We expect the ECB to strengthen its forward guidance by linking the future path of policy rates to a new asset purchase programme.We estimate that a new QE2 programme worth at least EUR600bn would be needed for the ECB to close a 0.50% inflation gap. If anything, the decreasing marginal returns of QE and the risk of a de-anchoring of inflation expectations call for a more aggressive programme.How much does the ECB need to ease? QE size matters, but so do other parameters including the...

Read More »Euro area monetary policy – “Sintrapped”

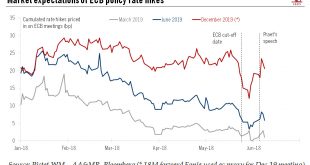

Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.In Sintra, Mario Draghi signalled the ECB’s unequivocal readiness for further stimulus “in the absence of improvement”. Although the final decision will depend on US-China trade negotiations, the Fed and economic data, the ECB is likely to deliver a comprehensive easing package in September.We now expect the ECB to adjust...

Read More »ECB: the end of constructive ambiguity

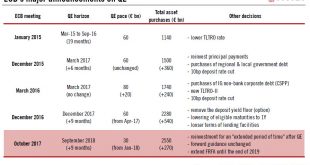

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation...

Read More »ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners). Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been...

Read More »ECB gets ready to make the leap

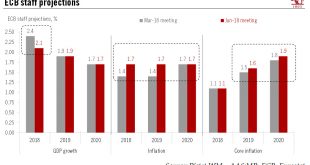

An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.We expect the staff projections to be revised lower in terms of GDP growth,...

Read More »PMIs point to downside risk to near term euro area growth

Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the situation prevailing a few months ago. The deterioration...

Read More »PMIs point to downside risk to near term euro area growth

Following another disappointing set of business sentiment indicators, speculation over a longer extension of QE is rising.Euro area flash PMI indices failed to stabilise in May. Details were somewhat less worrying than headline numbers and overall still consistent with a broad-based economic expansion, if only at a slower pace than last year. Our forecast of 2.3% GDP growth in 2018 still holds, but the balance of risks is now clearly tilted to the downside in sharp contrast with the...

Read More »ECB QE composition – some degree of constructive ambiguity

The ECB has hinted it intends to remain flexible when it comes to the composition of future asset purchases, with a chance that corporate bonds will play a bigger role.Arguably, the most important aspect of last week’s ECB quantitative easing (QE) announcement was that the programme will remain open-ended. As we have long suggested, the pledge to extend asset purchases beyond September 2018 can only be credible if there are enough German Bunds for the ECB to buy. Bund scarcity could be...

Read More »Bend it like Draghi

The ECB’s announcement on bond purchases leads us to expect its QE programme to end by Q1 2019, with a hike of the main refi rate in September that year.The European Central Bank’s (ECB) decisions today were in line with our and consensus expectations, including a slower pace of asset purchases (rescaled from EUR60bn to EUR30bn per month), a longer and open-ended extension (until September 2018, or beyond if necessary), and stronger forward guidance (committing to keeping policy rates at...

Read More »ECB preview: slower, longer, stronger

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org