Swiss Franc The Euro has risen by 0.17% to 1.1396 CHF. EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank’s decision. We are concerned that given the strong performance and market positioning, a rate hike could spur “buy the rumor, sell the fact” activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales. Today’s decision is not followed by a press conference or monetary policy review to help guide sentiment. A bounce in the greenback could see

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Retail PMI, Featured, FX Daily, FX Trends, GBP, Germany Factory Orders, Japan Average Cash Earnings, JPY, newsletter, TLT, U.S. ISM Manufacturing Employment, U.S. ISM Non-Manufacturing PMI, U.S. Markit Composite PMI, U.S. Services PMI, U.S. Trade Balance, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.17% to 1.1396 CHF. |

EUR/CHF and USD/CHF, September 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

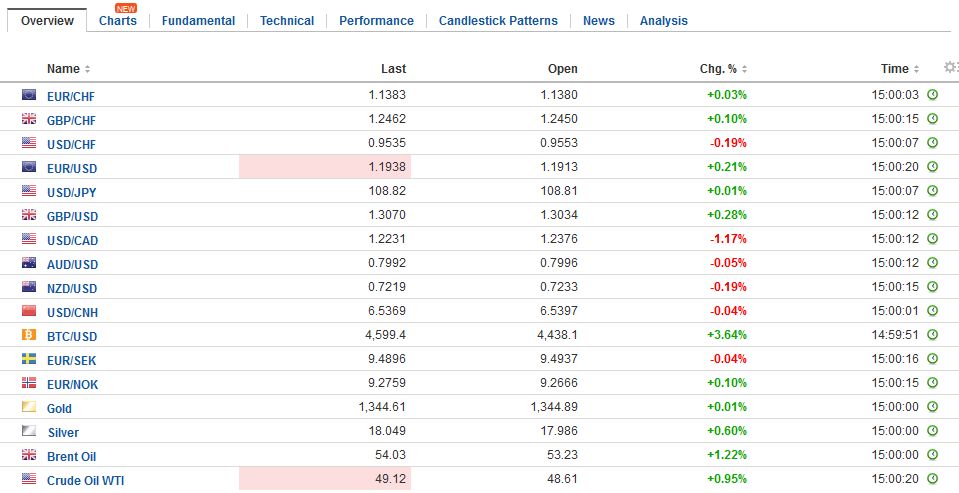

FX RatesThe US dollar fell to new lows since mid-2015 against the Canadian dollar yesterday. It is flattish today as the market awaits the central bank’s decision. We are concerned that given the strong performance and market positioning, a rate hike could spur “buy the rumor, sell the fact” activity. Alternatively, a disappointment if the Bank does not hike could also lead to some Canadian dollar sales. Today’s decision is not followed by a press conference or monetary policy review to help guide sentiment. A bounce in the greenback could see new sales emerge in the CAD1.25 area. In the US, for example, economists have generally been more optimistic about another Fed hike this year than the market (which now looks to be a little less than a 1 in 3 chance). In Canada, a Bloomberg poll found less than 20% of those surveyed expect the Bank of Canada to hike today, while the OIS is discounting a little more than a 55% chance. The euro is edging higher for the third session. Recall that end of last week, after a disappointing US jobs report, the euro had raced back to $1.1980 before the unsourced story suggesting the ECB might not be ready to announce its intentions for the asset purchase program until December sent the euro back to $1.1850. The euro made a two-year high on August 29 near $1.2070 before falling to $1.1825 on the last day in August, the day before the US jobs report. The $1.1945 and $1.1975 level s correspond to the 50% and 61.8% retracement of the pullback from the high. |

FX Daily Rates, September 06 |

| Another record storm is headed for the US mainland; North Korea appears to be preparing for another missile launch, the looming US debt ceiling constraint saw 4-week T-bills yield rise to 1.3% at yesterday’s auction even as the 10-year yield plumbed to depths not seen since last November. In addition to the already busy schedule for the US Congress as they return from the summer vacation that includes aide for Harvey, the debt ceiling, spending authorization, an ongoing investigation into Russia’s attempt to influence the US election, we must add now six-month period to address the grown children of illegal immigrants.

There are national elections in New Zealand, Norway, and Germany. The French labor reforms will spark industrial action in a week, but will still most likely be accepted by the Cabinet later this month before being implemented by decree, as Parliament has granted. In the UK, the government’s Great Repeal (transposing EU laws into English and Scottish law) is facing opposition in Parliament. Around midday in London, May faces questions by Labour leader Corbyn. The negotiations themselves are apparently proceeding sufficiently to turn the agenda to the post-amputee relationship. The EU’s chief negotiator is to brief the 27 countries today, but the deputy negotiator has already tilted the hand. The Reserve Bank of Australia met yesterday, and attention turns to the Bank of Canada today (ahead of the Riksbank and ECB tomorrow). Despite the talk about how central banks are exiting their extraordinary policies, only the Bank of Canada, among the major central banks, is likely to raise rates this year, according to investors. |

FX Performance, September 06 |

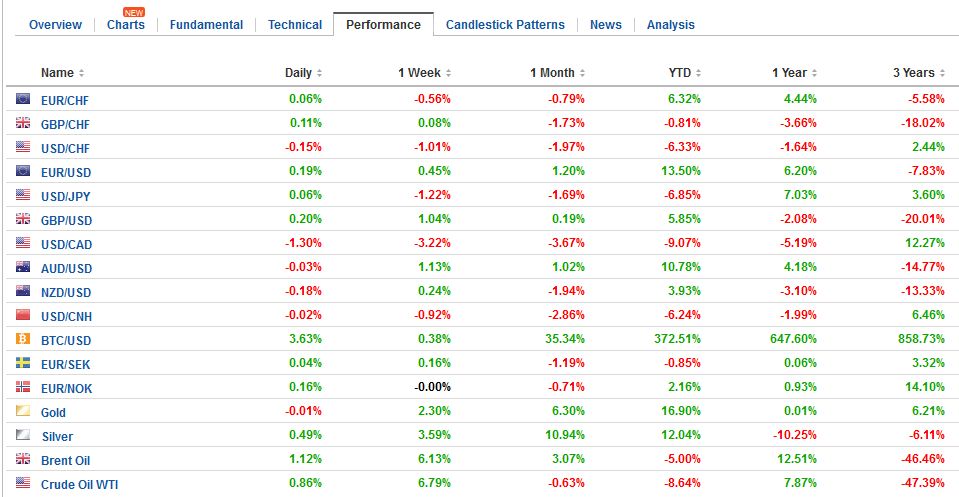

JapanThere have been several economic reports today to note. Japan reported unexpectedly poor labor earnings. Economists had forecast a year-over-year gain of 0.5% in labor cash earnings. Instead, they fell 0.3% following a 0.4% decline in June. It appears that there was a decline in special cash earnings, which include bonuses. Despite tight labor market conditions, Japanese wage growth remains disappointing. Before the weekend, Japan is expected to revise Q2 GDP lower from 1.0% initially to around 0.7%. Meanwhile, the dollar is lower against the yen for the third session. It is holding above last month’s low just below JPY108.30. It appears more driven by the sharp decline in US yields than purely Japanese fundamentals. |

Japan Average Cash Earnings YoY, September 2017(see more posts on Japan Average Cash Earnings, ) Source: investing.com - Click to enlarge |

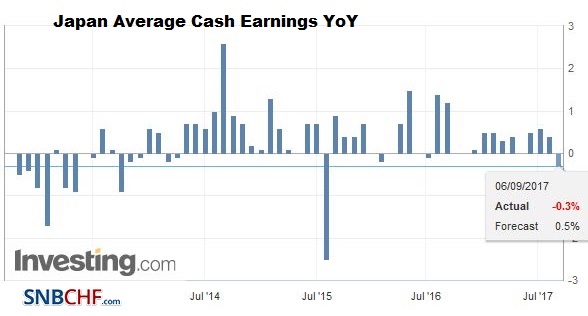

EurozoneWhile the eurozone continues to grow at a pace that is above what is seen as trend growth (~1.3%), evidence continues to accumulate that the momentum has waned. This is evident in the PMIs. Germany has appeared fairly resilient. Much of its industry is competitive at stronger euro levels though the cost structure of other economies is not as favorable. However, today Germany reported an unexpected 0.7% decline in factory orders, which typically are volatile. It is the first decline since April. Domestic manufacturing orders fell by 1.6%, while foreign orders were flat. Among those foreign orders, though, orders from EMU members fell 1% while orders outside of the zone increased by 0.6%. Tomorrow Germany reports July industrial output, which is expected to have bounced back a bit after the sharp 1.1% fall in June. |

Eurozone Retail Purchasing Managers Index (PMI), August 2017(see more posts on Eurozone Retail Purchasing Managers Index, ) Source: investing.com - Click to enlarge |

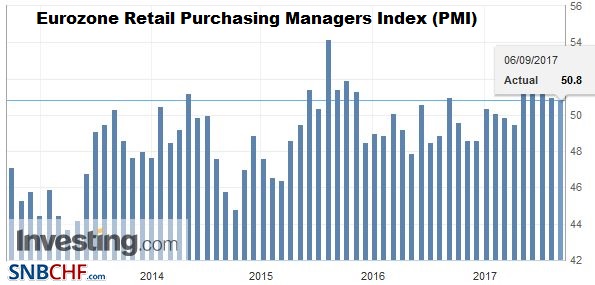

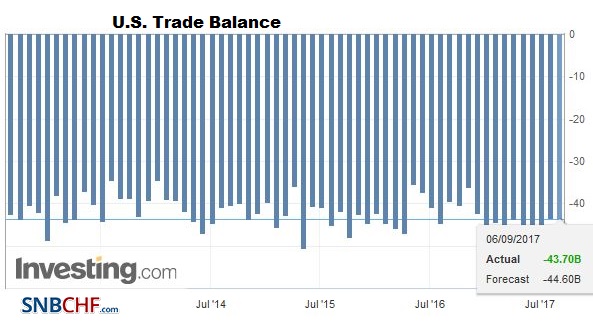

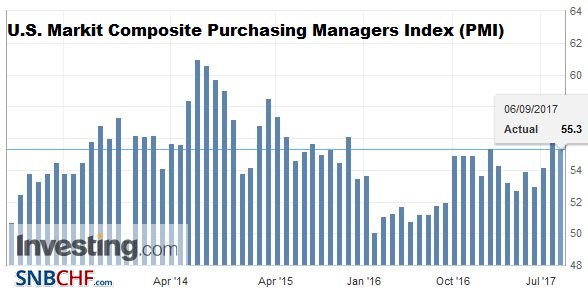

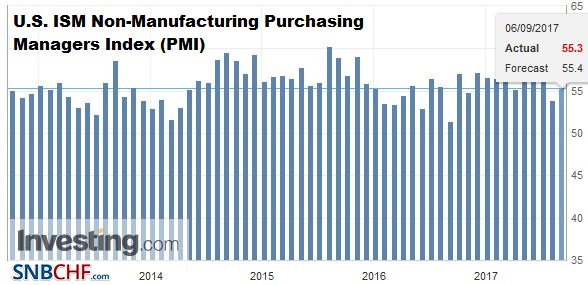

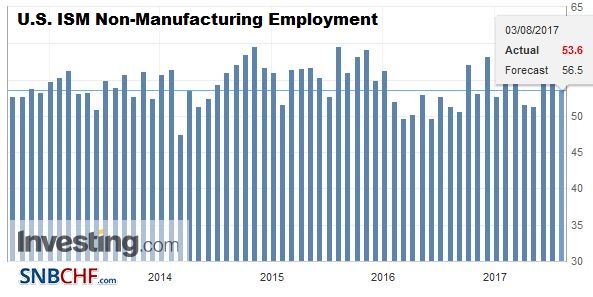

United StatesThe US reports the July trade balance, which is expected to have deteriorated a little and the non-manufacturing ISM for August. . Late in the session, the Fed will release its Beige Book in preparation for the FOMC meeting later this month. At that meeting, the Fed is expected to announce that its efforts to gradually shrink its balance sheet will begin in October. This will be achieved not by selling a single security, but rather by not rolling over the complete amount that is maturing. Meanwhile, the US House of Representatives is expected to pass initial funding for FEMA and small businesses as soon as today. It is in the Senate that is likely to attach an increase in the debt ceiling to the measure. It may face a bit of resistance there, but it is expected to pass. Then the bill returns to the House where the debt ceiling increase may be more intensely debated. |

U.S. Trade Balance, July 2017(see more posts on U.S. Trade Balance, ) Source: investing.com - Click to enlarge |

U.S. Markit Composite Purchasing Managers Index (PMI), August 2017(see more posts on U.S. Markit Composite PMI, ) Source: investing.com - Click to enlarge |

|

U.S. Services Purchasing Managers Index (PMI), August 2017(see more posts on U.S. Services PMI, ) Source: investing.com - Click to enlarge |

|

U.S. ISM Non-Manufacturing Purchasing Managers Index (PMI), August 2017(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: investing.com - Click to enlarge |

|

U.S. ISM Non-Manufacturing Employment, August 2017(see more posts on U.S. ISM Non-Manufacturing Employment, ) Source: investing.com - Click to enlarge |

Australia

Australia reported Q2 GDP of 0.8% after 0.3% growth in Q1. The report fell a little shy of expectations. Australia reports July retail sales and trade tomorrow. The Australian dollar rose to one-month highs yesterday near $0.8030 but is being pushed back below $0.8000 today. Support is seen ahead of $0.7950.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,Eurozone Retail PMI,Featured,FX Daily,Germany Factory Orders,Japan Average Cash Earnings,newsletter,U.S. ISM Manufacturing Employment,U.S. ISM Non-Manufacturing PMI,U.S. Markit Composite PMI,U.S. Services PMI,U.S. Trade Balance,USD/CHF