Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in January 2015). Of course, in hindsight, it makes sense that durable negative interest rates would lead to permanent backwardation. What use to decarry gold—i.e. sell the metal, buy a future, and use the cash for some productive purpose—if there is no productive purpose? If no one bids a positive interest

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, backwardation, Basic Reports, capital consumption, dollar price, falling interest, Featured, fraud, gold basis, Gold co-basis, gold price, gold silver ratio, Monetary Policy, newsletter, perverse incentive, perverse outcome, silver basis, Silver co-basis, silver price, Swiss

This could be interesting, too:

investrends.ch writes Lufthansa will zentralisieren – Swiss betont ihre Stärke

investrends.ch writes Swiss erwartet weiteren Druck auf den Gewinn

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in January 2015).

Of course, in hindsight, it makes sense that durable negative interest rates would lead to permanent backwardation. What use to decarry gold—i.e. sell the metal, buy a future, and use the cash for some productive purpose—if there is no productive purpose? If no one bids a positive interest rate for said cash, then traders will not part with their gold to get the use of it.

There is an analogy to gold. In today’s world (other than us), the bid on the gold interest rate is negative. Gold typically serves no better purpose than to be stored. Which has a cost.

As an aside, this is how they manipulate the value of gold! How many people are like Warren Buffet, seeing no utility in gold because it pays no yield (and hence who own none)? If the government did not force people to stop using gold productively in 1933, then gold would still have the same utility today as it had then (and everyone would own some).

Gold can be traded for goods and services. But it serves no productive purpose while you hold it. So the marginal bid for its use is negative.

The franc is different than gold in one key respect. Unlike gold today, a great deal of lending and borrowing is done in francs. Yet said franc borrowers make a negative bid for francs. Why?

They’re drowning in francs. They were flooded with them, back in 2014 and January 2015 when the Swiss National Bank was borrowing like mad to buy euro-denominated assets, to keep the euro above CHF1.2.

Most people think a central bank prints money. It’s not money, but credit. And it’s not printed, but borrowed. The printing money theory cannot explain why the SNB abruptly allowed its currency peg to fail catastrophically. A short few weeks prior to that event, SNB President Thomas Jordan promised that the SNB “will continue to enforce it with the utmost determination…”

It seems simple enough. Unlike a banana republic, which tries to prop up its currency by selling dollars, the SNB was trying to keep the franc down. It would seem easy for it to print an unlimited quantity of francs to achieve that objective. Yet it failed, spectacularly. At the time, Keith argued the SNB hit its stop-loss.

The printing money theory is wrong.

The SNB borrows. It issues its credit paper, the franc, to fund its purchase of an asset, the euro. But the market wanted to sell off the euro and buy the franc. So the SNB borrowed more and more to fight the market.

The SNB is not bigger than the market. No one is bigger than the market. We are reminded of the sea change in rock music around 1982. The bands that had become successful, and filled arenas with music based on hard rocking electric guitar riffs changed to a synthesizer-based, softer, more processed sound. Look at Rush, Jethro Tull, Van Halen, and many others. The market did not want any more Tom Sawyers, Aqualungs, or Ain’t Talkin’ ’bout Love. Instead, the radio stations gave their air time to Distant Early Warning, Lap of Luxury, and Jump.

Anyways, back to the franc. So what’s the technical term for borrowing more and more to buy more and more assets?

Leverage.

| The SNB increased its leverage and kept increasing it, until it hit its line in the sand. Every borrower has a limit, whether self-imposed or whether involuntarily.

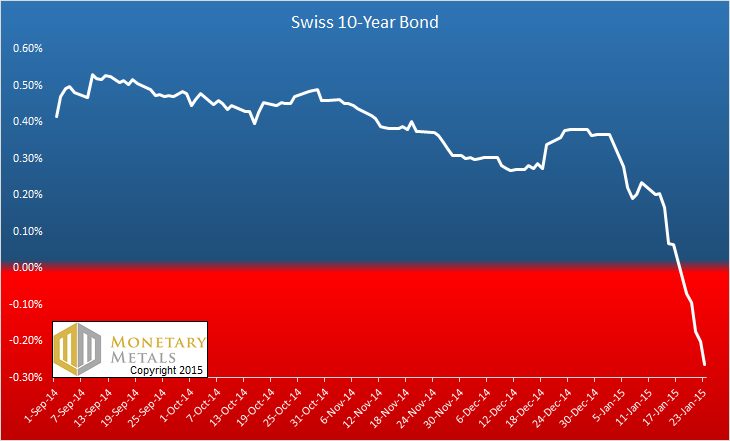

Anyways, the theory is that a rising quantity of money is supposed to cause prices to rise. And two consequences are supposed to come of that: (1) rising interest rates and (2) falling currency. Instead, what Switzerland got was a rising currency, a plunge in interest rates, and stagnant prices. Here is the graph of the Swiss 10yr government bond that we published in 2015. |

Swiss 10 year Bond History |

It was falling even months before to the snapping of the peg, but then look at it go from around 30bps to -25. So what really happened?

To understand, it is helpful to look through the eyes of a Swiss bank or pension fund portfolio manager. Suppose you had recently bought a German bond at CHF120. We get to 120 by assuming it sold for par in euros, and the euro is CHF1.2.

Then the SNB buys it from you at 121. You get your 120 back, plus 1 franc profit. What are you going to do?

Well, you are not going to pay 1 (much less 121) to yourself or your team to go out and spend on consumer goods. After you get over your moment of pleasure at the capital gain, you have to go to the market to look what asset you can buy next. You see, your job is to get yield. You find that you are not the only asset manager whose bonds were picked up by the SNB. Your peers are all in the market taking their new francs to bid up all other franc-denominated assets.

Every asset trades at a spread to the risk free government bond. With the yield on the government bond falling, so is the yield on other assets.

The SNB, in buying up so many assets, has not only pushed up their prices but it has dumped too many francs into the market. These francs serve no productive purpose, and indeed there is no purpose to which they can be put.

Indeed, the SNB has flooded the market with francs, as the unintended consequences of its euro peg policy. However, the SNB did not grow the Swiss economy. It did not create more franc-denominated assets. A central bank has the power to issue more currency, but it cannot make businesses produce. It cannot make anyone bid up the yield on all those new currency units.

That Which Has No Productive Purpose

The franc, being irredeemable like the dollar and all paper currencies, has no extinguisher of debt. The market remains flooded today, nearly four years later. There is no mechanism to un-flood the market.

So now the franc is a hot potato in Switzerland. No one really wants to hold it, because to do so incurs guaranteed losses. Yet, their need for liquidity remains (or grows, if they have taken on more debt due to dirt cheap borrowing costs). A deeply indebted business needs more liquidity than a debt-free business does.

Right now, the cost of holding that liquidity is -75bps. This is sufficient to cause some of them to sell francs for dollars, and buy francs in the futures market. That is, to decarry. They are not decarrying to make a profit from a franc backwardation—indeed, the franc is in contango. They are doing it to avoid holding francs and taking the loss from the -75bps deposit rate.

Their decarrying pushes the franc contango upwards. The more they decarry, the more the price of the future-franc rises. Unfortunately for them, they are not making the franc basis, but the paying the cobasis. Which as of last week, is 3% for Dec 2018 to 4% for Dec 2019.

So if you manage a franc-denominated balance sheet, you can lose -0.75% on cash deposits. Or your alternative is -3% to decarry and invest the dollars for the same duration. 3-month LIBOR was +2.38% last week. So, the net on this trade is only a -62bps loss. That’s a bit less than the losses on cash.

The Incentive to Repudiate the Currency

This is a perverse incentive that will cause perverse behaviors. One of these days, these perverse behaviors will lead to a perverse and terrible outcome.

Consider a simple purchase. Party A signs a contract with Party B, to buy a capital good in 15 months’ time. Assume Party A has the cash. Its smartest move is to exchange francs for dollars and buy a futures contract to get the francs back just prior to when the payment is due. Once the seller has the francs, it too has an incentive to exchange for another currency (and not necessarily buy a futures contract).

That is, the buyer prior to a purchase, and the seller following a purchase do not hold the currency. The currency is used for the exchange only. The currency is used for one instant only. Preference for holding the currency is minimal.

What happens when both parties realize that the other does not want to hold francs? What happens if they decide to do business in dollars or euros? The deeper the franc interest goes below zero, the more powerful the incentive to do just that.

Incentive Matter

While the negative interest rate disincentivizes holding francs, it does incentivize something. Loss-generating businesses. Right now, not many Swiss corporate bonds are sold at negative yields. However, as the deposit rate falls, the downward pressure on corporate bond yields increases.

In a normal world, a business that destroys its investors’ capital should go out of business. However, if it can borrow that capital at a negative rate, it can earn a profit so long as it generates losses at a lower rate than the negative interest on its bond! Think about that, if your investors lend you CHF 10,000,000 at -2% a year, they are paying you CHF 200,000 just to borrow their capital! If you lose only CHF 100,000 then you actually have a profit at the end of the year.

Negative interest rates magically turn losses into profits! Well, actually, they foist the losses off onto savers.

Last week, we said that we would address the question of when the franc will collapse. We cannot put a date to it. That’s not how economics works. However, we can frame it in terms of market conditions. Specifically, we can express it in terms of spreads.

Follow the Spreads

There are several, but we looked at two here. One is the franc-dollar interest rate spread. The greater this spread, the more disincentive there is to hold francs.

The other is the corporate bond rate to corporate profit rate spread. Lower corporate bond rates pull down profits, because there is arbitrage between the two. Any industry offering a return on capital significantly greater than the prevailing cost of capital will draw in capital to create more capacity until returns fall to the level prevailing across the economy.

So what happens if you have rising preference not to hold the currency even among businesses domiciled in country, combined with capital destruction born of negative interest rates?

It’s a recipe for currency collapse.

The proximate trigger may be corporate defaults. So look also for a widening spread between Swiss government and corporate bonds.

One group we have not talked about, is the speculators. The Swiss franc remains one of the most loved irredeemable paper currencies. From the libertarian in California to the dentist in Argentina, there is a strong preference to hold the franc that is hard to disrupt. So we would not predict that these groups will respond to our arguments made above.

If they respond to anything, it may be to chronic losses on their franc deposits. Rising losses will cause the marginal currency speculator to sell his francs.

Permanent gold backwardation. Disincentive to hold francs, even for Swiss businesses and citizens. And for foreign speculators too. Naked incentive to consume investor capital. This is the toxic stew churning beneath the surface.

Keith will be in New York City, London, Brussels, Madrid, Zurich, Hong Kong, Singapore, Sydney, and Auckland. If you would like to meet, please contact us.

Supply and Demand FundamentalsThe price of gold blipped $13, while the price of silver is unchanged. Speaking of interest rates and central planning by central banks, we note that in mid-2016, a correction (countertrend move to the main trend) began in 10-year bond yields. It occurs at the same time in the Swiss government bond the US Treasury. Also the German bund, the British gilt, and the Japan government bond. Americans, living in a bubble of our own making, think the Fed is printing dollars to infinity, therefore inflation, therefore higher rates. The proof that this view is wrong, is that the same move occurs all over the world at the same time. At the same time, an extraordinary thing is occurring in less-watched spread. Corporations with a credit rating that’s below investment grade should pay more to borrow than the risk free bond. How much more? This is a spread, and the St. Louis Fed provides a convenient graph of it. This spread has just broken down to a new post-global-financial-crisis low. So we’re going to have inflation, and you better trade your risk-free bonds for junk bonds issued by zombie corporations? Do it quick before inflation and rates really rise! Fretting about the government’s ability to pay the interest in rising rates, they buy the debt of corporation who already couldn’t pay the interest prior to rates going up?? Clearly, here’s a rotation out of government bonds, based on whatever story. Which does not need to be a true story, or even consistent. And the gold community wonders why the gold price action doesn’t seem to make sense… |

Junk Treasury Spread, Nov 2017 - Oct 2018 |

Gold and Silver PriceWe will look at the supply and demand fundamentals of both metals. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

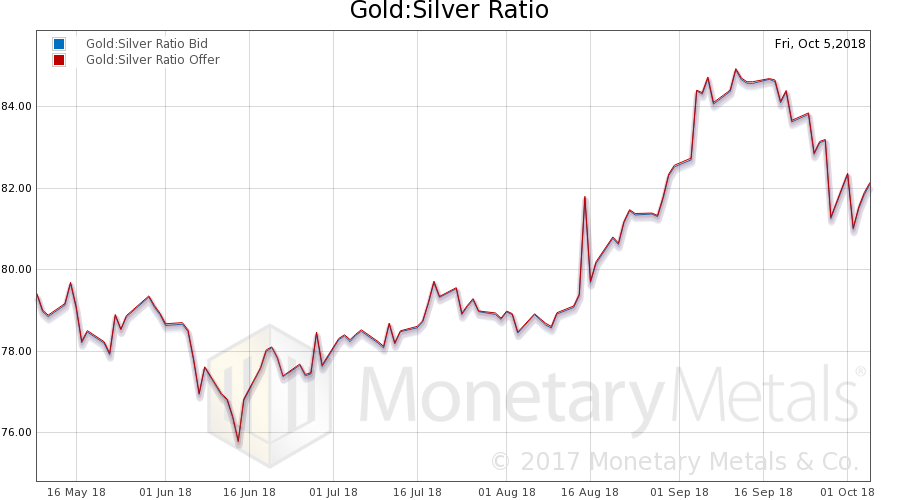

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It rose this week. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

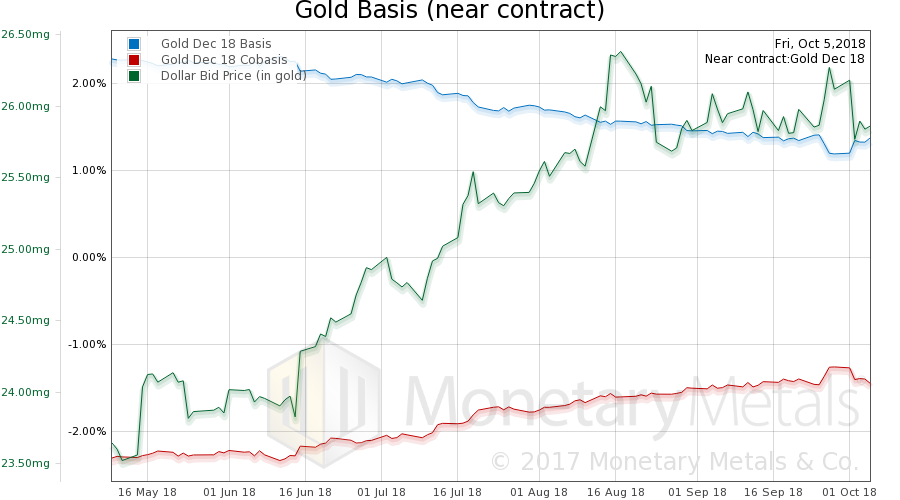

Gold Basis and Gold Co-basisHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. The price of the dollar dropped slightly from 26.1mg gold to 25.9mg (i.e. the price of gold, measured in rubber-band dollars rose). However, along with this, we see a reduction in scarcity, the cobasis from -1.25% to -1.4%. Including on Friday, when the price of gold dropped. Which means the price move was caused by selling of metal, not futures. The Monetary Metals Gold Fundamental Price fell hard, from $1,352 to $1,272, especially Friday. We shall see if this drop is durable. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

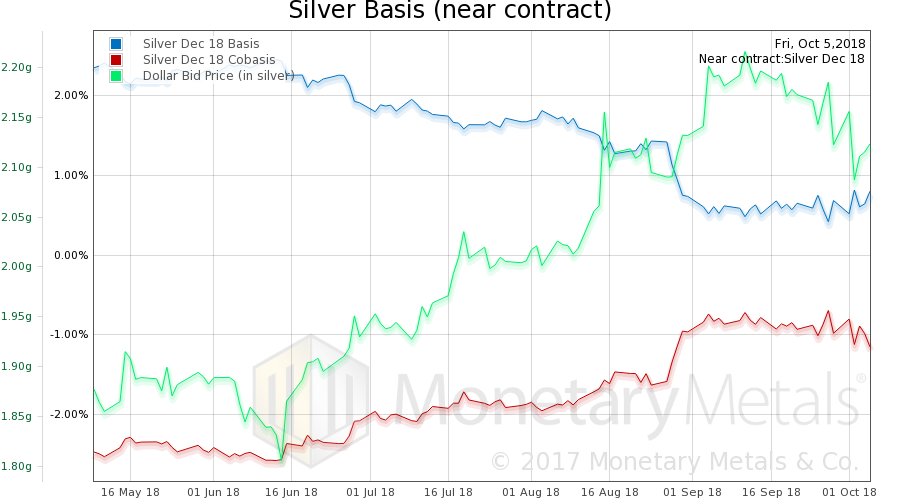

Silver Basis and Silver Co-basisSo let’s look at silver. In silver, the same action occurs Thu and Fri—price of metal falling (dollar measured in silver, green lie, rising) with cobasis falling. Someone’s selling metal. The Monetary Metals Silver Fundamental Price also fell hard, from $15.83 to $15.27. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2018 Monetary Metals

Tags: Backwardation,Basic Reports,capital consumption,dollar price,falling interest,Featured,fraud,gold basis,Gold co-basis,gold price,gold silver ratio,Monetary Policy,newsletter,perverse incentive,perverse outcome,silver basis,Silver co-basis,silver price,swiss