First The Telegraph, then The Sun, and today The Spectator all came out on the “Leave” side of the Brexit debate. However, perhaps even more shocking to the establishment is the CIO of a major bank’s asset management arm dismissing the apparent carnage that Cameron, Obama, and Osborne have declared imminent, warning that, “many articles on the Brexit vote overstate its risks and consequences.” As JPM’s Michael Cembalest adds, the reality is “hardly the stuff that economic calamity is made of.” As The Spectator concludes, “the history of the last two centuries can be summed up in two words: democracy matters.” As JPMorgan Asset Management CIO Michael Cembalest explains… My sense is that many articles on the Brexit vote overstate its risks and consequences for the UK, and/or overstate the vote’s impact on political movements and economic malaise in the Eurozone that predate it by months and years. Here are some thoughts on issues I have seen raised over the last few weeks. “UK growth will suffer a huge hit”. Of all the analyses I’ve read about a possible Brexit scenario, I found Open Europe’s report to be the most clear-headed and balanced. Their realistic case estimates the cumulative impact of Brexit on UK GDP at just -0.8% to 0.

Topics:

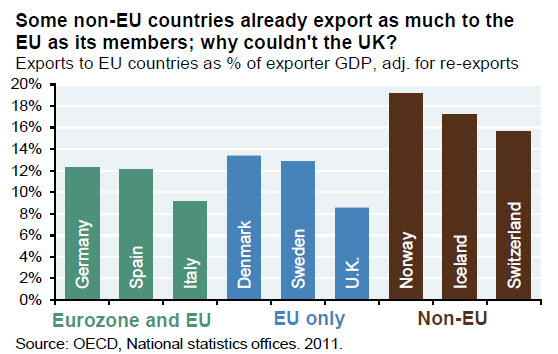

Tyler Durden considers the following as important: Barack Obama, British Pound, Central Banks, China, David Cameron, Eurozone, Featured, France, Iceland, Italy, Japan, Michael Cembalest, newsletter, Norway, Reality, Switzerland, UK inflation, UK-EU trade will collapse

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

First The Telegraph, then The Sun, and today The Spectator all came out on the “Leave” side of the Brexit debate. However, perhaps even more shocking to the establishment is the CIO of a major bank’s asset management arm dismissing the apparent carnage that Cameron, Obama, and Osborne have declared imminent, warning that, “many articles on the Brexit vote overstate its risks and consequences.” As JPM’s Michael Cembalest adds, the reality is “hardly the stuff that economic calamity is made of.” As The Spectator concludes, “the history of the last two centuries can be summed up in two words: democracy matters.”

As JPMorgan Asset Management CIO Michael Cembalest explains…

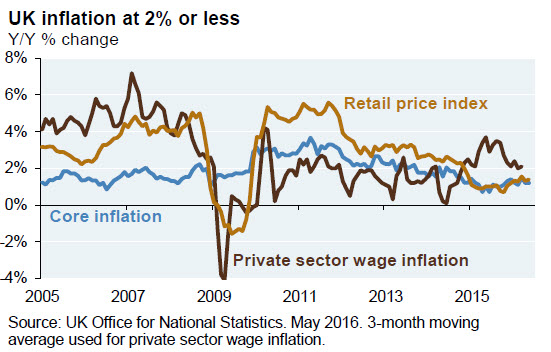

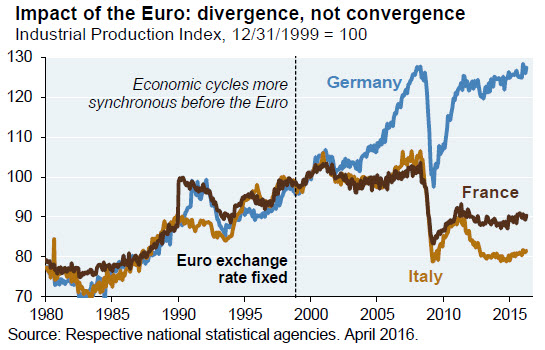

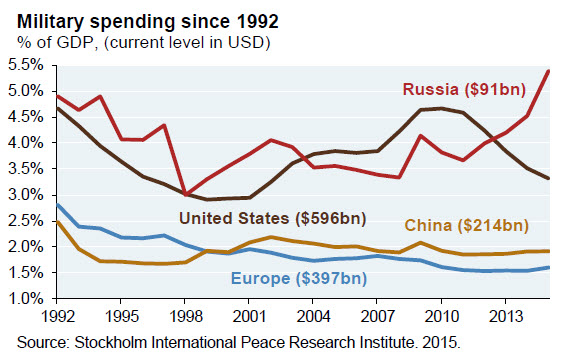

My sense is that many articles on the Brexit vote overstate its risks and consequences for the UK, and/or overstate the vote’s impact on political movements and economic malaise in the Eurozone that predate it by months and years. Here are some thoughts on issues I have seen raised over the last few weeks.

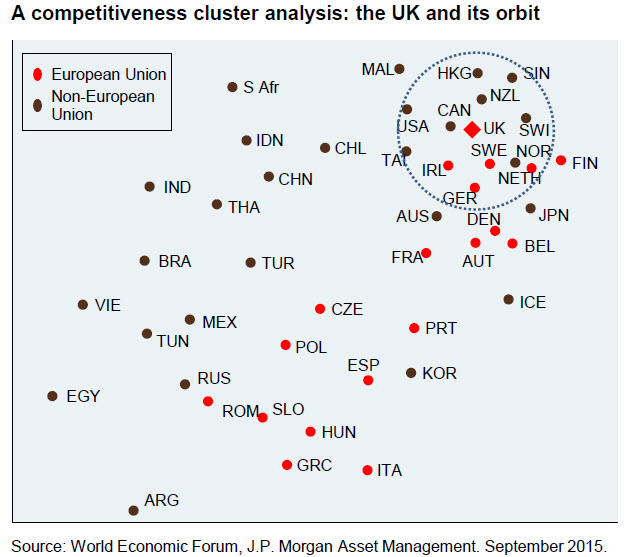

Our cluster chart is based on data from the World Economic Forum’s Competitiveness Rankings. The closer countries are to each other, the more similar they are with respect to WEF factors. While some EU countries are in the UK’s immediate orbit (GER, NETH, SWE, IRL), other EU countries are not (FRA, ITA, ESP, PRT). From a purely theoretical UK perspective, a political union based on commonly shared practices & principles might include CAN, NOR, SWI and the USA instead.

Examples of factors included in World Economic Forum Competitiveness Rankings:

- Legal frameworks and property rights

- Judicial independence and corruption

- Investor protections

- Infrastructure, electricity and energy

- Secondary and tertiary education

- Labor flexibility and productivity

- Capital markets access and depth

- Supply chain development

- Procedures required to start a new business

- Innovation, IT development and patents

One last point. The Lisbon Treaty includes Article 50 which does contemplate the departure of an EU member. As messy as it might be, a Brexit would be managed by the parties involved, and be a far cry from dissolving a monetary and fiscal union to which member states had “pledged their lives, their fortunes and their sacred honor”.

So having said all that, we leave it to The Spectator to sum it all up…

No one — economist, politician or mystic — knows what tumult we can expect in the next 15 years. But we do know that whatever happens, Britain will be better able to respond and adapt as a sovereign country living under its own laws.

The history of the last two centuries can be summed up in two words: democracy matters.