- Click to enlarge The pound to Swiss franc exchange rate has been steadied following comments from Mark Carney during a briefing on the global economy at the Barbican centre in London yesterday. I was fortunate to be in attendance and was struck by Carney’s confident manner, although he highlighted some major risks ahead which would be key for GBP/CHF rates. Sterling was weaker going into the talks, particularly...

Read More »Digital Gold Provide the Benefits Of Physical Gold?

– Will digital gold provide the benefits of physical gold?– Digital gold and crypto gold products claim to combine efficiencies of blockchain with value of gold– They are yet to provide the same benefits or safety as owning physical gold– National mints jumping in on the ‘sexy blockchain’ act – BOE declares bitcoin ‘not a currency;’ Royal Mint launches blockchain gold product– Digital gold, blockchain gold and crypto...

Read More »FX Daily, October 24: Dollar Begins Mostly Slightly Lower, and Risk is On to Start the Week

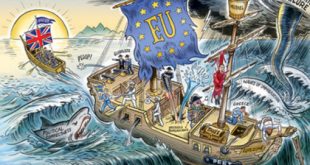

Swiss Franc Sterling vs the Swiss Franc has remained close to its lowest level in history caused by the aftermath of the Brexit vote back in June and more recently the announcement that Article 50 will be triggered by March 2017. Confidence in Sterling exchange rates has plummeted recently and until we get some form of assurances as to how the talks may go with the European Union we could see Sterling fall even...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

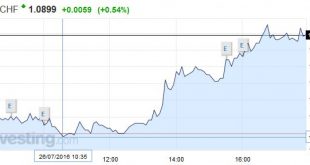

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

Read More »Brexit and what if means for the Bank of England

“Some market and economic volatility can be expected as this process unfolds,” Carney said in a televised statement in London after the referendum result. His comments followed Prime Minister David Cameron’s announcement that he will step down this year, which will inject political uncertainty into an already volatile period. His full announcement is below and his statement can be found here: [embedded content]...

Read More »The British Referendum And The Long Arm Of The Lawless

Submitted by Danielle DiMartino Booth via DiMartinoBooth.com, “Kings have long arms, many ears, and many eyes.” So read an English proverb dated back to the year of our Lord 1539. And thus was born an idiom that today translates to the very familiar Long Arm of the Law. It stands to reason that such a warning was born of feudal times when omnipotent and seemingly omnipresent monarchs personified the law, possessed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org