The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices. Everyone still thinks there’s a direct monetary injection in this case by the central monetary agency which causes stocks to rise for no good reason. While we don’t have to argue the Fed’s bank reserves here, the truth of the matter is stocks have been severed...

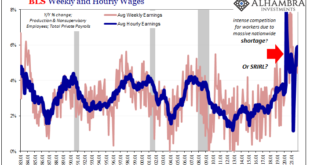

Read More »As The Fed Tapers: What If More Rapid (published) Wage Increases Are Actually Evidence of *Deflationary* Conditions?

Since the Federal Reserve is not in the money business, their recent hawkish shift toward an increasingly anti-inflationary stance is a twisted and convoluted case of subjective interpretation. Inflation is money and if the Fed was a central bank the issue of consumer prices wouldn’t necessarily be simple, it would, however, be much simpler: is there or isn’t there too much money flowing through the economy. News to the vast majority of the public, no one at any...

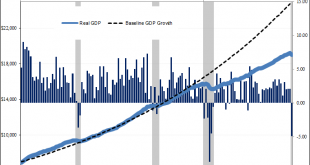

Read More »GDP + GFC = Fragile

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation. It wasn’t until the middle of March that the first major shutdown orders began to appear – on Twitter feeds – and these weren’t the total lockdowns...

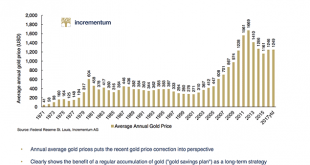

Read More »Key Charts: Gold is Cheap and US Recession May Be Closer Than Think

by Dominic Frisby of Money Week Every year, Ronald-Peter Stoeferle and Mark J Valek of investment and asset management company Incrementum put together the report In Gold We Trust – 160-plus pages of charts and thoughts, mostly gold-related, on the state of the world’s finances. There’s so much to look at and consider. It’s a sort of digital equivalent of a coffee-table book. Yesterday I got an email from them, containing a “best of” – a compendium of some of the best...

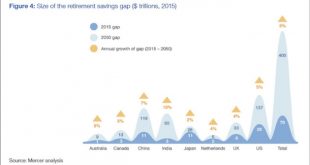

Read More »“This Is A Crisis Greater Than Any Government Can Handle”: The $400 Trillion Global Retirement Gap

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Swiss Mystery: Someone Keeps Flushing €500 Bank Notes Down The Toilet

While there are several comments one can make here, “dirty money”, “flush with cash” and “flushing money down the toilet” certainly coming to mind, perhaps the ECB was on to something when it warned that €500 “Bin Laden” bills (which it has since discontinued to print) tend to be used by criminals. The reason for this is that in recent weeks, Swiss prosecutors have been gripped by a mystery, trying to figure out why...

Read More »Toward The Housing Bubble, Or Great Depression?

During the middle 2000’s, one more curious economic extreme presented itself in an otherwise ocean of extremes. Though economists were still thinking about the Great “Moderation”, the trend for the Personal Savings Rate was anything but moderate, indicated a distinct lack of modesty on the part of consumers. In early 2006, the Bureau of Economic Analysis calculated that the rate had been negative for all of 2005. It...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

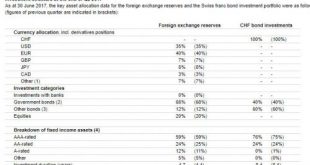

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and "other bonds", at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable - and unexpected - development, and it had to do with the SNB's -0.75%...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org