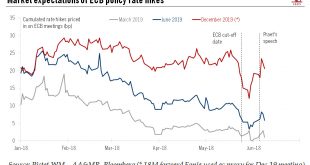

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation...

Read More »ECB gets ready to make the leap

The ECB has had essentially two options going into the June meeting: either a dovish decision but a hawkish communication (hinting at an imminent QE tapering), or a hawkish decision but a dovish communication (counterb alancing a tapering announcement with dovish sweeteners). Ever since economic indicators have started to deteriorate this year and risks to global trade have accumulated, ECB rhetoric has been...

Read More »ECB gets ready to make the leap

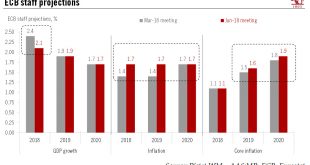

An announcement on quantitative easing is looking likely as early as next week. But the jury is out on what the central bank will actually say.Peter Praet’s hawkish comments on inflation this week did not surprise us in terms of substance but did in terms of timing. The view of the (usually dovish) ECB chief economist carries significant weight, and therefore an announcement on QE is now likely at the 14 June meeting.We expect the staff projections to be revised lower in terms of GDP growth,...

Read More »ECB meeting preview: guide me if you can!

We see little incentive for the ECB to precipitate things at the beginning of the year, especially as core inflation continues to disappoint, but there could be hints at “gradual changes” in forward guidance.We expect no policy decision and no major change in the ECB’s communication at its 25 January meeting. There is no incentive for the ECB to fuel further hawkish market re-pricing at this stage, especially after core inflation disappointed again and the EUR has strengthened once more. The...

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB...

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data.Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB will act in 2018, announcing a tapering of its asset purchase programme in...

Read More »ECB preview: slower, longer, stronger

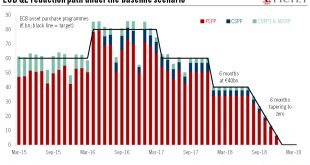

Recent signals suggest that the ECB is likely to announce next week the extension its asset purchases for nine months, at a reduced pace of EUR30bn. We expect corporate bonds to form a bigger part of total purchases.Recent ECB communication has been remarkably consistent in signalling a ‘slower for longer’ QE extension into 2018. In light of these signals, we expect the ECB to announce at its 26 October meeting that asset purchases will be extended for nine months, until at least September...

Read More »Scenarios for QExit

With important decisions on the future of its bond-buying programme looming, what are the ECB’s options?The European Central Bank (ECB) is expected to announce the bulk of its decisions on quantitative easing (QE) at its 26 October meeting. We would expect a broad commitment to extend QE beyond 2017 at a reduced pace, but several options are possible and additional technical details could be postponed to the 14 December meeting. Our baseline scenario remains that asset purchases will be...

Read More »ECB, a forced taper

As the ECB comes closer to a decision on the future of its quantitative easing programme, we look at the choices and dilemmas it faces.With the economic recovery in the euro area looking increasingly robust and broadbased, the ECB appears set to embark on a policy normalisation path, gradually phasing out of negative interest rate policy (NIRP) and quantitative easing. The ECB’s new narrative implies that the era of crisis-fighting unconventional monetary measures is over, as deflation risks...

Read More »ECB: first (hawkish) move since 2011

The ECB took its first step towards a very slow normalisation of its monetary stance – a very small one, but symbolically important nonetheless.As we expected, the ECB moved to a more neutral stance today by describing the risks to economic activity as “broadly balanced” and by removing its bias to even “lower” policy rates. The symbolic significance of the move should not be underestimated. It is the first time that the balance of risks to growth has been upgraded since August 2011, just...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org