With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does...

Read More »ECB preview: an end to net asset purchases

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation.At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end. However, it is likely to stress that the end of the net asset purchase programme does not represent a tightening of its policy stance. We also think the ECB will...

Read More »ECB: the end of constructive ambiguity

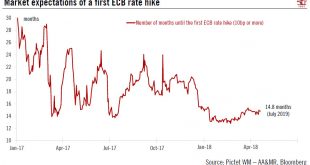

The ECB provides a pretty clear signal that quantitative easing will be wound up at the end of this year, with a first rate hike coming in 2H 19.Based on its upgraded assessment of the inflation outlook, the ECB delivered the QE tapering that the market expected, signalling the end of net asset purchases in December 2018 following a final three-month extension of EUR15bn per month. Importantly, today’s decision is flexible and conditional, “subject to incoming data” confirming the inflation...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case. If anything, the soft patch should only...

Read More »ECB policy: Stop Worrying and Love the Soft Patch

Weaker economic momentum and low inflation in the euro area is unlikely to affect ECB monetary stance.We see little incentive for the ECB to change its broad assessment of the economic situation at the 26 April meeting. The normalisation of the monetary stance will continue to be dictated by the ECB’s guiding principles of confidence, patience, persistence, prudence, and gradualism.Talk is cheap, and Mario Draghi could still put more emphasis on those contingencies that would force the ECB...

Read More »Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers International Women’s Day highlights the underreported UK Women’s pension crisis 2.66 million affected by UK government’s change to state pension act Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees Changes by government highlights the counterparty risks pensions are exposed to Global problem as pensions gap of...

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB...

Read More »2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data.Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year. Yet our faith in ECB’s courage knows no bounds and this still feels relevant today, with the caveat that the ECB will act in 2018, announcing a tapering of its asset purchase programme in...

Read More »ECB preview: close to target…by 2020

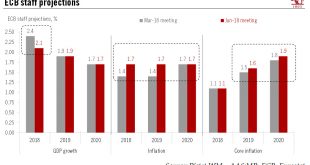

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth...

Read More »ECB preview: close to target…by 2020

At the 14 December meeting, attention will be focused on the ECB staff forecasts and any changes in communication on plans for unwinding QEs. The main talking points ahead of the ECB’s last policy meeting this year on 14 December are the new staff projections for growth and inflation as well as forward guidance on asset purchases. We expect higher oil prices to push ECB staff forecasts for inflation higher, to 1.4% in 2018 and 1.6% in 2019. A lower...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org