Fear vs Facts The coronavirus epidemic seemingly came out of nowhere in the beginning of the year and within a matter of days managed to wreak havoc with stock markets. As the days and weeks passed, and as the confirmed cases and the death toll rose, the media stoked fear and panic over worst-case scenarios. All kinds of “experts” and commentators put forward near-apocalyptic warnings and theories over a potential global pandemic that would trigger an economic recession. But how...

Read More »If Bitcoin Is A Bubble…

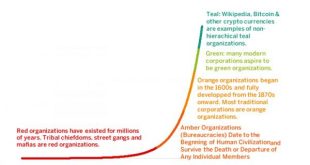

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »SNB: It’s A Bonfire Of The Absurdities

Authored by John Mauldin via MauldinEconomics.com, “Vanity of vanities, saith the Preacher, vanity of vanities; all is vanity.” – Ecclesiastes 1:2, King James Version (attributed to King Solomon in his old age) This week’s letter will take a look at the growing number of ridiculous, inane, and otherwise nonsensical absurdities that fill the daily economic headlines. I have gone from the occasional smile to scratching my...

Read More »BIS Finds Global Debt May Be Underreported By $14 Trillion

In its latest annual summary published at the end of June, the IIF found that total nominal global debt had risen to a new all time high of $217 trillion, or 327% of global GDP... ... largely as a result of an unprecedented increase in emerging market leverage. While the continued growth in debt in zero interest rate world is hardly surprising, what was notable is that debt within the developed world appeared to have peaked, if not declined modestly in the latest 5 year period. However,...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

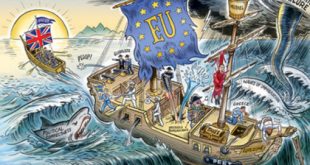

Read More »10 Ways The UK Could Leave The EU

Authored by Alastair Macdonald, originally posted at Reuters.com, Stalemate between Britain and the European Union over what happens next following Britons’ referendum vote to leave has opened up a host of possible scenarios. Here are some that are (in some cases, barely) conceivable: 1. BY THE BOOK Prime Minister David Cameron, who said he will resign after losing his gamble to end British ambivalence about...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More »8 Lessons That We Can Learn From The Economic Meltdown In Venezuela

Submitted by Michael Snyder via The End of The American Dream blog, We are watching an entire nation collapse right in front of our eyes. As you read this article, there are severe shortages of just about anything you can imagine in Venezuela. That includes food, toilet paper, medicine, electricity and even Coca-Cola. All over the country, people are standing in extremely long lines for hours on end just hoping that they will be able to purchase some provisions for their hungry...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org