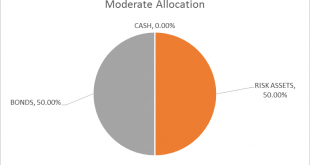

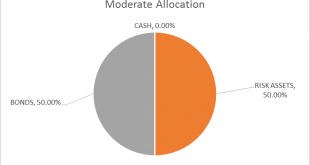

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY. Interest rates are on the rise again, the 10 year Treasury yield punching through 3% again this morning. That is an indication that growth and/or inflation expectations have risen...

Read More »Global Asset Allocation Update

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »Global Asset Allocation Update

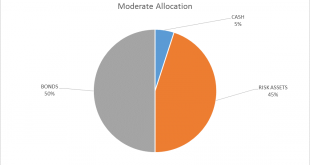

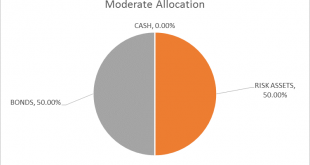

The risk budget changes this month as I add back the 5% cash raised in late October. For the moderate risk investor, the allocation to bonds is still 50% while the risk side now rises to 50% as well. I raised the cash back in late October due to the extreme overbought nature of the stock market and frankly it was a mistake. Stocks went from overbought to more overbought and I missed the rally to all time highs in...

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

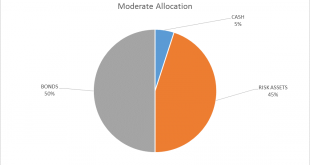

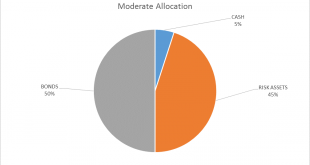

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

Read More »Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. The extreme overbought condition of the US stock market did not correct since the last update and so I will continue to hold a modest amount of cash. Prediction is very difficult, especially about the future… Niels Bohr Every time I see that quote I think to myself, “but that...

Read More »Global Asset Allocation Update

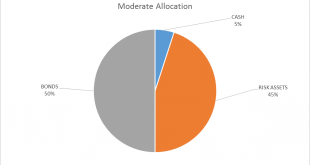

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »Global Asset Allocation Update: Step Away From The Portfolio

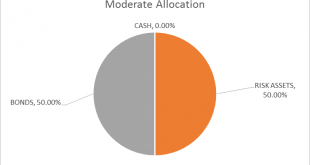

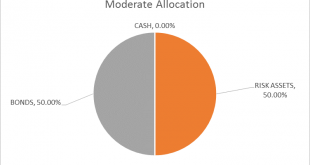

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a...

Read More »Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org