See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Different Vantage Point The prices of the metals were up slightly this week. But in between, there was some exciting price action. Monday morning (as reckoned in Arizona), the prices of the metals spiked up, taking silver from under .90 to over .25. Then, in a series of waves, the price came back down to within pennies of last Friday’s close. The biggest occurred on Friday. One thing that is worth noting. Although people think it is gold that goes up and down against a constant, stable dollar, it is the other way around. This means that when people use leverage to speculate that gold is going up, they are

Topics:

Keith Weiner considers the following as important: dollar price, Featured, Gold and its price, gold basis, Gold co-basis, gold price, gold silver ratio, newsletter, Precious Metals, silver basis, Silver co-basis, silver price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

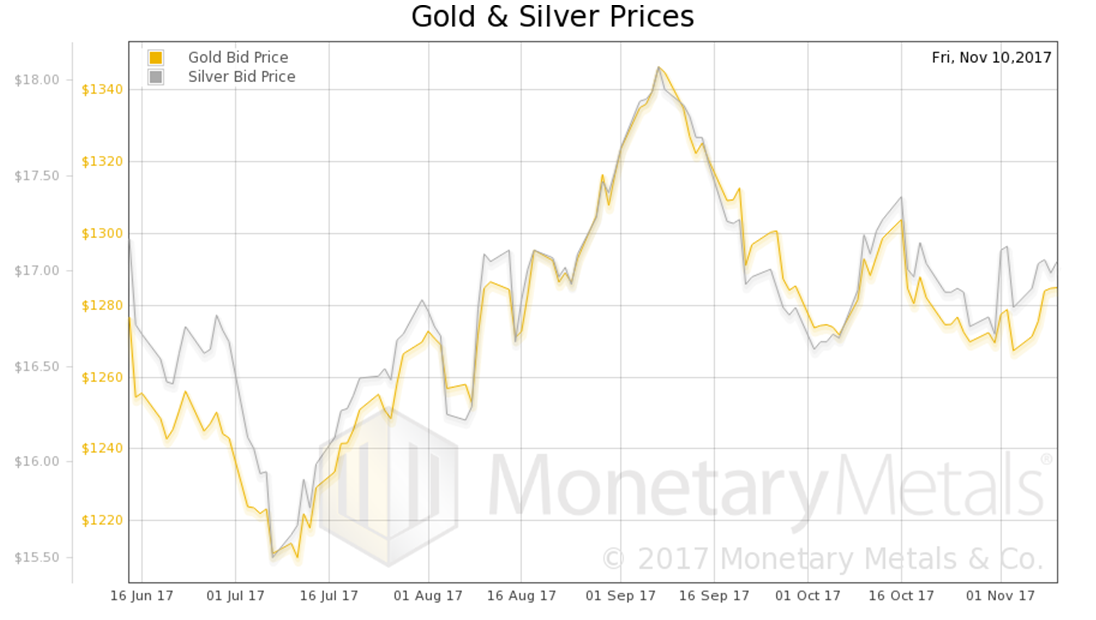

A Different Vantage PointThe prices of the metals were up slightly this week. But in between, there was some exciting price action. Monday morning (as reckoned in Arizona), the prices of the metals spiked up, taking silver from under $16.90 to over $17.25. Then, in a series of waves, the price came back down to within pennies of last Friday’s close. The biggest occurred on Friday. One thing that is worth noting. Although people think it is gold that goes up and down against a constant, stable dollar, it is the other way around. This means that when people use leverage to speculate that gold is going up, they are actually betting the dollar will go down. Gold is unique that way. For example, in times of stress or crisis, it is always the bid that is withdrawn. There are always plenty of offers. Suppose the US Geological Survey says that “there will be an earthquake in Los Angeles, 15 on the Richter scale. Nothing taller than a dollhouse will be left standing.” You will not find any bids to buy real estate in LA. We suspect not from Santiago, Chile to Vancouver, Canada and as far eastward as the Mississippi River. On the other hand, offers will be plenty. Some people will set their offer close to what they expected before the announcement. Others will desperately try to unload at a far lower price. Gold, on the other hand, behaves opposite. Suppose the Fed announces that it is “on the brink of insolvency, of failing to timely pay its obligations.” And, further, it adds, “the US government itself is imminently at high risk of a failed bond auction.” You would not find a lack of bids to buy gold. You would find a lack of offers to sell it. This is because the nomenclature (and the thinking) have it exactly backwards with gold. One is not buying gold. One is selling dollars! One is not selling gold, one is buying dollars. This may seem like a semantic argument, but it is vitally important to understand the distinction. We are not going to reiterate yet again that gold is money and the dollar is irredeemable credit. We have a different point. Gold is the thing people want to own when the debtors — and the mother of all debtors, the US government — default. This is because a defaulted credit instrument is worthless. Gold cannot be impaired. Intuitively, our remark about long gold futures position being a dollar short should make sense. What do gold promoters most often talk about as the driver for gold to go up? Threats to the value of the dollar, the reserve status of the dollar, the existence of the dollar, the use of the dollar outside the US, etc. They say “gold is going to go up” but they argue “the dollar is going to go down.” |

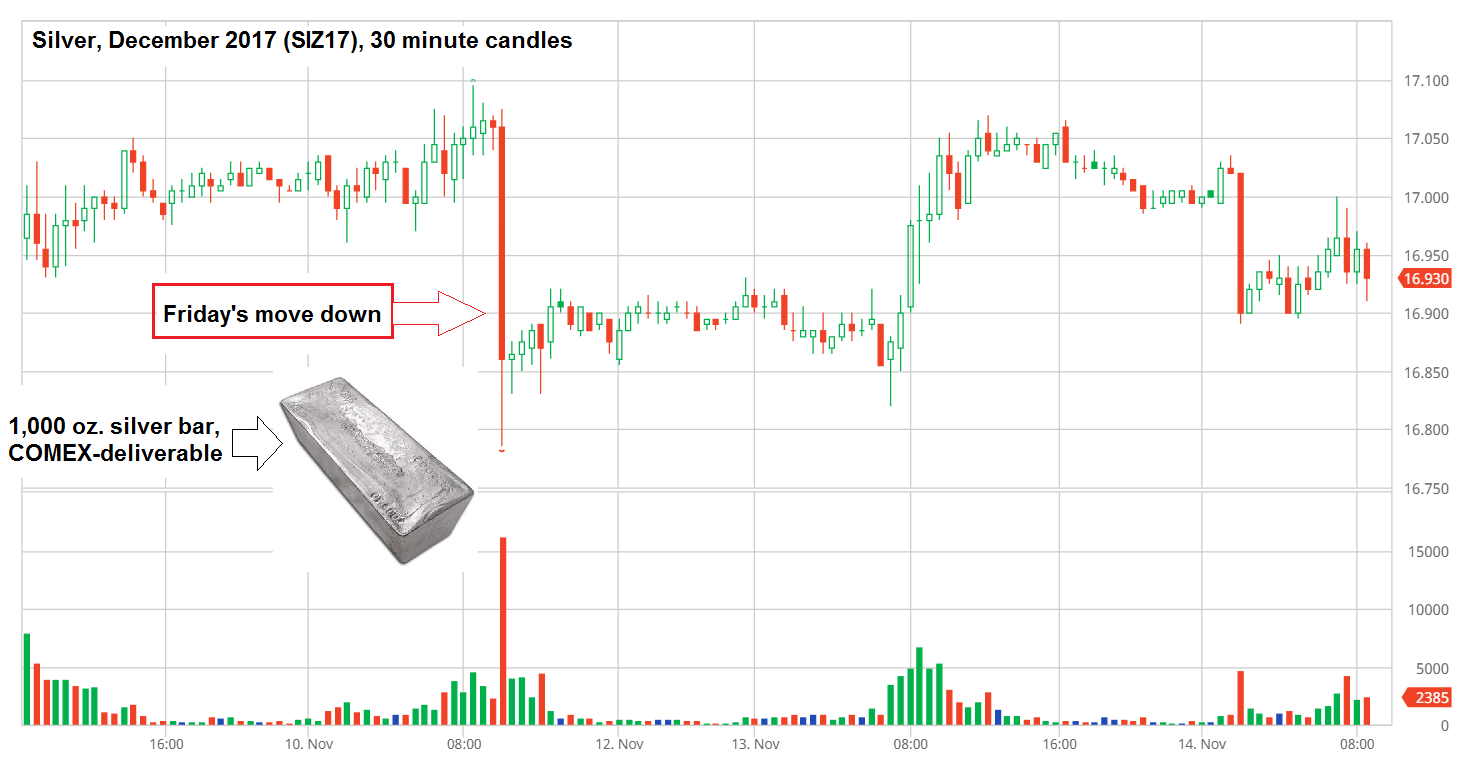

Silver, December 2017 - 30 minute Candles(see more posts on silver, ) Silver ended slightly up on the week after a somewhat bigger rally was rudely interrupted on Friday. These intra-week ups and downs that end up going nowhere have become routine in recent weeks. Remember that industrial demand for silver is strongest in January – that is something short term oriented traders might want to keep in mind, as the effect on prices tends to be very strong on average (the “going nowhere in Q4” trend is also a recurring seasonal phenomenon over the past 45 years). [PT] - Click to enlarge |

Fundamental DevelopmentsWe will look at gold and silver supply and demand fundamentals, and also we have charts for Friday’s price and basis moves. But first, here are the charts of the prices of gold and silver, and the gold-silver ratio. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

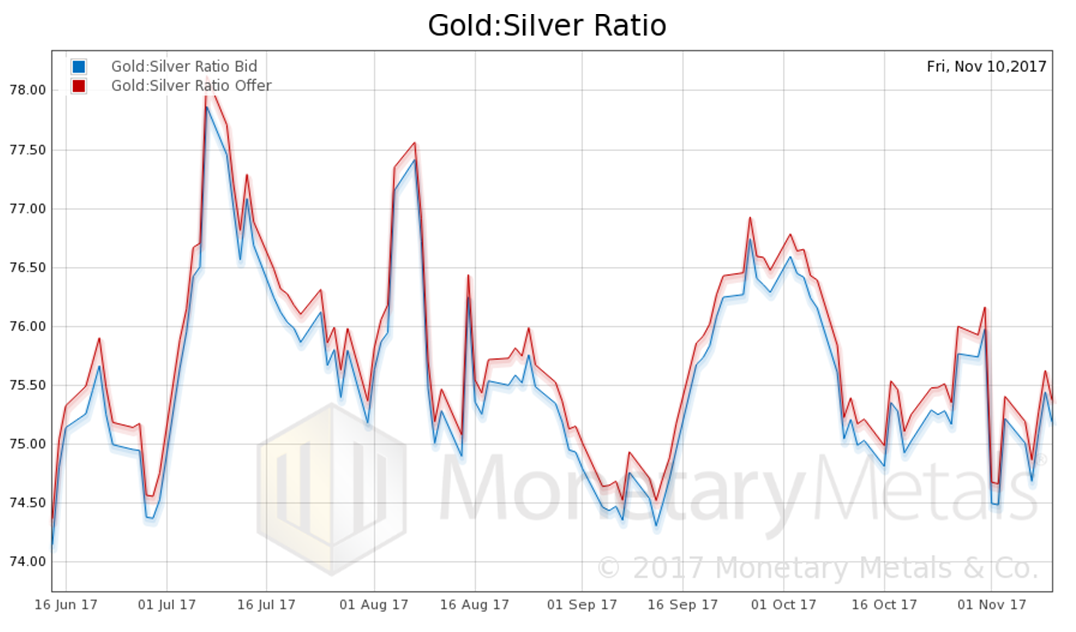

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. The ratio rose a hair.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

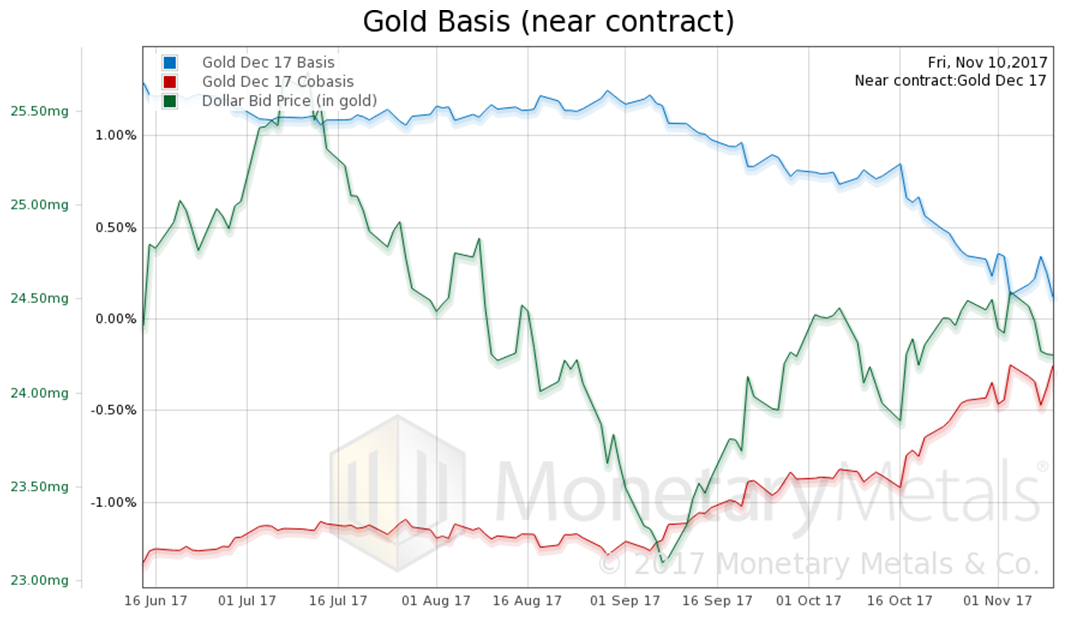

Gold Basis and Co-basis and Dollar PriceHere is the gold graph showing gold basis and co-basis with the price of the dollar in gold terms. The co-basis (our measure of scarcity) continues to track the price of the dollar (inverse of the price of gold, in dollar terms). Keep in mind that the December contract is nearing expiry, and so will tend to have a rising co-basis. This is, as we said to Ted Butler, because the short positions are held by arbitragers and not speculators. Our calculated Monetary Metals gold fundamental price moved down, but not by a lot. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

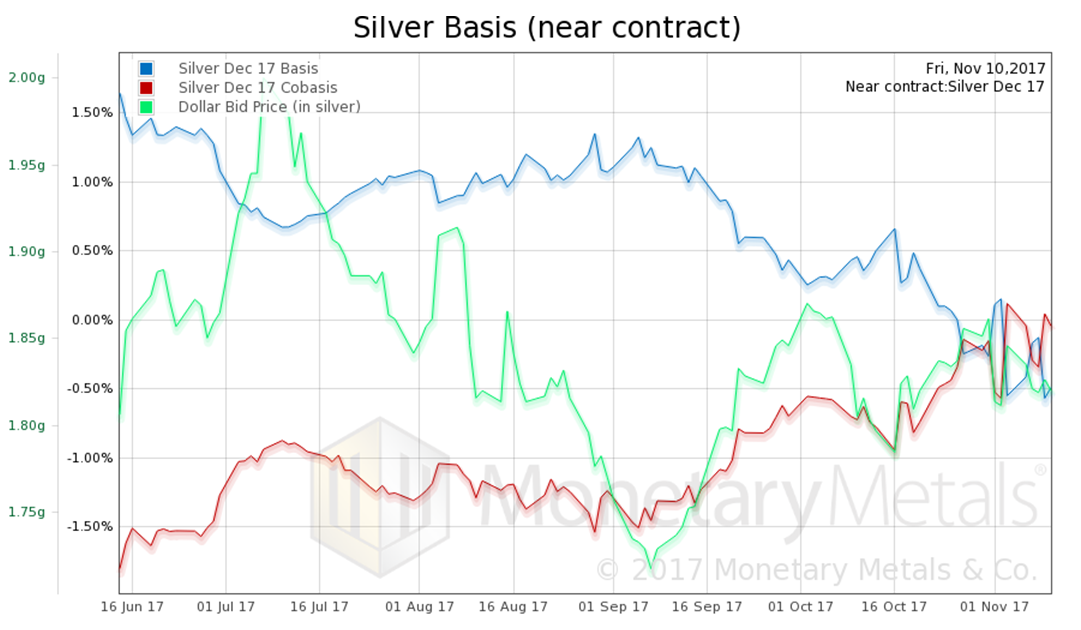

Silver Basis and Co-basis and Dollar PriceNow let’s look at silver. We also see the co-basis tracking the price of the dollar, keeping in mind that contract roll distortions are larger in silver than in gold owing to its lesser liquidity. Our calculated Monetary Metals silver fundamental price rose insignificantly. Now, on to Friday’s crash. Is it like last Friday’s crash? In Part II of this article, we analyze intraday graphs for both metals. |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

© 2017 Monetary Metals

Charts by: BarChart, Monetary Metals

Chart captions by PT

Tags: dollar price,Featured,gold basis,Gold co-basis,gold price,gold silver ratio,newsletter,Precious Metals,silver basis,Silver co-basis,silver price