Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A.57 bln vs. expectations for A5 mln) and building permits up more than twice as expected (2.6% vs. 1.0%). Today is the first session since April 19 that the Australian dollar has risen above the previous day’s high. Initial resistance is seen near %excerpt%.7550 and then %excerpt%.7580. The yen is firmer but largely sidelined. After trying to push through JPY110 unsuccessfully

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, EUR/CHF, Eurozone Consumer Price Index, Eurozone Core Consumer Price Index, Featured, GBP, JPY, newsletter, SPY, TLT, U.S. ISM Non-Manufacturing PMI, U.S. Services PMI, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.03% to 1.1944 CHF. |

EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

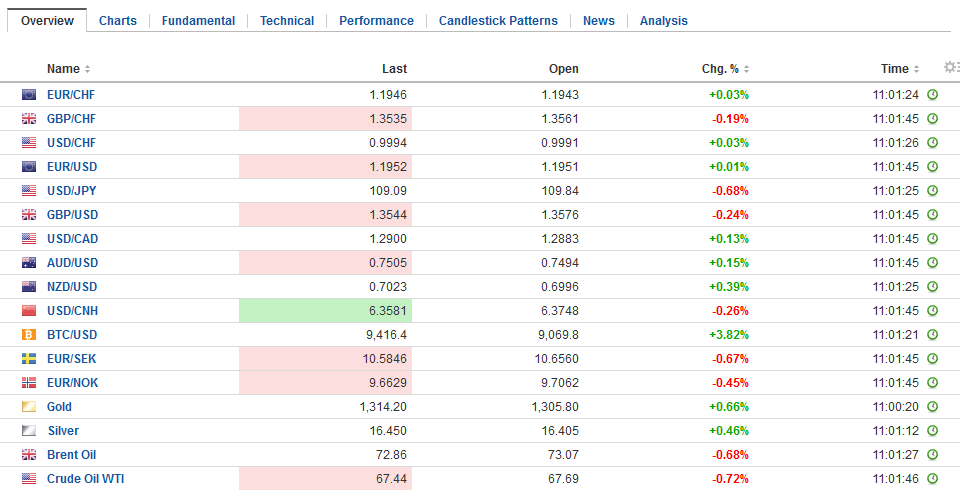

FX RatesThe Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up more than twice as expected (2.6% vs. 1.0%). Today is the first session since April 19 that the Australian dollar has risen above the previous day’s high. Initial resistance is seen near $0.7550 and then $0.7580. The yen is firmer but largely sidelined. After trying to push through JPY110 unsuccessfully for a third session, the market has pushed the dollar toward JPY109.50. |

FX Daily Rates, May 03 |

| Global equities are trading heavily after US losses following the FOMC meeting. The MSCI Asai Pacific Index was off (~-0.15%) for a third consecutive session. China, Australia, and Thailand managed to buck the trend and post modest gains. Foreign investors, which had turned buyers of South Korean equities this week after heavy sales in late April turned back to the sell side today and offset the purchases conducted in the first half of the week.

European equities are also lower, with the Dow Jones Stoxx 600 nursing about a 0.3% loss, led by telecom, real estate, and financials. Energy, utilities, and healthcare are posting small gains. The benchmark has alternated between gains and losses this week and today’s loss trims the week’s net gain by nearly half. |

FX Performance, May 03 |

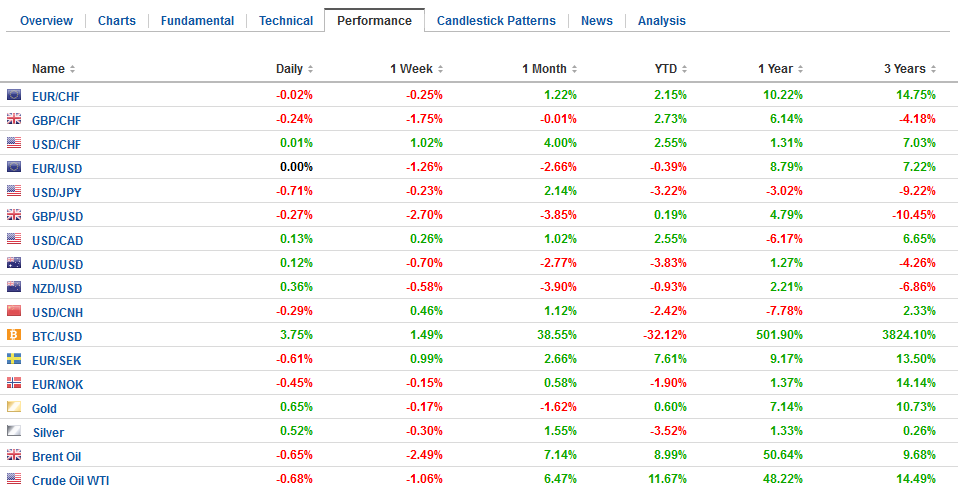

EurozoneThe euro bounced after being drilled to support in the $1.1930 area post-FOMC yesterday. The recovery has not been derailed by a shocking miss on the preliminary April CPI. Headline CPI slipped to 1.2% from 1.3%. |

Eurozone Consumer Price Index (CPI) YoY, May 2013 - 2018(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| But the more meaningful miss was the slump in the core rate to 0.7% from 1.0%. Recall that the core rate bottomed at 0.6% three years ago. |

Eurozone Core Consumer Price Index (CPI) YoY, May 2013 - 2018(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

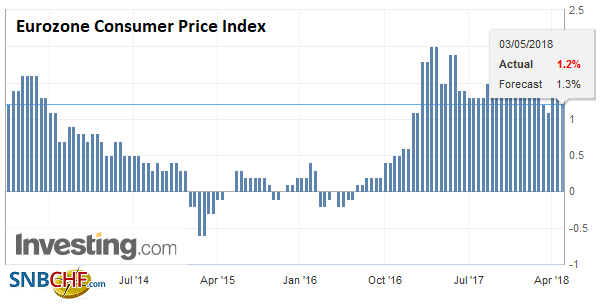

United KingdomSterling is also enjoying relief from its recent slide. It is trying to snap a six-day slide. In each of the past two weeks, sterling has managed to close higher in one session. Today may be the session for this week. To do so, sterling has to shrug off the service PMI. Although it rose, the gain was less than expected. The April service PMI rose to 52.8 from 51.7. The market expected 53.5. Given the disappointment (decline) in manufacturing, the better construction PMI, and today’s service reading, the composite was sure to disappoint. It improved to 53.2 from 52.4, missing the recovery to 53.7 as expected. |

U.K. Services Purchasing Managers Index (PMI), Apr 2009 - May 2018(see more posts on U.K. Services PMI, ) Source: Investing.com - Click to enlarge |

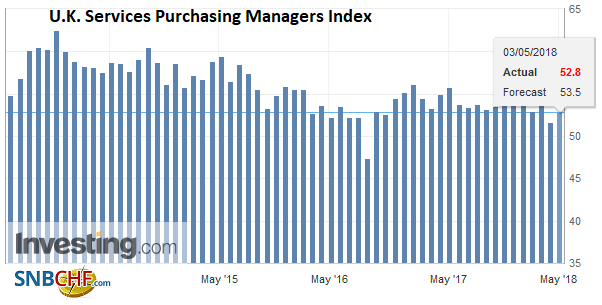

United StatesThe release of US Q1 GDP steals much of the thunder from March US data that will be released today. The FOMC statement suggests officials will look past whatever weakness is seen, and therefore the data, including the April non-manufacturing ISM. The market is more interested in the April employment report tomorrow. We suspect today’s price action is about an overdue (see Bollinger Bands for example) and not about the economic data. The miss on the eurozone core CPI is most important development with policy implications but one that will take time to digest. |

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), Jun 2013 - May 2018(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

US 10-year Treasuries has pulled back from the 3.0% threshold. At 1.95% now, the yield is off a basis point on the day. European benchmarks are off two basis points. There is little stress in Italian debt despite the failure of the Five Star Movement to reach an agreement to form a government. The center-right may be given an opportunity, and if that fails new elections may be difficult to avoid. Italian shares are slightly underperforming.

Volatile trading was seen after the release of the FOMC statement, which by most accounts was unsurprising. Some observers seemed to place emphasis on the use of the word symmetric when referring to inflation, which they understood to mean that was signaling that it would tolerate inflation overshoot as it tolerated inflation undershooting. The dollar initially sold off to approach session lows, while the S&P 500 recorded session highs.

However, the markets quickly reversed. The modest dollar pullback was snapped up the and greenback’s recent gains were extended against the major currencies except for the Australian dollar. The S&P 500 gave up nearly one percent from the high made shortly after the FOMC announcement. The real material impact on expectations was negligible.

The January 2019 Fed funds futures contract is arguably among the cleanest metrics of expectations for the year-end Fed funds effective rate. It edged a half a basis point lower to 2.26%. At the start of April, it stood at 2.125%. If there were to be three hikes more hikes by the end of this year, the effective Fed funds rate would be 75 bp more than the current 1.70% or 2.45%. If the Fed would to hike rates only twice more than effective Fed funds rate would be around 2.20%.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$JPY,$TLT,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,Featured,newsletter,SPY,U.S. ISM Non-Manufacturing PMI,U.S. Services PMI,USD/CHF