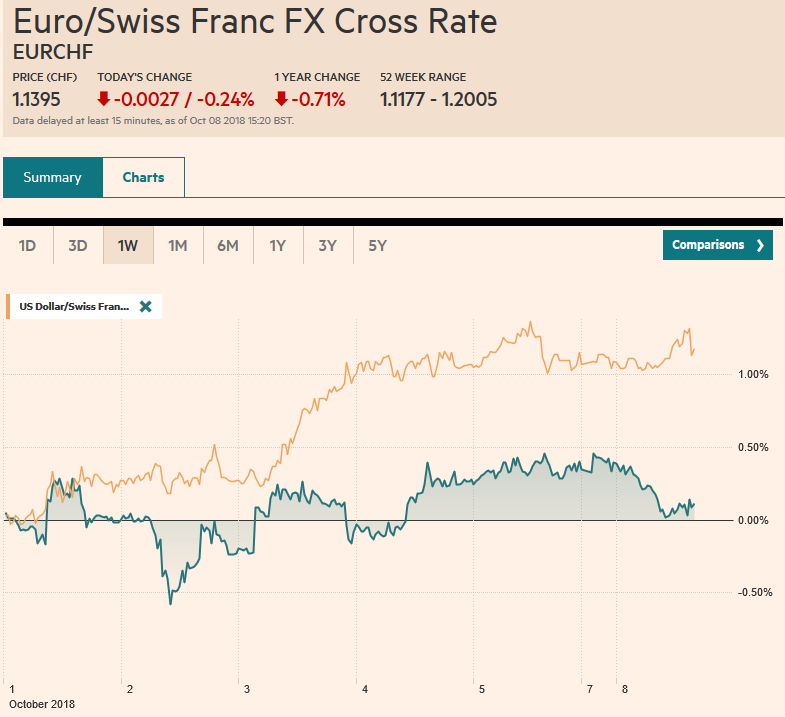

Swiss Franc The Euro has fallen by 0.24% at 1.1395 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%. There are appears to have been a jump in offshore sales of mainland shares through the stock connect facilities. Japanese markets are closed for a national

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, AUD, brl, CAD, EUR, EUR/CHF and USD/CHF, Featured, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.24% at 1.1395 |

EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

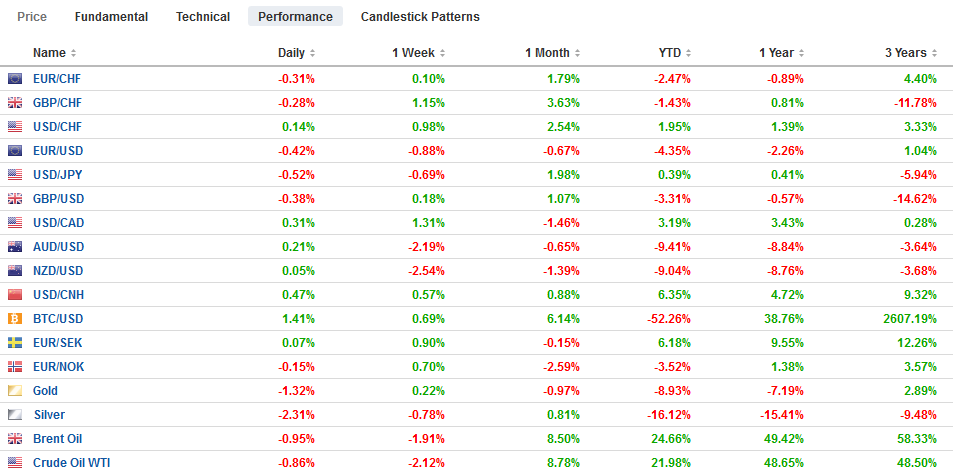

FX RatesOverview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%. There are appears to have been a jump in offshore sales of mainland shares through the stock connect facilities. Japanese markets are closed for a national holiday, which spared, for the time being, the erosion of equities throughout the region. European shares are losing ground for a third session. Italy’s bond continues last week’s slide,, induced by the confrontation with the EU over the 2019 budget. Core bond yields are lower. The dollar is firmer against nearly all major and emerging market currencies, though the risk-off mood has seen the yen and Swiss franc resist the greenback’s pull. Emerging market equities are broadly lower, and South Africa, China, Russia, and Turkey currencies are the weakest. |

FX Performance, October 08 |

China

Given the slide in equities and the dollar’s strength last week, the return of China was set to be dramatic. The cut in required reserves and the better than expected Caixin non-manufacturing PMI (53.1 vs. 51.5in August and expectations for 51.4) and composite (52.1 vs. 52.0 in August) were unable to stem the tide. The dollar rose above CNY6.92, and there is speculation that the line in the sand at CNY7.0 is not as significant as it was previously. Economic conditions have deteriorated, and monetary policy has been relaxed.

Separately, and amid another volley of media reports claiming the demise of the dollar, China may be preparing to bring dollar-bonds to the market. Indications are for around $3 bln of 5-, 10-, and 30-year maturities. It would be the second dollar offering this year. Despite a lower credit rating, China pays a small 15-20 bp premium on top of Treasuries.

There are two important developments in the euro area today. The first is disappointing news from Germany. Industrial output unexpectedly fell for the third consecutive month in August. The 0.3% decline was expected to be a gain of the same magnitude. The manufacturing PMI has fallen every month this year but July, and yet it remained over the 50 boom/bust level. Industrial production was by 0.1% a month on average this year after rising 0.5% a month on average last year. Last week’s rise in factory orders (2.0% vs. forecasts for a 0.8% increase) had many observers leaning the wrong way.

Eurozone

The second important development is less surprising but just as impactful. Italy has refused to back down in the face of opposition from the EC on is 2019 budget proposals. The confrontation is set to escalate, and this is hurting Italian assets. The 10-year yield rose nearly 60 bp over the past two weeks and is up another 15 bp today and blew past 3.50% to push above 3.60%. The two-year yield has risen nearly the same of the past couple of weeks and is up a little more than 20 bp today. Italian stocks are off around 2% today, the most in Europe, while the Dow Jones Stoxx 600 is off about 0.8%. Bank shares, closely linked to the performance of the bond market, are off 3.75% today after declining 13% over the past two weeks.

The euro has been sold steadily since the Asian open and through the European morning. Last week’s lows near $1.1465 are within spitting distance, and there is a 1.5 bln euro option struck at $1.1450 that expires today. A break signals a test on $1.14, with the August 15 low near $1.13 the big technical draw. That said, the technical indicators a stretched, and the lower Bollinger Band comes in near $1.1450 today.

Sterling initially pushed through the pre-weekend high in Asia before reversing lower. It is flat to slightly weaker than the euro today. It is a big week for UK economic data, which includes the release of trade, industrial production, and the new monthly GDP report for August. Brexit also looms large. The UK and EU are preparing of the summit later this month to ideally take a major step toward an agreement. By the middle of this week, the UK is expected to unveil its latest proposals for the Irish border. Meanwhile, the Prime Minister May has been reaching out to some Labour MPs for support for her Chequers plan, which some of her own party will not. Support for sterling is seen in the $1.2980-$1.3000 area. On the cross, the euro needs to re-establish a toehold above GBP0.8800 to stabilize the technical tone, which has seen the euro tumble from near GBP0.9100 in late August.

United States

The dollar had been pushing near JPY114.50 last week, but has lost its mojo and is near JPY113.25 in the European morning. A break of JPY113.00 targets JPY112.50, and possibly JPY112.00. Rising US yields are by themselves an insufficient prop for the greenback against the yen. Anxiety is running high over Europe, China, and emerging markets. Recall that the euro appreciated by about 6.6% against the yen from the middle of August through the end of September. At JPY130 today, it has retraced 38.2%. The next retracement target is near JPY129 and then JPY128.

The Australian dollar made a marginal new low near $0.7040 today. Technically, it looks stretched, and it is where we suspect there is a reasonable chance for an upside reversal this week. It recovered fully in Europe today from the selling in Asia. A move above $0.7090 today would lend support to our near-term technical view. Not so with the Canadian dollar. It continues to unwind the NAFTA2.0 gains. The US dollar is moving above CAD1.30 to approach the 50-day moving average near CAD1.3020. The next important chart point is near CAD1.3060, a retracement objective, and the 100-day moving average.

Among the most important emerging market stories, today is the near first-round victory for Bolsonaro in Brazil’s presidential race. The anti-corruption thrust of his campaign appears to have offset some of the negativities surrounding his candidacy. Brazilian assets, including ETFs, are doing well in Europe and are expected to continue in the domestic session today. By nearly winning an outright majority, Bolsonaro looks to be the easy favorite for the run-off later this month. Elsewhere, we note that the market’s responded negatively to news that South Africa’s Finance Minister Nene offered to resign. This policy uncertainty comes ahead of the important budget statement in a couple of weeks and rating review. Bank shares are under pressure and falling for the seventh consecutive session, the longest streak in three years.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,brl,EUR/CHF and USD/CHF,Featured,newsletter