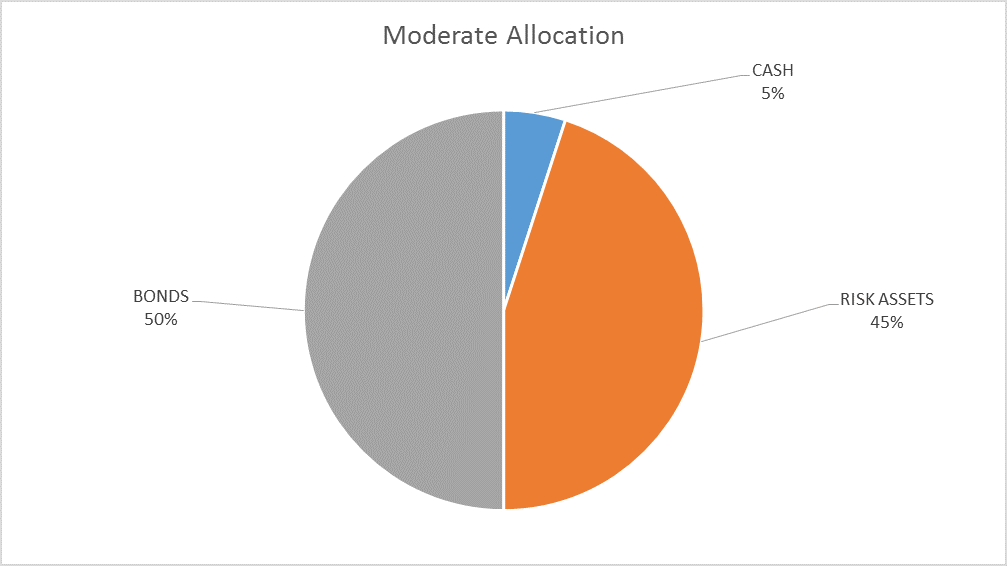

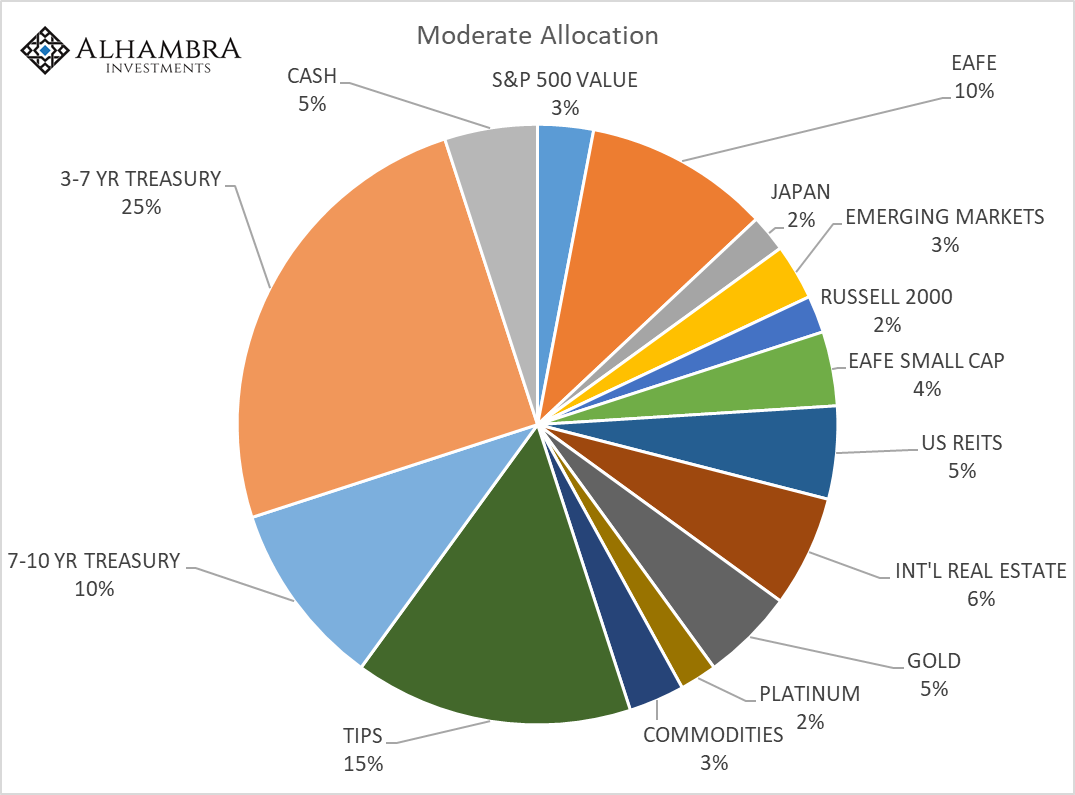

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that won’t stop Wall Street from trying”. I’ve been asked repeatedly recently whether Congress will pass tax reform and my stock answer is always that I have no idea. On a financial channel this morning I heard a reporter say that the Senate would vote on their version of the tax bill this week. I don’t know

Topics:

Joseph Y. Calhoun considers the following as important: Alhambra Research, asset allocation, bonds, commodities, credit spreads, Crude Oil, eafe, economy, emerging markets, Featured, Global Asset Allocation Update, Gold, Japan, Markets, Model Portfolios, momentum, newsletter, REITs, S&P 500, S&P 500, stocks, tax reform, Taxes/Fiscal Policy, The United States, US dollar, valuations, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash.

Every time I see that quote I think to myself, “but that won’t stop Wall Street from trying”. I’ve been asked repeatedly recently whether Congress will pass tax reform and my stock answer is always that I have no idea. On a financial channel this morning I heard a reporter say that the Senate would vote on their version of the tax bill this week. I don’t know who wrote the reporter’s lines but I can’t fathom from where they gained the confidence to say such a thing with any conviction. We don’t know if they will vote on it this week. As best I can tell, they don’t have the votes to pass the bill in its current form and if they can’t twist some arms there is no way they’ll air that dirty laundry on the floor of the Senate. So, not only do I not know whether they will pass tax reform, I don’t even know if they’ll vote on it. The amount of airtime and ink and pixels dedicated to handicapping the likelihood of tax reform this year is staggering – and largely worthless. No one knows whether Congress will pass any tax changes this year much less something that really earns the label of “tax reform”. All we really know is that the people tasked with reforming the tax code are the same ones who’ve spent their entire careers making it so complicated it needs reforming. Congress is run by lawyers and expecting them to make anything simpler is the triumph of hope over experience. We won’t be needing the Tax Lawyer Re-Employment Act anytime soon. Since I can’t tell the future I spend my time trying to figure out the present – which isn’t nearly as easy as it sounds. Most of the economic data we get on a daily basis will be revised extensively from what is initially reported. What we believe about the economy today will likely change as that data is revised until one day we look back on this time with a completely different recollection of what we thought at the time. That’s just human nature but it should be a warning about our ability to see very far in the future when we can’t even reliably trust our analysis of the past. Investment analysis is aided by the existence of deep markets that provide us with an instant and ongoing analysis of our economic future. The wisdom of crowds, of markets, is not perfect but the incorporation of new information is relentless and ongoing. If you consider multiple markets across multiple asset classes a view of the future can be sketched. It won’t be clear, it won’t be perfect and it will be more abstract and vague than we’d prefer. Probabilities will change and the approximations of the future that we call markets will change. Markets will conflict at times, different groups, traders, coming to polar opposite conclusions. And at times there will be near unanimous agreement about a future that never comes to pass because of some event that no market could foresee. Markets are composed of humans who are flawed, who make bad decisions, who at times believe impossible things. And yet, when we aggregate all their combined knowledge into a market price we usually get a pretty good approximation of “the truth”. “Usually” being an unusually important word in that sentence. Today’s markets have factored in some probability that tax reform will pass Congress and be signed into law. We don’t have any way to know what that probability really is but certainly it is above zero. And the closer we get to a vote – or not – the closer the market will represent the actual future. Markets will continue to adjust as new information becomes available and investors adjust to reality as it unfolds. That reality as I see it right now is that the markets are not discounting much growth from tax cuts. From recent action one might fairly conclude the market believes the tax reform being considered by the Senate will be counterproductive if enacted. If one assumes the odds of passage have risen over the last month, which seems to be confirmed by the action in the municipal bond market, then consider that longer dated Treasuries have rallied, the yield curve has flattened, the dollar has declined and credit spreads have moved wider during that same month. Surely all those assets were affected by other factors besides tax reform but regardless, the market’s expectation is that when all factors are considered, growth isn’t about to get a lot better. The only market that seems enthusiastic about tax reform is the one for equities and I’d just remind stock punters of the old Wall Street admonishment to buy the rumor and sell the news. So, will Congress pass tax reform this year? Despite observing markets closely every day, I still don’t know the answer. I will have to wait, like everyone else, for the future to arrive. When it does, markets will adjust again and if necessary so will our portfolios. No crystal ball required. |

|

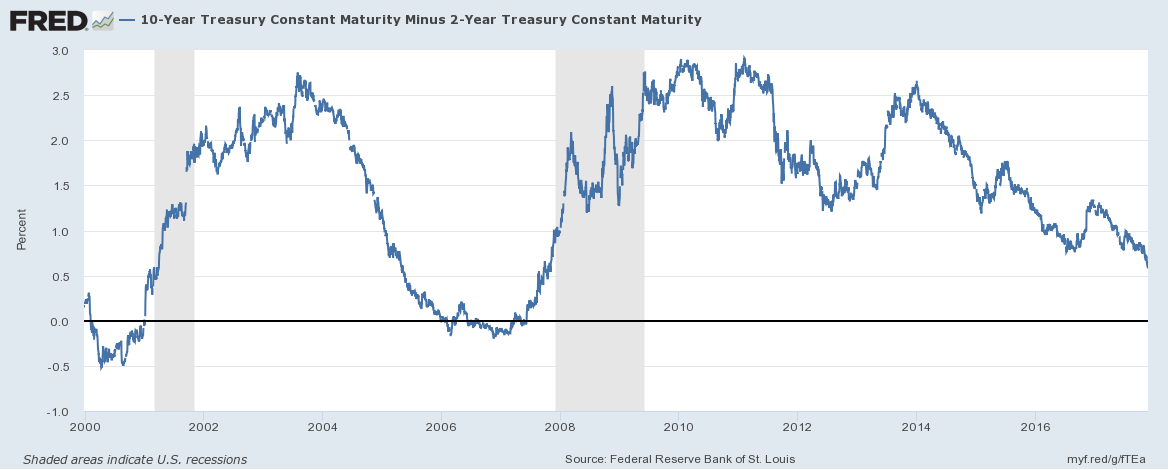

Yield CurveAs I said, the yield curve flattened since the last update and it was fairly rapid, about a 25 basis points change in one month. The spread between the 2 year and 10 year Treasury is now the narrowest of this cycle. Flatter curves are generally associated with weaker growth but as I’ve said many times before, we don’t know if we’ll get to flat before the next recession. That isn’t the important signal in any case. The curve will steepen rapidly just before recession as the Fed eases to try and get ahead of recession. It probably won’t work but they’ll try anyway. Whether that steepening occurs when the curve is flat or inverted or right about here really doesn’t make much difference. The point is that it is how the curve is changing that provides useful information, not the absolute level. |

US 10 Year Treasury Constant Maturity, 2000 - 2017 |

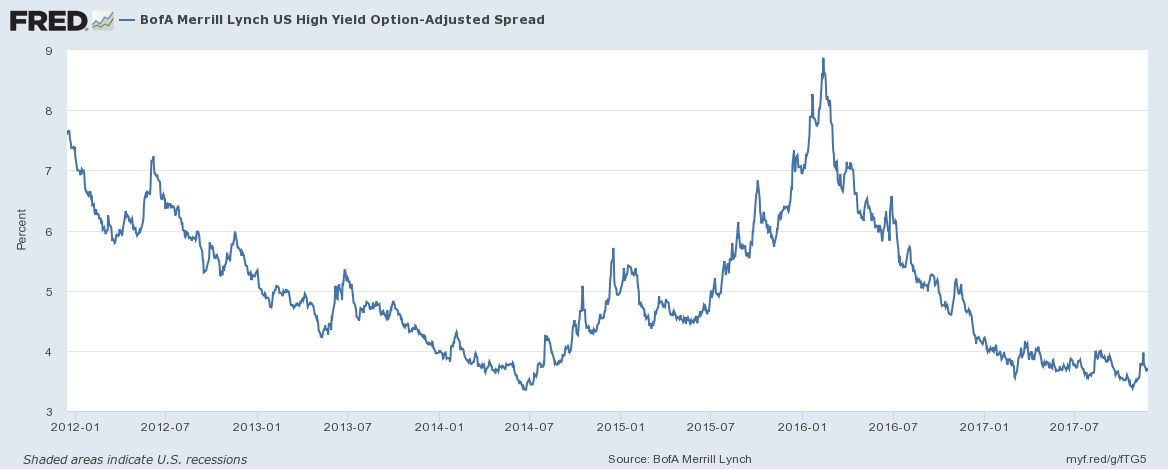

Credit SpreadsCredit spreads also changed by 25 basis points on the month, in this case a widening. The movement so far is not sufficient to warrant any portfolio changes. Our process doesn’t dictate a change unless spreads widen by at least 10% in any month. Spreads do appear to have bottomed, at least for now, so we’ll be watching them very closely to see if this directional change lasts. Right now it is nothing more than profit taking in the junk bond market. |

US BofA Merrill Lynch High Yield Option, Jan 2012 - Jul 2017 |

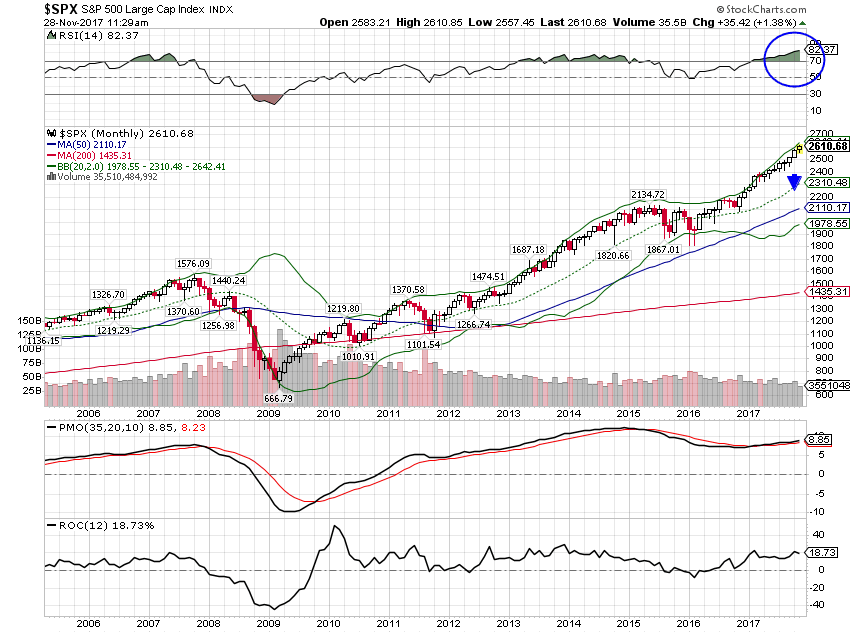

ValuationsNothing has changed with regard to asset valuations. Stocks are expensive with EM about the only broad category that can still be called cheap. International markets are generally more reasonably priced than US stocks although Europe is catching up pretty quickly. Japan is still cheap on current earnings, price to sales ratio and price to book ratio but its CAPE is only slightly less than the US. I hear all the time that valuation is not a good timing tool and that is quite true. What high valuations imply though is increased risk and it seems to me that anyone acting in a fiduciary capacity – as Alhambra does – must take valuations into account. Too often it seems that the “valuations are a poor timing tool” argument is being used an excuse to do what the speaker wants, namely to own stocks because they are going up, to pursue momentum at all costs. That cannot be the standard for a fiduciary. Take the case of an investor identified as moderate risk. An appropriate portfolio that is moderate risk at median valuations is not moderate risk at today’s valuations. Valuations are somewhat subjective so I understand those who say these types of adjustments are difficult but no one said this job was easy. Passive cannot be an excuse to shirk one’s responsibilities. I’ll get off my soapbox now…. MomentumThe S&P 500 is still quite overbought but I suspect any downside will be limited by money managers who have a need to keep up with the index. Any equity manager lagging the market – and as usual that is a long list – is trying to play catch up into the end of the year so every dip gets bought quickly. What changes that dynamic I’m not sure but maybe a failure on the tax bill would do the trick. Or maybe, just a buy the rumor, sell the news effect where the reality of what gets passed is underwhelming versus what was hoped for. I don’t know but overbought conditions can persist so maybe it doesn’t break until after the turn of the new year. |

S&P 500 Large Cap Index, 2006 - 2017(see more posts on S&P 500, ) |

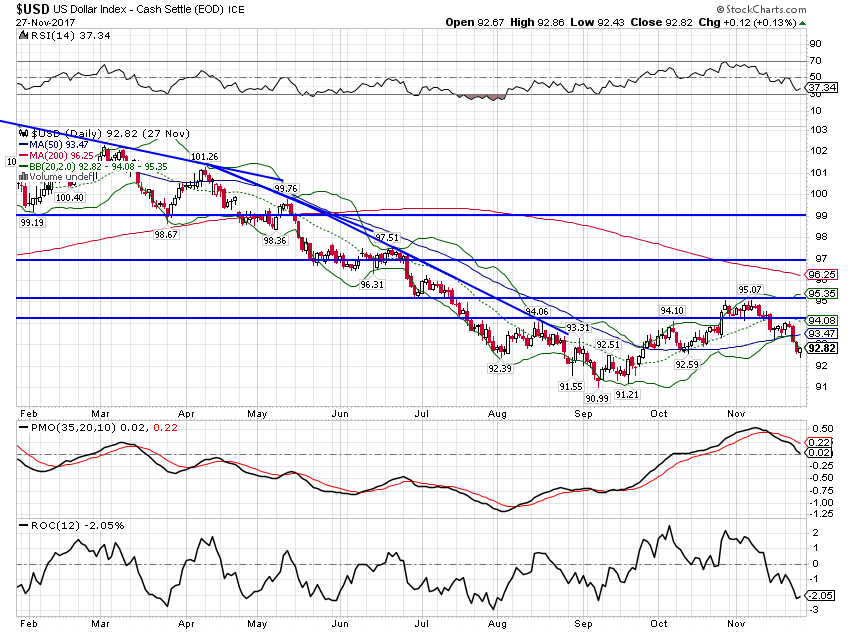

| The dollar downtrend appears to have resumed after a short counter-trend rally. What is driving that is impossible to know for sure but the timing of the renewed fall does point to tax reform and bigger deficits. The rest of the global economy is doing better and expectations for European growth continue to rise though so dollar weakness may be more about European optimism than US pessimism. Whatever it is, it isn’t positive for US growth. I suspect there may be more consolidating for the dollar to do at these levels – sentiment isn’t quite bullish enough yet for this contrarian – but a break under 90 would be quite negative. |

US Dollar Index, Feb - Nov 2017(see more posts on US Dollar Index, ) |

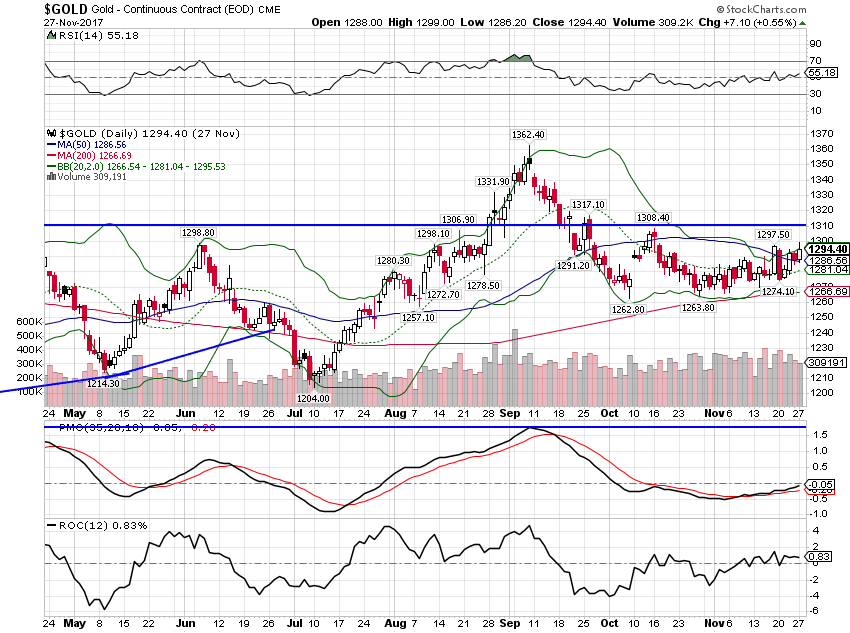

| The weaker dollar is a large part of the reason that gold remains well bid, now approaching the $1300 level again. Again, not a positive sign for US growth: |

Gold Daily, May - Nov 2017(see more posts on Gold, ) |

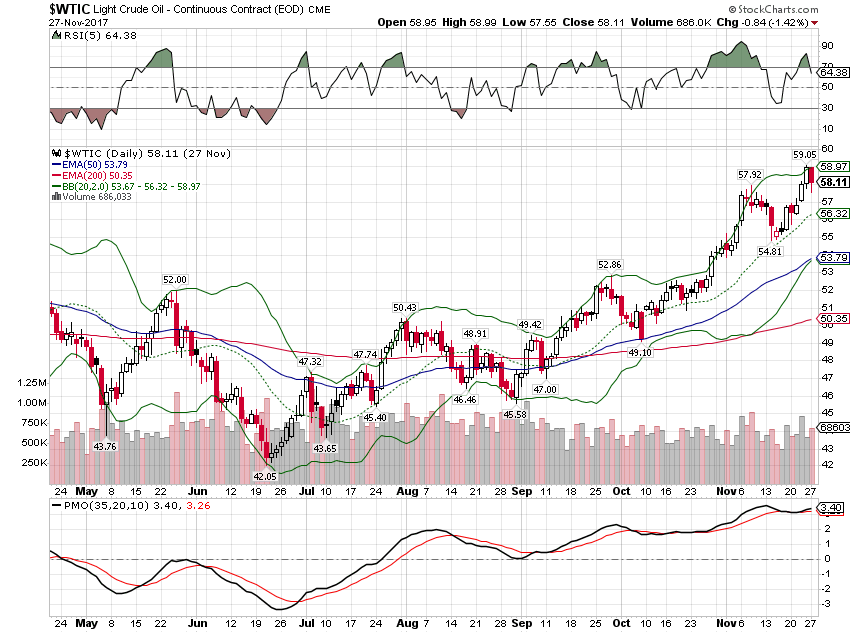

| Some portion of the crude oil rally must be attributed to the weak dollar as well. I do wonder how far this can go before it starts to have a more negative impact on other consumption. It does not appear that capital is as willing these days to commit to more shale production at these prices so supply may be slow to respond. |

Light Crude Oil, May - Nov 2017 |

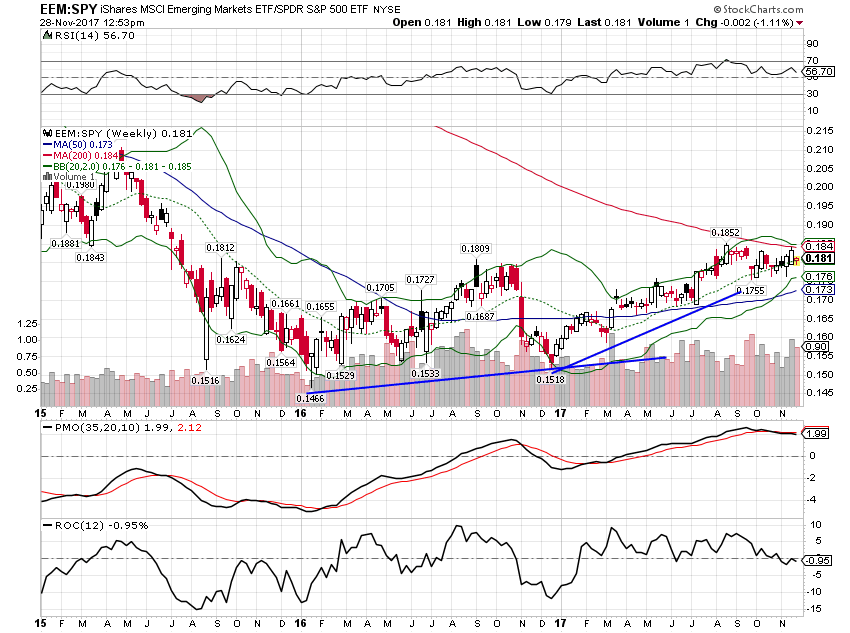

| The negative momentum in the dollar continues to impact international stock markets with EM leading the way over the EAFE. Capital flows have an outsized impact on EM economies because of their relatively small size so this dollar weakness isn’t just a positive for their stock markets. With still large dollar debts across almost all EM countries though, a reversal at this point would not be welcome. I suspect it will be a long time before we hear Brazil or any other EM country complain about excessive capital inflows. |

EEM:SPY Weekly, Feb 2015 - Nov 2017 |

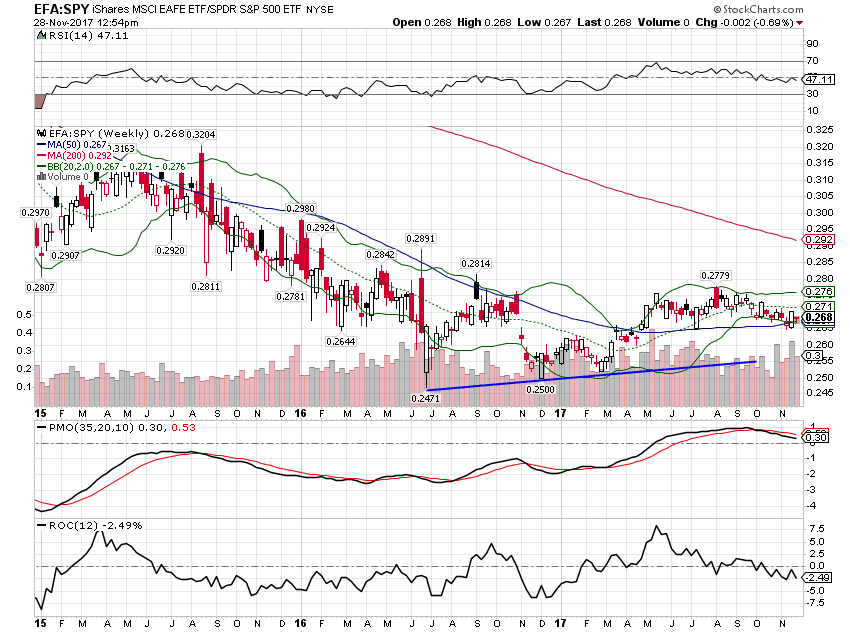

| EAFE is still in an uptrend versus the S&P 500 but the trend has been flat since about mid-year. If the dollar resumes its fall in earnest, expect the trend to re-accelerate. |

EFA:SPY Weekly, Feb 2015 - Nov 2017 |

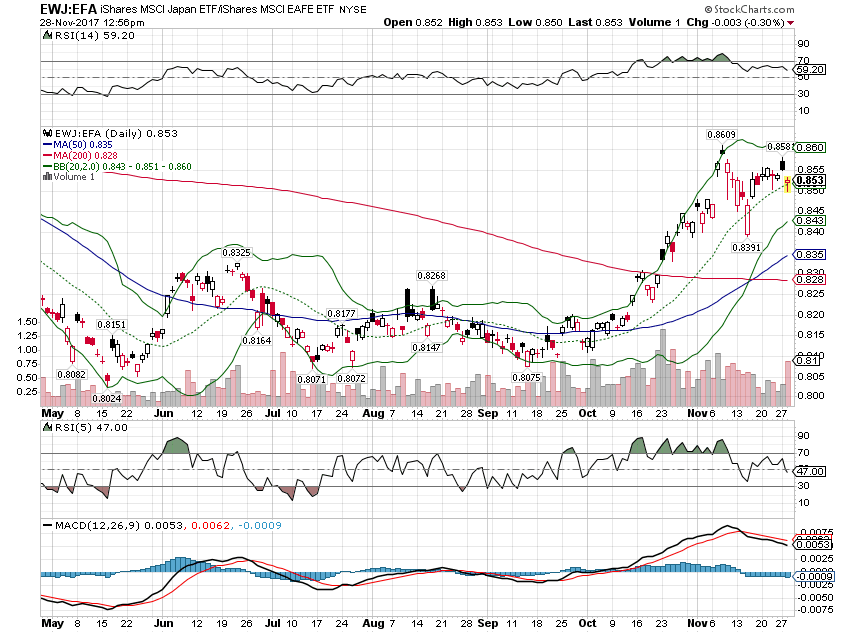

| Japan’s recent outperformance versus the EAFE and the S&P continued: |

EWJ:EFA Daily, May - Nov 2017 |

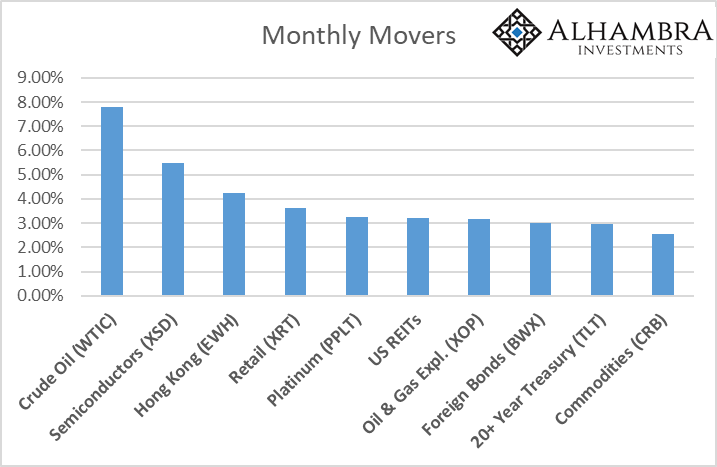

| The big monthly movers include a number of weak dollar plays, commodities most prominently. Within technology, semiconductors continue to perform well. We hear a lot about the FAANGS but the nuts and bolts companies of the technology world are doing well too. Retail stocks rebounded as some people figured out that there are still some well run companies that will survive the Amazon onslaught. |

Monthly Movers |

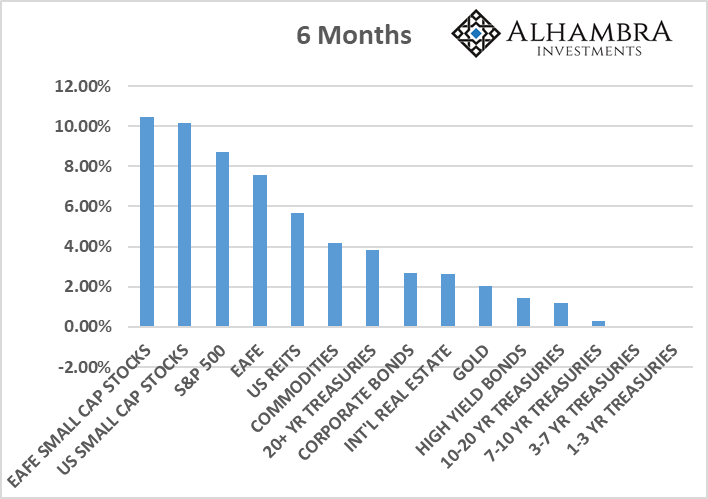

| Looking over a longer time frame, we see small cap stocks – international and US – leading the way. Markets all over are taking on a more speculative tone. Seeing stocks dominate the top of the list isn’t surprising but REITs, commodities and long term Treasuries have also done well. I’m not sure what exactly that means other than there is a lot of money out there looking for a home and almost everything is being bid higher. |

Monthly Movers |

| I’m not making any changes to the portfolio this month. The trends we’ve been tracking all year are all pretty much still in place. The weak dollar – a consequence of weak US growth expectations primarily – is the driving force for much of our positioning. We are overweight international – non-dollar – assets and have a full allocation to commodities. Our positioning also reflects our view – and the bond market’s – that US economic growth will remain weak. We are overweight bonds as the yield curve continues to flatten. As we get closer to the end of this business cycle I would expect to lengthen the duration of our bond portfolio but it is still a little early for that. Another nod to weak growth is our overweight to gold in the commodity allocation.

This positioning is not dependent on our ability to predict the future – thank goodness. Predicting the future isn’t, as Niels Bohr said, “very difficult”. It is impossible. And it has no place in an investment process. |

|

Tags: Alhambra Research,Asset allocation,Bonds,commodities,credit spreads,Crude Oil,eafe,economy,Emerging Markets,Featured,Global Asset Allocation Update,Gold,Japan,Markets,Model Portfolios,momentum,newsletter,REITs,S&P 500,stocks,tax reform,Taxes/Fiscal Policy,US dollar,valuations,Yield Curve