Germany has recently joined Switzerland in the dubious All Negative Club. The interest rate on every government bond, from short to 30 years, is now negative. Many would say “congratulations”, in the belief that this proves their credit risk is … well … umm … negative(?) And anyways, it will let them borrow more to spend on consumption which will stimulate … umm… well… all of the wasteful consumption for which governments are rightly infamous. While those who are about to borrow may find cause to cheer (as opposed to those who have already borrowed, at higher rates, who are now disadvantaged by this move), the savers are harmed. How can anyone save in an environment where savings has a cost? John Maynard Keynes called for the “euthanasia of the rentier”.

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, Basic Reports, bond bubble, dollar price, Featured, Germany, gold basis, Gold co-basis, gold price, gold silver ratio, Gold Standard, irredeemable currency, negative rates, negative yield, newsletter, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Germany has recently joined Switzerland in the dubious All Negative Club. The interest rate on every government bond, from short to 30 years, is now negative. Many would say “congratulations”, in the belief that this proves their credit risk is … well … umm … negative(?) And anyways, it will let them borrow more to spend on consumption which will stimulate … umm… well… all of the wasteful consumption for which governments are rightly infamous.

While those who are about to borrow may find cause to cheer (as opposed to those who have already borrowed, at higher rates, who are now disadvantaged by this move), the savers are harmed. How can anyone save in an environment where savings has a cost?

John Maynard Keynes called for the “euthanasia of the rentier”.

Congratulations, Germany, we say in all sarcastic seriousness. You have gone even beyond Keynes vicious idea. Your rate is now negative!

The Preference of the Savers

Instead of writing more on the destructiveness of this, we want to tackle a different question today. How is this possible? What are the mechanics? Why don’t savers rebel?

We wrote about the Crime of ’33 a few months ago, and it’s worth re-reading before going on. 1933 is when President Roosevelt made the dollar irredeemable. Prior to that, if you didn’t like the interest rate, you could sell the bond and hold gold coins instead. The gold coin has no default risk. And, back then—in the gold standard–it had no price risk.

Today one can own gold, to avoid default risk. This is a big part of why gold is now $1,500. But one takes price risk. And price volatility to be is considered a feature, not a bug, by the gold bugs!

The act of expressing that preference to hold gold coins over gold bonds did not just change one’s personal risk level. It also had an economic effect. It changed the exchange rate of the gold bond relative to the gold coin. I.e. it changed the price of the gold bond. I.e. it changed the interest rate. Let that sink in, as it is vitally important.The preference of the savers could change the interest rate.

When a saver chooses to opt out of the bond, he pushes the interest rate up. And this, of course, makes the bond more attractive to all other savers. Interest is the compensation paid for taking risk.

Thus, the gold standard had a very firm floor under the rate of interest. It was: time preference. Time preference is part of the nature of the human condition. Being that we are mortal, we must eat today in order to be alive tomorrow. So there is a reality-given bias to preferring goods now compared to goods in the future. Such as ten years.

Irredeemable Currency Disenfranchises Savers

However, we don’t have a gold standard today. We have the very model of a modern monetary mechanism (apologies to Gilbert and Sullivan). And in this system, the bond is not priced in terms of gold. It is priced in terms of the dollar (which is backed by the bond).

This means that if you opt out of the bond to hold gold, you are not affecting the interest rate. You are affecting the price of gold (or as we always remind readers, the price of the dollar measured in gold). The price of gold has no impact on the economy today (other than to the gold miners, and the gold supply chain). It could be $300 or $3,000 and it would make no difference.

As an aside, we write a lot about the falling interest rate which causes rising asset prices. And that rising asset prices is a process of conversion of one person’s wealth into another’s income. The latter consumes it. Endless bull markets may be popular, but they are just wholesale consumption of capital. They are part of Keynes’ evil plan. It makes no difference whether people speculate on equities, properties, or precious metals. The result is the same: earlier speculators spend later speculators’ wealth.

Let’s go back to that last statement, above, “…you are not affecting the interest rate.” This is the key to understanding why the interest rate has gone off the rails. If you buy equities, properties, antique cars, old masters artworks, or precious metals, you have no impact on the interest rate.

You are trading your money balance (i.e. credit balance) to someone else. In exchange, you are getting his non-money goods. In this case, gold. So what changed? Only the name in the banking system record, and the title to the goods.

And the seller inherits your position. He, too, is disenfranchised. In fact, regardless of whose name is on the record of each money balance, the dollars are captive within the banking system. They cannot get out.

In the gold standard, the interest rate goes up when people remove their gold from the banking system. In the irredeemable dollar system, there is no way to remove dollars from the banking system.

It’s All About the Spread

In Crime of ’33, we said, “Interest is a spread. It is the spread between the gold coin and the gold bond.”

Now we can see it in a new light. The interest rate is the spread between money held outside the banking system, and money held inside the banking system. If the spread is too small, people at the margin are incentivized to pull more money out. This causes interest rates to rise.

However, in a system where it is not possible to pull money out, this mechanism is not in operation. Like in our system. One person can trade a money balance in the banking system for a gold coin. But then the gold seller just gets that money balance. And he has the same dearth of options. A purchase from a third-party is not the same thing as a redemption.

As an aside, we exclusively use the word money to mean the most marketable commodity. And the extinguisher of debt. In the preceding few paragraphs, we have used it in a different sense. Nothing has changed in our intention or thinking. We simply felt that the terminology of money was the simplest way to make the point clear.

The proof is in the pudding. A number of major economies have negative interest rates. Now two major economies are entirely devoid of positive interest. And even zero interest. They are exclusively negative.

This is why Monetary Metals is on a mission to pay interest on everyone’s gold, to help the world move to a new gold standard, and restore the monetary franchise.

Supply and Demand Fundamentals

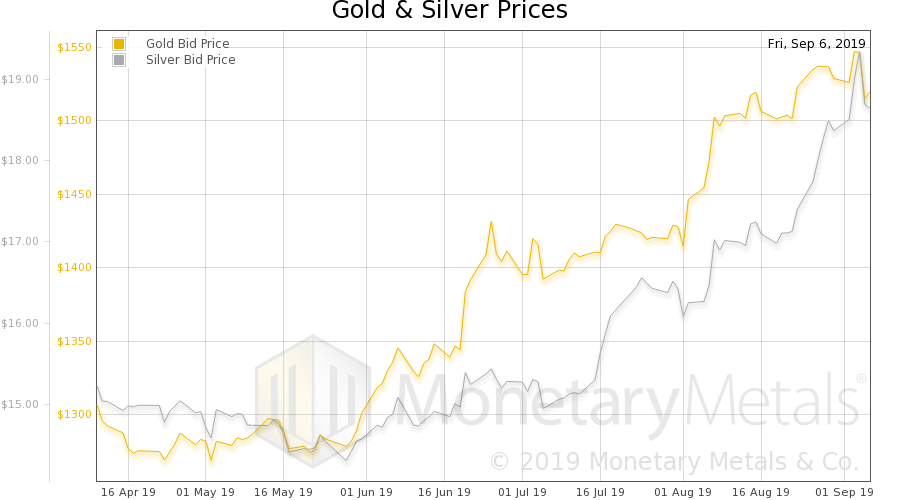

The price action got pretty intense this week! The prices of the metals were up Monday, Tuesday, and Wednesday. But Thursday and Friday, there was a sharp reversal and the silver price ended the week below its end last week.

Silver made a round trip down from $18.35 to $18.16 by way of $19.65. That is it was +$1.35 for a moment on Wednesday, and then ended -$0.19. Gold was a bit more muted, going from $1,520 down to $1,507 by way of $1,557. It was +$37 to close -$7.

OK, so how do you explain this? One facile answer is “da boyz in da cartel smashed the metals down.” Aside from the government having no reason to care about the price of gold, as it has little economic impact, this idea holds no water. As we explained to Ted Butler, the evidence is against it. We won’t rehash the same old argument today.

We offer a rather more prosaic answer. Actually, two drivers.

Gold has no default risk but no yield (other than Monetary Metals investments). It is therefore the asset to own when you are more concerned with return of capital than return on capital.

This is why the price of gold has been up when the stock market has been down. Every time President Trump has tweeted a policy that will be bad for business, stocks have responded by nose-diving and the price of gold has moved up. As has the price of Treasury bonds. So Treasurys are near their all-time high, and gold is getting there too. The price of long bonds in Germany is making new highs.

In the latter half of the week, optimism, if not for the economy then at least the stocks of the big corporations, has grown. By Friday’s close, US equities in the S&P 500 index were up 2.7% from Wednesday’s open. So long as people think they can make speculative gains in equities, they don’t prefer to hold a yieldless lump of metal. And they don’t prefer silver in preference to not preferring to hold gold. In other words, silver is more speculative than gold, and therefore they sell it first.

Renewed optimism is one driver. We shall see how long that lasts. “Normally” during the boom phase, wealth-destroying enterprises like WeWork can enjoy skyrocketing valuations. Speculators aggressively demand assets, and the lowest-quality issues can go up the fastest. WeWork’s pending IPO may be in trouble. Fellow wealth-destroyer, Uber, went public in May and its stock has fallen about 25% since the end of July. Can they juice up another move higher in equities? Anything is possible, but the more capital is destroyed—both by speculators and by these wealth-destroying enterprises—the more that the risk of a wave of defaults ratchets up.

The other driver is in the nature of speculative markets. There are many speculators who bought gold, and especially silver, at higher prices. They have been long suffering, not willing to sell at such low prices, and despairing of the chance of higher prices. They have seen any number of price blips, which have not been durable. So the price has gone up, and they begin to think it’s time to sell, and get out.

Perhaps the downtick on Wednesday due to the renewed optimism in equities was the trigger for these speculators with their likely hair-trigger offers to sell. The price dropped and many would certainly have seen their chance to sell going up in smoke. So they dumped their metals, as they reckoned it, before it would be too late. Too late may turn out to be when the selling wave is over, and the price begins to rise again. We shall look at the supply and demand fundamentals below.

Gold and Silver PricesBut, first, here is the chart of the prices of gold and silver. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

Gold to Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). The ratio had fallen very sharply through Wednesday, hitting a new low of 79.25. But then the last two days of the week, it rocketed up to close just above last week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

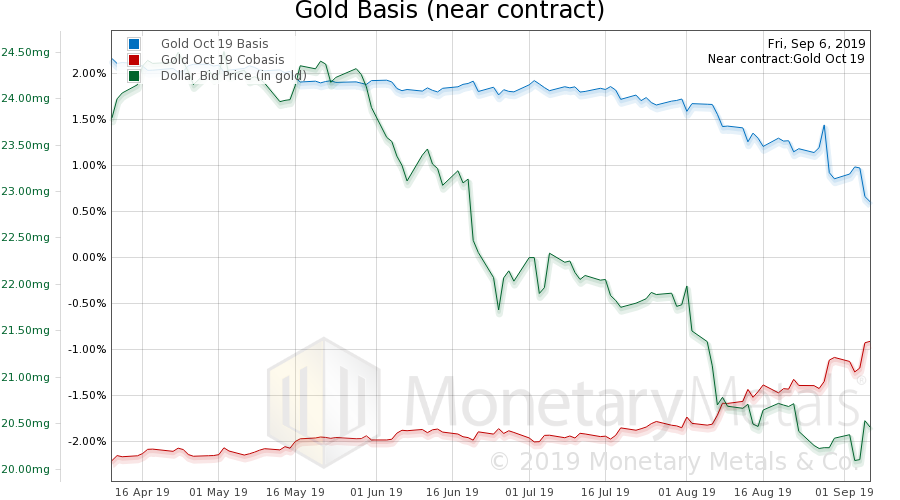

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The October gold basis, now approaching expiry, is falling. But this may be due to tendency towards temporary backwardation as the contract rolls. To find out, we look at the gold basis continuous. There was no change in this measure. So naturally, the Monetary Metals Gold Fundamental Price dropped a bit, anther $11 to $1,525. |

Gold Basis and Co-basis and the Dollar Price(see more posts on gold basis, ) |

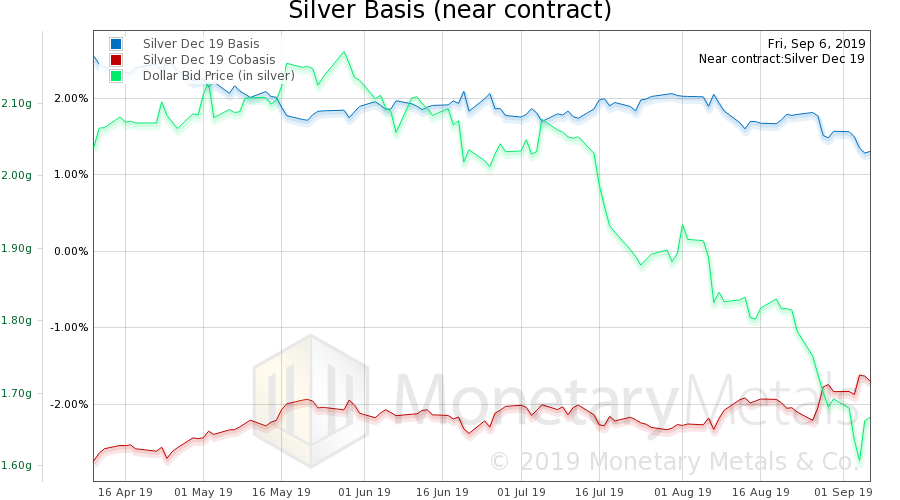

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The scarcity of silver (i.e. cobasis) rose a bit this week. The Monetary Metals Silver Fundamental Price moved up another $0.41, to $18.72. It seems that the selling of metal on Friday, if not on Thursday, was led by those selling futures contracts, likely bought on margin. This fits with our idea that speculators turned back to the stock market as their preferred go-to casino table. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Gold: Silver Ratio FundamentalLet’s end with a chart of the gold-silver ratio, showing both the market price and the Monetary Metals Gold Silver Ratio Fundamental. The fundamental fell from 83.9 to 81.4 this week. It is now back to where it was at the beginning of August 2018. Except the difference is that this time it’s falling. A bet on a rising ratio here is a bet that the stock market is back to full bull, and also that mean reversion in the ratio will be further postponed. One might not want to bet on a falling ratio with leverage, but it’s hard to see the case for betting that the ratio will rise. |

Gold: Silver Ratio Fundamental |

© 2019 Monetary Metals

Tags: Basic Reports,bond bubble,dollar price,Featured,Germany,gold basis,Gold co-basis,gold price,gold silver ratio,gold standard,irredeemable currency,negative rates,negative yield,newsletter,silver basis,Silver co-basis,silver price