Swiss Franc The Euro has risen by 0.22% to 1.1646 CHF. EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of .31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation. The 0.1% decline in October contrasts with expectations for a 0.1% increase. This, coupled with the base effect, saw the year-over-year rate fall to 1.7% from 2.1%. It is the slowest pace since June. The Riksbank has one of the most

Topics:

Marc Chandler considers the following as important: China Fixed Asset Investment, China Industrial Production, China Retail Sales, EUR, Eurozone Gross Domestic Product, Eurozone Industrial Production, Eurozone ZEW Economic Sentiment, Featured, FX Trends, GBP, Germany Consumer Price Index, Germany Gross Domestic Product, Germany ZEW Economic Sentiment, Italy Consumer Price Index, Italy Gross Domestic Product, JPY, newsletter, Spain Consumer Price Index, TLT, U.K. Consumer Price Index, U.K. Core Consumer Price Index, U.K. House Price Index, U.S. Core Producer Price Index, U.S. Producer Price Index, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

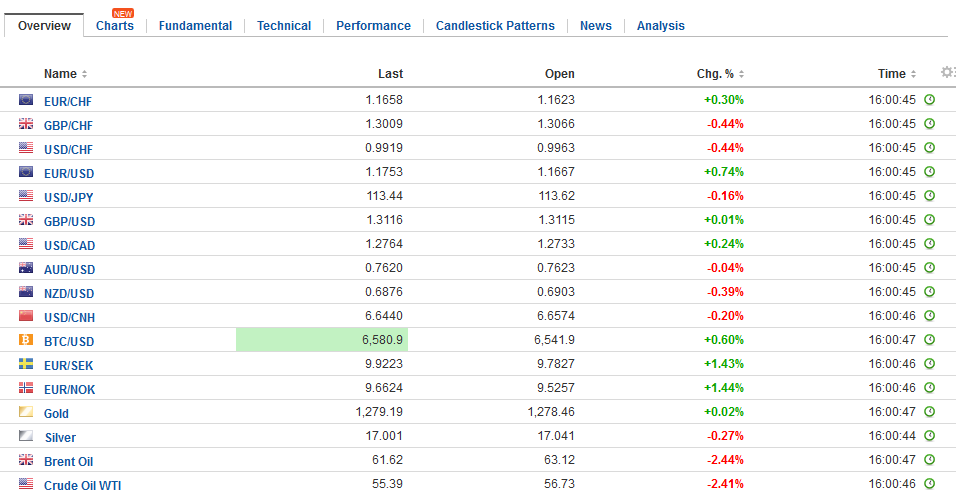

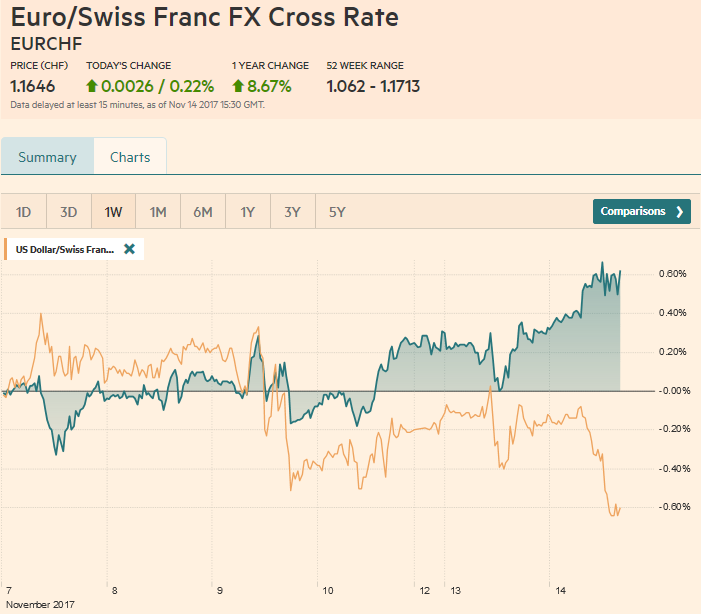

Swiss FrancThe Euro has risen by 0.22% to 1.1646 CHF. |

EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesSterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26. Sweden also reported softer than expected October inflation. The 0.1% decline in October contrasts with expectations for a 0.1% increase. This, coupled with the base effect, saw the year-over-year rate fall to 1.7% from 2.1%. It is the slowest pace since June. The Riksbank has one of the most aggressive monetary policies, with deeply negative deposit rate (minus 1.25%) and repo rate (minus 50 bp) and QE. The euro has rallied to new highs for the year against the krona (~SEK9.8825). The euro had tested SEK9.71 on November 9 before staging an upside reversal. Last year’s peak (November 9) was near SEK10.08. This seems to be a bit far, but many short-term traders and medium-term investors may have been caught the wrong way, and the weekly technicals favor the euro. |

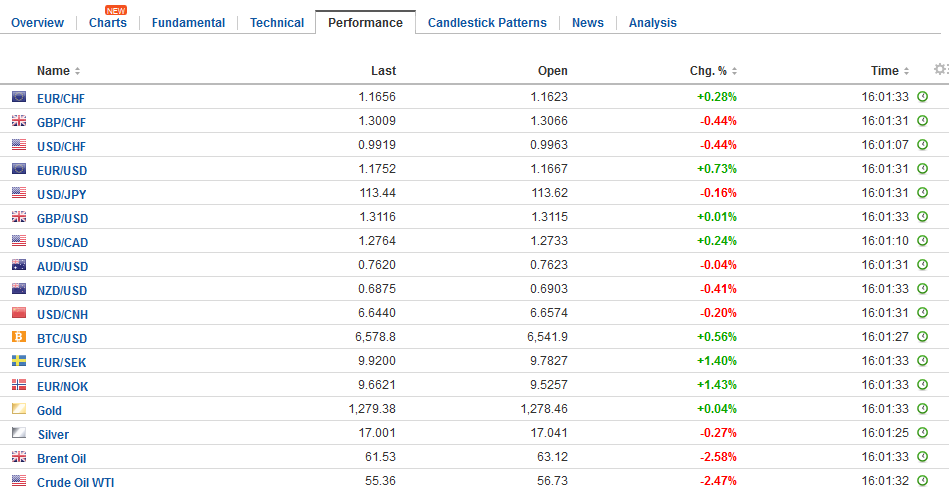

FX Daily Rates, November 14 |

| Against the dollar, the euro is extended the recovery that began last week from about $1.1555 (the lowest level in four months) and is above the 20-day moving average (~$1.1685). We see risk toward $1.1745-$1.1760. We view these euro upticks as corrective in nature and note that the US two-year premium over Germany continues to widen. It stands near 2.43% now, up 40 bp in the past two months. |

FX Performance, November 14 |

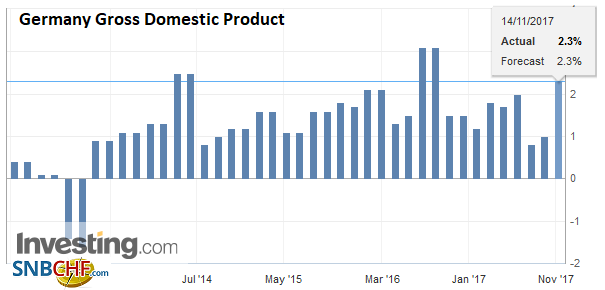

GermanyThe euro was already trading firmly before German GDP surprised to the upside, and the report helped lift the single currency through $1.17 for the first time ECB meeting in late October. |

Germany Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Germany Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| The 0.8% quarterly expansion lifted the workday adjusted the year-over-year rate to 2.8% from a revised 2.3% in Q2, which is the fastest in six years. |

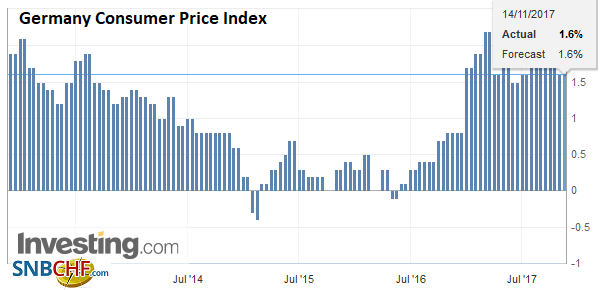

Germany Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Germany Consumer Price Index, ) Source: Investing.com - Click to enlarge |

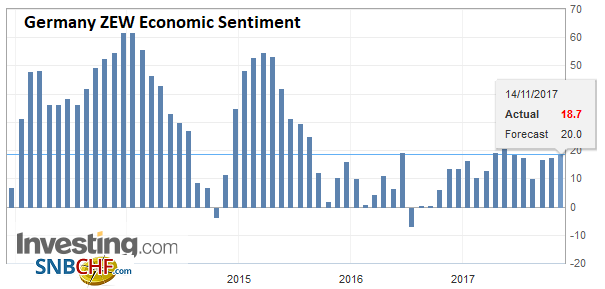

Germany ZEW Economic Sentiment, Nov 2017(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

|

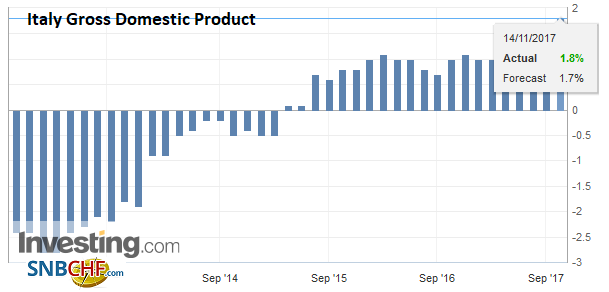

ItalyItalian Q3 GDP was also firm at 0.5%, matching its best pace in seven years. The 1.8% year-over-year pace is also the best since 2011. |

Italy Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on italy-gross-domestic-product, ) Source: Investing.com - Click to enlarge |

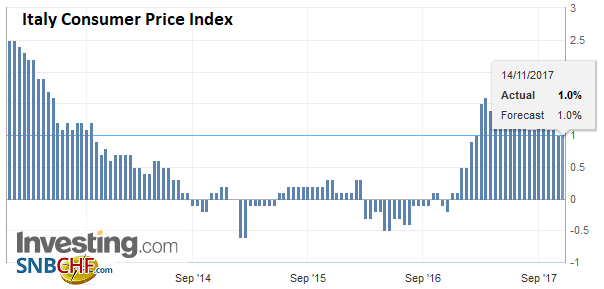

Italy Consumer Price Index (CPI) YoY, Nov 2017(see more posts on Italy Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

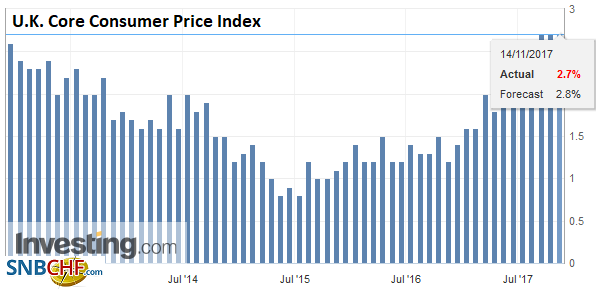

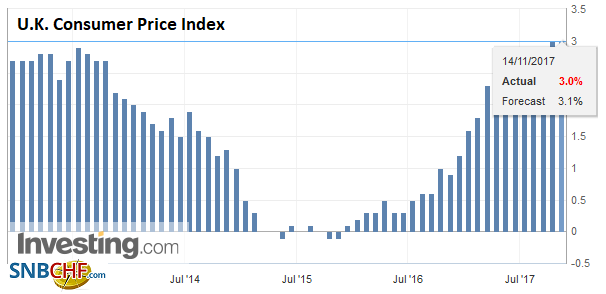

United KingdomThe euro was also boosted by cross rate demand after the softer than expected UK and Swedish inflation. The BOE’s preferred measure, CPIH was unchanged at 2.8%. |

U.K. Core Consumer Price Index (CPI) YoY, Oct 2017(see more posts on U.K. Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Headline and core CPI was also unchanged at 3.0% and 2.7% respectively. The BOE and the market had expected a small rise. The unchanged report means that BOE Governor Carney does not have to write a letter to the Chancellor to explain the overshoot, which is not more than 1%. |

U.K. Consumer Price Index (CPI) YoY, Oct 2017(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

| Although we expect UK inflation to peak here in Q4, it is not clear with today’s report that this is it. That fact that food prices rose 4.2% year-over-year, the most in four years, seems to still reflect the echo of sterling’s decline from last year. |

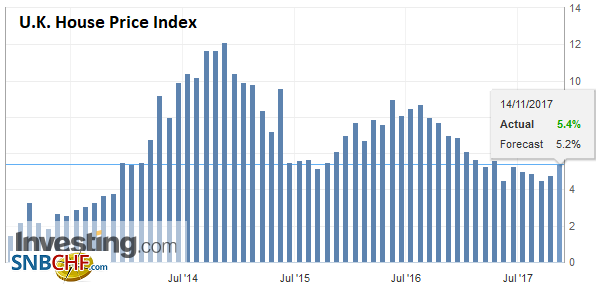

U.K. House Price Index YoY, Oct 2017(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

United States

The US 10-year yield is hovering around 2.40%. The initial push higher in Asia helped extend yesterday’s dollar gains to almost JPY114.00, before being sold in the European morning back toward the session low near JPY113.55. |

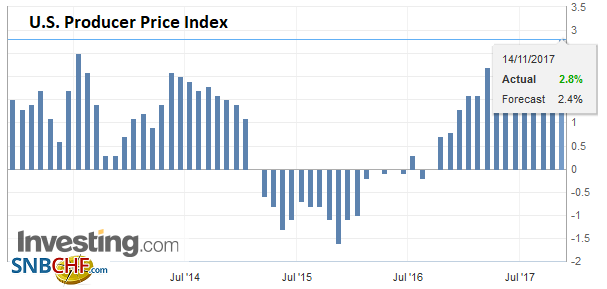

U.S. Producer Price Index (PPI) YoY, Oct 2017(see more posts on U.S. Producer Price Index, ) Source: Investing.com - Click to enlarge |

| Meanwhile, profit-taking weighed on Japanese shares for the fourth session. Some reports suggest that the foreign buying spree may be ending. Weekly MOF figures covering last week will be out in a couple of days. The Topix and Nikkei gapped higher on November 1. The attempt to fill the gaps, which are found near the 20-day moving averages (1770 and 22100, respectively) and the uninspired close warns that the downdraft may not be complete. |

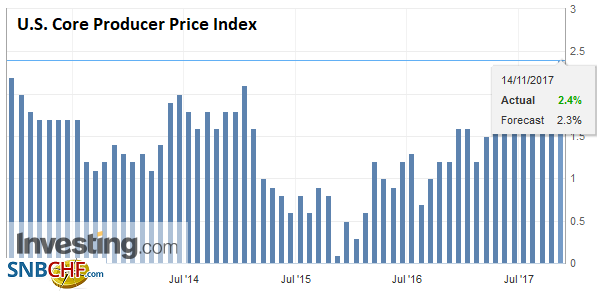

U.S. Core Producer Price Index (PPI) YoY, Oct 2017(see more posts on U.S. Core Producer Price Index, ) Source: Investing.com - Click to enlarge |

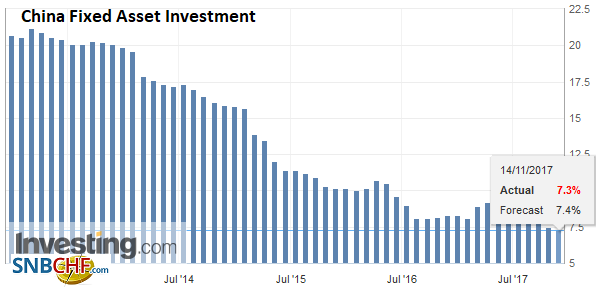

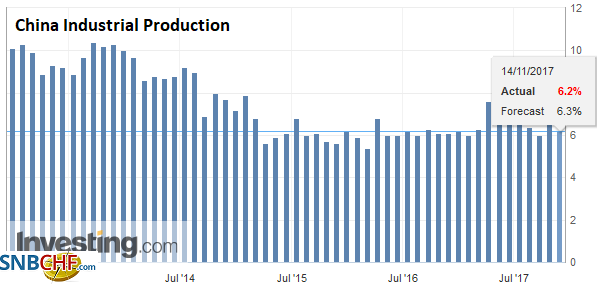

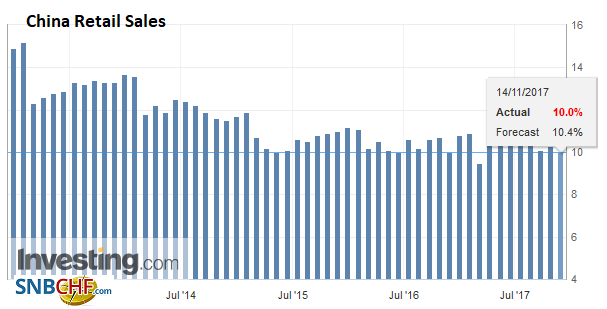

ChinaChina’s data showed that the world’s second-largest economy is slowing. October reading of retail sales, industrial production, and urban fixed-asset investment also slowed sequentially. |

China Fixed Asset Investment YoY, Oct 2017(see more posts on China Fixed Asset Investment, ) Source: Investing.com - Click to enlarge |

| However, the 19th Party Congress may have had a cooling effect, and it seems premature to jump to any hard conclusions. |

China Industrial Production YoY, Oct 2017(see more posts on China Industrial Production, ) Source: Investing.com - Click to enlarge |

| That said, the emphasis on quality over quantity, the deleveraging efforts, paring excess capacity are all consistent with moderating activity. |

China Retail Sales YoY, Oct 2017(see more posts on China Retail Sales, ) Source: Investing.com - Click to enlarge |

EurozoneThere ECB conference that hears from Draghi, Yellen, Carney, and Kuroda, among others is not generating much market response. |

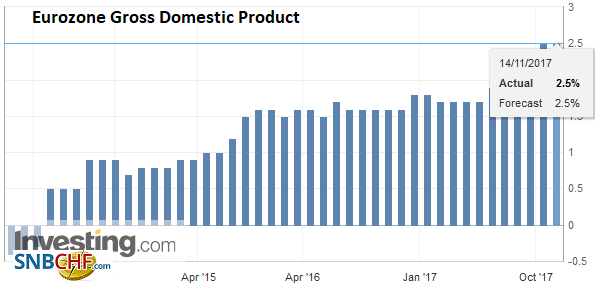

Eurozone Gross Domestic Product (GDP) YoY, Q3 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

| Little new ground appears to have been broken. The event still poses headline risk. The North American session features US PPI, which is not a market-sensitive report. |

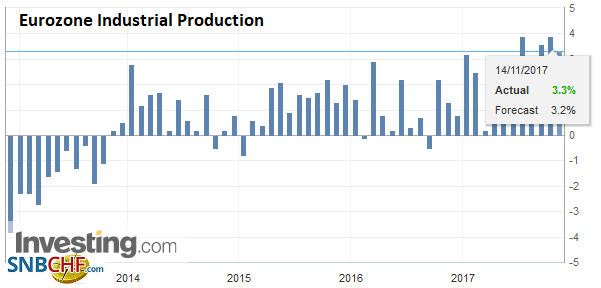

Eurozone Industrial Production YoY, Sep 2017(see more posts on Eurozone Industrial Production, ) Source: Investing.com - Click to enlarge |

| However, economists will look for clues into tomorrow’s CPI report. Lower gasoline prices may weigh on the headline CPI, but the core is expected to be unchanged at 1.7%, where it has been since May. |

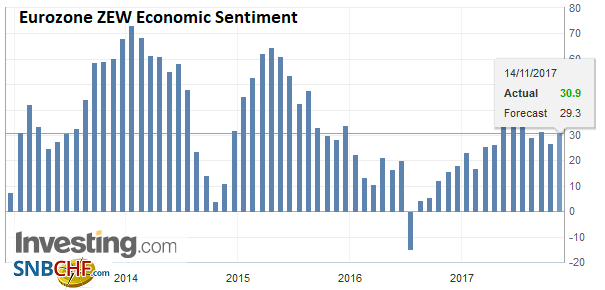

Eurozone ZEW Economic Sentiment, Nov 2017(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

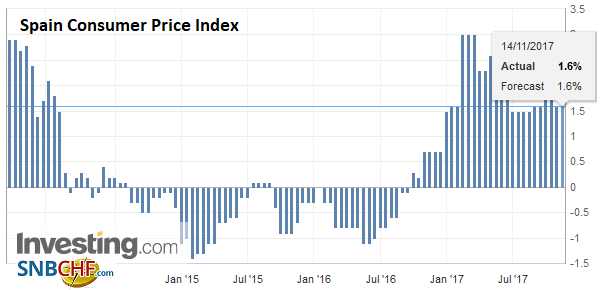

Spain |

Spain Consumer Price Index (CPI) YoY, Oct 2017(see more posts on Spain Consumer Price Index, ) Source: Investing.com - Click to enlarge |

Our calculations put fair value for the December Fed funds contract, assuming a 25 bp rate hike next month, at 1.295%. That is where the contract settled yesterday. However, fiscal policy, i.e., tax reform is overshadowing monetary policy at the moment. The House seems to be moving toward a vote later this week, even though there may still be some last minute adjustments. President Trump is expected to address the House Republicans before the vote. Judging from the tweet storm, POTUS wants the bill to include a repeal of the individual mandate for the Affordable Care Act and wants to cut the top tax rate.

Separately, we note that a bipartisan group of Senators appear to have agreed to the number of US financial institutions regarded as systemically important from 40 to around 12. The regulatory obligations of banks with less than $250 bln in assets will be reduced. The Senate bill is co-sponsored by nine Democrats, suggesting the bill will likely secure the necessary 60 votes.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,$TLT,China Fixed Asset Investment,China Industrial Production,China Retail Sales,Eurozone Gross Domestic Product,Eurozone Industrial Production,Eurozone ZEW Economic Sentiment,Featured,Germany Consumer Price Index,Germany Gross Domestic Product,Germany ZEW Economic Sentiment,Italy Consumer Price Index,Italy Gross Domestic Product,newsletter,Spain Consumer Price Index,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index,U.S. Core Producer Price Index,U.S. Producer Price Index