Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The risk that the eurozone implodes over the next year has risen, but is still modest. Italy has surpassed Greece as the most likely candidate. The December referendum is the second part of Renzi’s political reforms. Sentix conducts investor surveys...

Read More »Why Portugal Matters

Summary: DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating. Many observers continue to tout Italian risks as the greatest in the euro area into the year end. The constitutional referendum that would emasculate the Senate, and end the perfect bicameralism that has contributed to...

Read More »European Court of Justice Ruling Weighs on Italian Banks

Summary: ECJ uphold principle of bailing in junior creditors before the use of public funds. Italian banks shares snap a three-day advance. The EBA/ECB stress test results at the end of next week are the next big event. The European Court of Justice upheld the principle of making creditors bear the burden for investment in banks that sour before government funds can be used. Italian banks are particularly...

Read More »New Wrinkle in European Bail-In Efforts

Summary: European Court of Justice could rule on July 19 that private investors do not have to be bailed in before public money can be used to recapitalize banks. Italy stands to gain the most, at least immediately, from such a judgment. Italian bank shares recovered after initial weakness. After the 2007-2008 bank recapitalization by governments, which means taxpayers’ money, Europe changed the rules. The...

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

Read More »European Banks and Europe’s Never-Ending Crisis

Landfall of a “Told You So” Moment… Late last year and early this year, we wrote extensively about the problems we thought were coming down the pike for European banks. Very little attention was paid to the topic at the time, but we felt it was a typical example of a “gray swan” – a problem everybody knows about on some level, but naively thinks won’t erupt if only it is studiously ignored. This actually worked for a...

Read More »Return of the Repressed: Europe’s Unresolved Banking Crisis

Summary The IMF identified three banks that posted the most significant systemic risks. It has been overshadowed by new pressure on Italy’s banks, and. Three UK commercial real estate funds have been frozen to prevent redemptions. The conventional narrative has it backward. It worries about the threats to stability emanating from the periphery in Europe. Policymakers, investors, and economists still refer to...

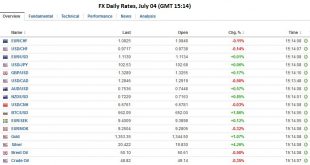

Read More »FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Summary Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment. FX Rates Monday, while Americans were celebrating the original Brexit, the US dollar drifted lower. The Australian dollar fully recovered from electoral...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

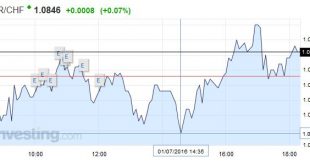

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More »How Exceptional are Conditions?

Summary If conditions are exceptional, isn’t BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe. How exceptional are market developments? Much rests on the answer. If these are extraordinary circumstances, then Japanese intervention becomes more likely. Of course, Japanese policymakers have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org