Swiss Franc The Euro has risen by 0.37% to 1.0969 EUR/CHF and USD/CHF, May 11(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The sell-off in US shares yesterday has triggered sharp global losses today, and there is no flight into fixed income as benchmark yields are higher across the board. Nor is the dollar serving as much as a safe haven. It is mostly softer against the major currencies. Japan and...

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

Read More »FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Swiss Franc The Euro has risen by 0.08% at 1.125 EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng’s nearly 1.9% decline was...

Read More »Chinese Inflation And Money Contributions To EM’s

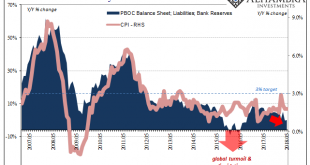

The People’s Bank of China won’t update its balance sheet numbers for May until later this month. Last month, as expected, the Chinese central bank allowed bank reserves to contract for the first time in nearly two years. It is, I believe, all part of the reprioritization of monetary policy goals toward CNY. How well it works in practice remains to be seen. Authorities are not simply contracting one important form of...

Read More »FX Daily, April 11: Mr Market Waits for Other Shoe to Drop

Swiss Franc The Euro has risen by 0.20% to 1.1846 CHF. EUR/CHF and USD/CHF, April 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Between Syria, trade tensions, and the US special investigator into Russia’s attempt to influence the US election, market participants are cautious as they wait for another shoe to drop. The US equity market recovery yesterday has short...

Read More »FX Daily, March 09: Today is about Jobs, but Not Really

(About to set off on another business trip. I will spend the next two weeks in Asia. The updates will be sporadic. Thanks for your patience.) Swiss Franc The Euro has fallen by 0.01% to 1.1706 CHF. EUR/CHF and USD/CHF, March 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US Administration has softened its initial hardline position of no exemptions for the new...

Read More »FX Daily, February 09: Equity Sell-Off Extends to Asia, but More Muted in Europe

Swiss Franc The Euro has risen by 0.38% to 1.1502 CHF. EUR/CHF and USD/CHF, February 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 100-point slide in the S&P 500 and the 1000-point drop in the Dow Jones Industrials yesterday spurred more bloodletting in Asia. The 1.8% drop in the MSCI Asia Pacific Index (for a 6.7% loss for the week) may conceal the magnitude...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More »Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well. All told, in 2017 alone, these Central Banks will printed over...

Read More »Global Inflation Continues To Underwhelm

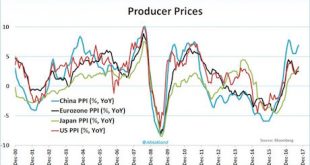

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org