On VoxEU, Refet Gürkaynak and Deborah Lucas argue in favor of helicopter drops to finance the fiscal burden due to Covid-19 and they propose an elegant way to implement such drops without undermining the central bank’s equity position (if regulators accept accounting tricks). The special issue bonds would be zero coupon perpetuities and therefore would not obligate Treasury to any future payments. The legislation would require the Fed to buy these bonds from the banks at par. The...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and...

Read More »“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the...

Read More »Albert Edwards: Investors Should Brace For A World Of Negative Rates, 15percent Budget Deficits And Helicopter Money

Eariler this week, when the San Fran Fed published a paper that suggested that the recovery would have been stronger if only the Fed had cut rates to negative, we proposed that this is nothing more than a trial balloon for the next recession/depression, one in which the Federal Reserve will seek affirmative “empirical evidence” that greenlights this unprecedented NIRPy step (in addition to QE of course). Today, in his...

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

[embedded content] Wer soll Franken herstellen dürfen? Nur die Schweizerische Nationalbank, oder auch die Geschäftsbanken wie UBS, CS oder die Kantonalbanken? Ginge es nach der Vollgeld-Initiative, über die wir am 10. Juni abstimmen, wäre künftig klar: Geld als gesetzliches Zahlungsmittel gäbe es nur von der SNB. Offsetmaschine zum Druck von Schweizer Banknoten bei der Schweizerischen Nationalbank. Keystone - Click to...

Read More »“Was Vollgeld bringt – und was nicht (Sovereign Money—Pluses and Minuses),” SRF, 2018

SRF, April 28, 2018. HTML with link to audio file (interview starts at 13:15). Interview with Swiss public radio about Vollgeld and the Vollgeld initiative.

Read More »Revenu universel, du néo-libéralisme jusqu’au bout

Les quantitative easing de la dernière décennie ont créé un assèchement de liquidités locales. Ceci est un fait observable. Les banques locales sont étranglées par diverses directives imposées par les tenants et « régulateurs » de la haute finance internationale (Finma pour la Suisse). L’échec économique se propage, avec de multiples faillites de commerces et d’entreprises? Vous n’avez plus accès à vos...

Read More »The Path to Inflation: “Helicopter Money”

Yet conventional economists are virtually unanimous that deflation is the danger and inflation is a “good thing” we need to spur so servicing existing debt becomes easier for debtors. Due to the deflationary pressures of technology and stagnant wages for the bottom 90%, the consensus sees low inflation as far as the eye can see. When the consensus is near-100% on one side of the boat, we can safely bet Reality will not...

Read More »The Point of War Is Not to Win

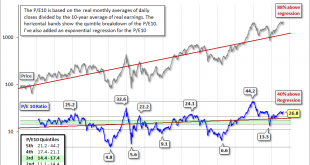

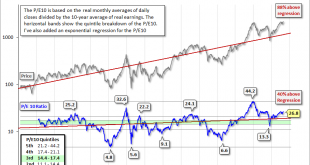

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past...

Read More »The Point of War Is Not to Win

Newfangled “Stimulus” In time, everything goes away. We are confident, for example, that it won’t be too long before the market cracks (please don’t hold us to this forecast, but don’t forget if it turns out to be correct!). U.S. corporate profits are falling. GDP is sinking. Productivity has slumped for the longest period since the 1970s. And going by the CAPE ratio, which looks at stock prices relative to the past...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org