The Wall Street Journal’s Jason Zweig famously referred to gold as a “Pet Rock” in 2015. He was blasted by people who understand that gold is no passing fad, and it serves some very important roles in an investment portfolio. The valuable roles played by gold have been well covered here. It’s a hedge against both inflation and deflation, it represents true diversification for portfolios stuffed with conventional securities, and it is a way of protecting wealth...

Read More »The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of...

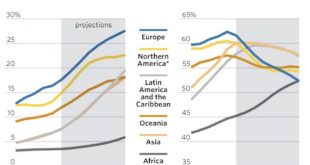

Read More »“This May Be The End Of Europe As We Know It”: The Pension Storm Is Coming

Authored by John Mauldin via MauldinEconomics.com, I’ve written a lot about US public pension funds lately. Many of them are underfunded and will never be able to pay workers the promised benefits – at least without dumping a huge and unwelcome bill on taxpayers. And since taxpayers are generally voters, it’s not at all clear they will pay that bill. Readers outside the US might have felt safe reading those stories....

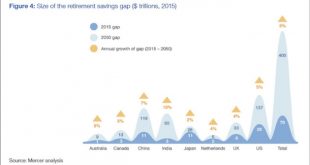

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

- Click to enlarge By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent – which often, not always, go hand in hand together – where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren’t for the fact it’s so damn far from the beach I could actually live here. It’s really quite lovely....

Read More »Talking Global Macro Investing With A 25-Year Market Veteran

By Chris at www.CapitalistExploits.at If you were rich, successful, and intelligent - which often, not always, go hand in hand together - where would you live? The last time I was in the Rockies, I remember thinking to myself. You know what, if it weren't for the fact it's so damn far from the beach I could actually live here. It's really quite lovely. Bite-your-hand-to-stop-you-from-crying-out-loud-lovely and if, like me, you're a sucker for snowboarding, then it's pretty hard to be...

Read More »Sweden’s Gold Reserves: 10,000 gold bars (pet rocks) shrouded in Official Secrecy

In February 2017 while preparing for a presentation in Gothenburg about central bank gold, I emailed Sweden’s central bank, the Riksbank, enquiring whether the Riksbank physically audits Sweden’s gold and whether it would provide me with a gold bar weight list of Sweden’s gold reserves (gold bar holdings). The Swedish official gold reserves are significant and amount to 125.7 tonnes, making the Swedish nation the...

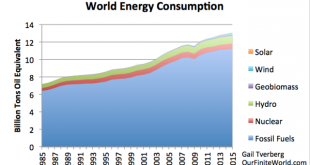

Read More »Destroying The “Wind & Solar Will Save Us” Delusion

The “Wind and Solar Will Save Us” story is based on a long list of misunderstandings and apples to oranges comparisons. Somehow, people seem to believe that our economy of 7.5 billion people can get along with a very short list of energy supplies. This short list will not include fossil fuels. Some would exclude nuclear, as well. Without these energy types, we find ourselves with a short list of types of energy — what...

Read More »The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto. After all, no matter where in the world you buy one, a Big Mac...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org