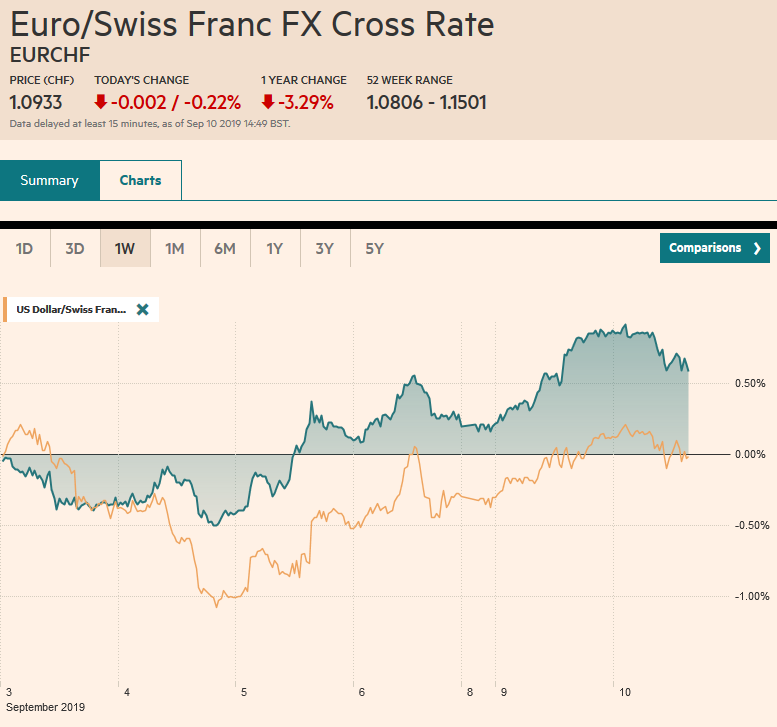

Asia PacificChina set the reference rate for the dollar lower than models as it has done for three weeks. While the fix has been largely steady, the market has gradually come back to it. The dollar is below the 20-day moving average against the yuan (~CNY7.1110) for the first time since late July. China reported August consumer and producer prices. The CPI was steady at 2.8%, but this masked a 46.7% year-over-year rise in pork prices. On the month alone, the rate increased by around 20 percentage points. Food prices increased 10% over the past year after a 9.1% pace in July. Food added almost two percentage points to headline CPI with pork prices accounting for about half. Gasoline prices fell by 10.2% year-over-year after a 9% decline in July. The core rate, which excludes food and energy, stood at 1.5%. It was 1.6% in July and been below 2% for a full year. |

China Consumer Price Index (CPI) YoY, August 2019(see more posts on China Consumer Price Index, ) Source: investing.com - Click to enlarge |

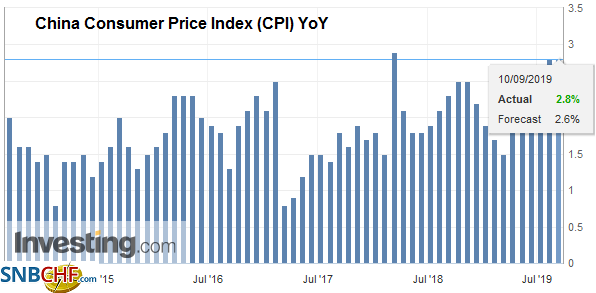

| The deflationary pressures from commodity prices were evident in the PPI. The year-over-year pace fell to minus 0.8% after minus 0.3% in July. There is unlikely to be a direct policy response to today’s data but will reinforce expectations for a reduction in the prime loan rate at the end of next week. |

China Producer Price Index (PPI) YoY, August 2019(see more posts on China Producer Price Index, ) Source: investing.com - Click to enlarge |

At the start of the week, Japan revised Q2 GDP lower to reflect less business spending than the preliminary estimate (0.2% rather than 1.5%). Today’s preliminary August machine tool orders confirm the weakness has carried over into Q3. The 37.1% drop year-over-year follows a 33% contraction in July. Core machine orders for July will be reported tomorrow and are expected to have fallen by 8% on the month after rising 13.9% in June. The year-over-year pace is likely to have fallen back into negative territory (~-3.7%).

The rise in US yields appears to have been the driving force to lift the greenback to JPY107.50. It had been toying with JPY107 in recent days and closed above it yesterday for the first time since August 1. The high was seen in Asia before the dollar drifted lower before bids were found near JPY107.20. Old resistance (JPY107) may now act as support, helped perhaps by a roughly $700 mln option struck there that expires today. The Australian dollar is trading inside yesterday’s range after stalling in front of resistance near $0.6880. It may remain trapped in a narrow range today with two expiring options strikes in play. There is an option for almost A$700 mln at $0.6835 and A$5780 mln at $0.6865.

Europe

After losing two more votes in Parliament yesterday, UK Prime Minister Johnson must be happy it suspended for the next five weeks. Although it is a long suspension and the logic undermines democratic rule, the courts have upheld the decision. Johnson lost his second attempt to force an early election, and the House of Commons voted to force the government to publish its preparations for a no-deal exit.

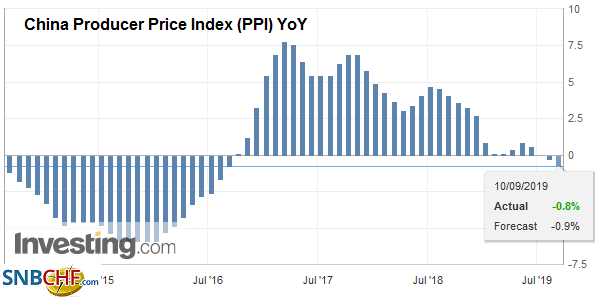

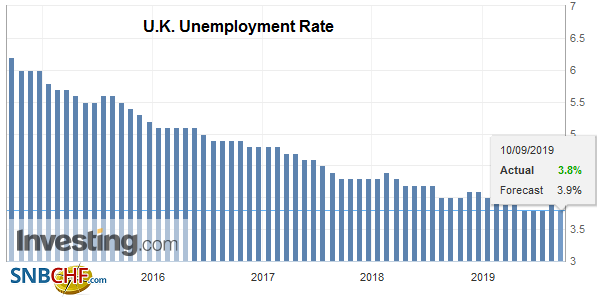

| Separately, the UK reported softening of a few labor market readings. The August claimant count rose by 28.2k compared with a 22k average through July. The three-month over three-month job growth slowed to 31k in July, its second-lowest of the year. Average weekly earnings rose to a new cyclical high for the three-months (year-over-year) through July of 4% (from a revised 3.8%, 3.7% initially). On the other hand, excluding bonus payments, average weekly earnings softened a touch to 3.8% from 3.9%. |

U.K. Unemployment Rate, July 2019(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

Italy’s Conte won his first confidence vote yesterday in the Chamber of Deputies and will likely win the vote in the Senate today. That a political and economic crisis has been averted has seen the Italian premium over Germany narrow to its smallest level since May 2018. Its work to revive the economy is needed. Today it reported a 0.7% decline in July industrial production, which is much weaker than expected. It follows a 0.3% fall in June. Together, June and July have offset the 1% gain in May. Separately, France also reported disappointing industrial output figures. The 0.3% rise was less than expected and leaves the 2.3% decline in June barely scratched. The year-over-year rate remained below zero for the second consecutive month. Manufacturing rose 0.3% compared to the 0.8% median forecast in the Bloomberg survey.

Sweden’s Riksbank has bucked the trend toward new monetary stimulus last week and still penciled in exiting negative interest rates later this year or early next year. Many were skeptical, while others cited it as evidence that monetary accommodation was reaching an end more broadly. Today it reported a 0.4% decline in CPI and bringing the CPIF, which uses fixed interest rate mortgages to 1.3%, its weakest pace in three years. It is the third consecutive month that the year-over-year pace has softened. The krona was sold and dragged Norway’s krone lower today. Swedish bonds yields eased.

The euro is little changed and confined to about a quarter of a cent below $1.1060. Neither the option for 525 mln euros at $1.10 nor the 2 bln euros at $1.11 appear to be in play today. The market seems to be biding its time until the ECB meeting on Sept 12. Sterling approached $1.24 yesterday as it recorded a large outside up day (trading on both sides of the previous session’s range and closed above the previous session’s high) and pulled back to almost $1.23 today. There is a large GBP1.8 bln option at $1.23 that expires today.

America

The North American economic calendar is light today. The main feature is the US JOLTS data, which even in the best of times typically does not move the market. Canada reports housing starts and permits, but also are not market-moving data points. Mexico’s August CPI, reported yesterday, was in line with expectations and the market remains divided about the prospects for a rate cut this month (Sept 26). Late yesterday, the US reported that July consumer credit soared by $23.3 bln, nearly half again as high as expected. It was the strongest rise since late 2017. Revolving credit (credit cards) jumped by $10 bln, which is also the most in a couple of years.

It has been three months since Mexico and the US struck a deal about the border that averted the US slapping tariffs on all imports from Mexico. The results look promising. People apprehended by the US or turned back fell for the third month in August. Reports put the number of people at 64k down from 82k in July. Mexico continues to resist US demands that it passes legislation that requires asylum seekers to remain in the first “safe harbor” that is reached.

The US dollar fell to about CAD1.3140 yesterday, its lowest level since July 31. However, the move seems exhausted after beginning last week near CAD1.3385. A technical correction could see CAD1.3230 initially. Similarly, the US dollar extended its recent losses against the Mexican peso to about MXN19.4750, just above our target near MXN19.45. The dollar recovered yesterday, leaving a potential bullish hammer candlestick in its wake. Initial resistance is near MXN19.62, but risk extends toward MXN19.75-MXN19.80 from a technical perspective in the coming days.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China,China Consumer Price Index,China Producer Price Index,Currency Movement,EUR/CHF,Featured,FX Daily,Mexico,newsletter,SEK,Sweden,U.K. Unemployment Rate,USD/CHF