With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does...

Read More »ECB preview: an end to net asset purchases

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation.At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does not represent a tightening of its policy stance. We also think the ECB will...

Read More »A successful bank should be boring

The main risk facing ECB watchers is that the next few meetings of the Governing Council will be increasingly boring and predictable. However, from the central bankers’ perspective, this may considered a sign of success, “like a referee whose success is judged by how little his or her decisions intrude into the game itself”, to quote former BoE Governor Mervyn King. Back to the economy, downside risks stemming from...

Read More »A successful bank should be boring

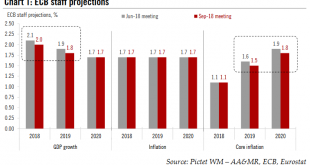

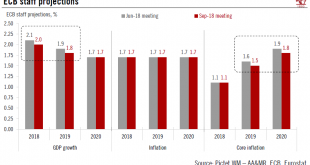

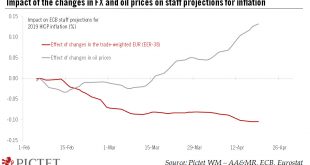

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff projections. In the end, downward revisions were...

Read More »ECB: the end of constructive ambiguity

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation...

Read More »The ECB’s steady hand

Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment. Indeed, Mario Draghi described the recent “moderation” in growth as the result of a pullback in sentiment from elevated levels, with economic...

Read More »The ECB’s steady hand

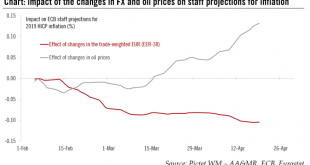

The ECB Governing Council acknowledges “moderation” in the pace of the euro area's recovery. It may wait until July before announcing its next policy decision.Another ECB meeting, another balanced message of confidence and prudence. Unsurprisingly, the statement today mentioned the deterioration in the data flow since March, but our impression is that the ECB is largely brushing off concerns about a soft patch in the economy for the moment.ECB president Mario Draghi said that the Governing...

Read More »ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” – in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi...

Read More »ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth...

Read More »ECB closer to the 2% inflation target than meets the eye

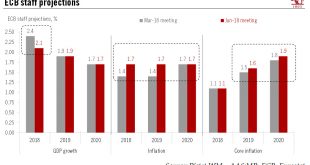

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org