Overview: Yesterday's string of dismal US economic data delivered a material blow to those still thinking that a soft-landing was possible. Retail sales by the most in the a year. Manufacturing output fell by nearly 2.5% in the last two months of 2022. Bad economic news weighed on US stocks. The honeymoon of New Year may have ended yesterday. The US 10-year yield fell below 3.40% for the first time since the middle of last September. The Atlanta Fed's GDPNow...

Read More »The End Game Approaches

The pendulum of market sentiment swings dramatically. It has swung from nearly everyone and their sister complaining that the Federal Reserve was lagging behind the surge in prices to fear of a recession. On June 15, at the conclusion of the last FOMC meeting, the swaps market priced in a 4.60% terminal Fed funds rate. That seemed like a stretch, given the headwinds the economy faces that include fiscal policy and an energy and food price shock on top of monetary...

Read More »FX Daily, July 13: Headline US CPI may Decline for the First Time in a Year

Swiss Franc The Euro has fallen by 0.18% to 1.0831 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: New record highs in the US S&P 500 and NASDAQ coupled with China allowing Tencent to acquire a search engine helped lift Asia Pacific equities. It is the first back-to-back by MSCI’s regional index for more than two weeks. Australia’s market was a notable exception. The lockdown...

Read More »FX Daily, July 12: Markets Adrift ahead of Key Events

Swiss Franc The Euro has risen by 0.04% to 1.0849 EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week has begun quietly. The dollar is drifting a little higher against most major currencies, with the Scandis and dollar-bloc currencies the heaviest. The yen and Swiss franc’s resilience seen last week is carrying over. Most liquid and freely accessible emerging market...

Read More »FX Daily, July 07: Dollar Stabilizes at Elevated Levels After Surging Yesterday

Swiss Franc The Euro has fallen by 0.03% to 1.0922 EUR/CHF and USD/CHF, July 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dollar has steadied after surging yesterday and has so far retained the lion’s share of its gains, though it remains lower against most major currencies today. The dollar-bloc and Norwegian krone are the best performers while the yen is underperforming. The freely accessible...

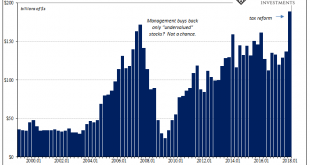

Read More »Buybacks Get All The Macro Hate, But What About Dividends?

When it comes to the stock market and the corporate cash flow condition, our attention is usually drawn to stock repurchases. With good reason. These controversial uses of scarce internal funds are traditionally argued along the lines of management teams identifying and correcting undervalued shares. History shows, conclusively, that hasn’t really been true. Last year’s tax reform law was meant ideally to spur...

Read More »Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Economic Reports Employment We received several employment related reports in the first two weeks of the year. The rate of growth in employment has been slowing for some time – slowly – and these reports continue that trend. The JOLTS report showed a drop in job openings, hires and quits. The Fed has been talking about a tight labor market but this report peaked last July so that may not be as much a concern as they...

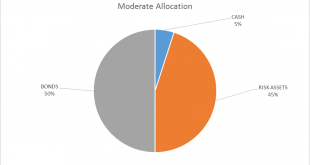

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market persists so I will continue to hold a modest amount of cash. There are some minor changes within the portfolios but the overall allocation is unchanged. - Click to enlarge There have been two major developments since...

Read More »Bi-Weekly Economic Review: Animal Spirits Haunt The Market

The economic data over the last two weeks continued the better than expected trend. Some of the data was quite good and makes one wonder if maybe, just maybe, we are finally ready to break out of the economic doldrums. Is it possible that all that new normal, secular stagnation stuff was just a lack of animal spirits? Is it possible that the mere anticipation of tax cuts was sufficient to break us out of the 2% growth...

Read More »Bi-Weekly Economic Review: Who You Gonna Believe?

We’ve had a pretty good run of data recently and with the tax bill passing the Senate one would expect to see markets react positively, to reflect renewed optimism about economic growth. We have improving economic data on pretty much a global basis. It isn’t a boom by any stretch of the imagination but there is no doubt that the rate of change has recently been more positive. We also have a change in tax policy that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org