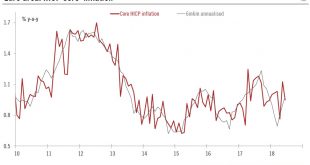

We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The...

Read More »Euro area core inflation to rise again after Easter

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »Euro area core inflation to rise again after Easter

Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a...

Read More »Watch out for a rebound in euro area core HICP in November

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the...

Read More »Euro area: solid growth, but inflation still under par

GDP figures confirming a strong and steady expansion have yet to turn up in core inflation data.According to preliminary Eurostat estimates, euro area real GDP increased by 0.6% q-o-q in Q3, slowing marginally from an upwardly-revised 0.7% in Q2. A breakdown by expenditure components will not be released until 14 November, but domestic demand was likely the key driver in the euro area’s solid momentum.At a country level, France and Spain are the first of the big four euro area economies to...

Read More »Rebound in euro area core inflation

While core inflation was slightly stronger than expected in June, we believe it will rise only slowly for the rest of this year.Euro area ‘flash’ HICP inflation eased to 1.3% y-o-y in June (down from 1.4% in May) while core inflation increased to 1.1% (up from 0.9% in May). Both figures were slightly above consensus expectations, but our overall assessment is unchanged. The bottom line from the June inflation report is that the broad picture remains unchanged – we continue to expect euro...

Read More »Core inflation clouds ECB’s next move

Although flash inflation was down in May, we expect core prices to pick up gradually and the ECB to move very cautiously toward policy normalisation.Euro area ‘flash’ HICP inflation came in at 1.4% y-o-y in May (down from 1.9% in April) while core inflation eased to 0.94% (down from 1.2%), both slightly below consensus expectations, as energy-related base effects and Easter distortions faded. We forecast euro area inflation to remain relatively stable in the next few months before core...

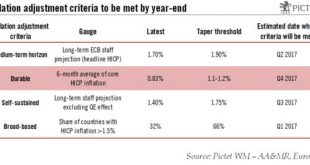

Read More »Inflation and the ECB (part 1): the four criteria

Euro area inflation was well above consensus in January. However, we believe that the ECB will look through this spike in (imported) inflation as underlying price pressures remain subdued.Although euro area headline inflation jumped to 1.8% in January, the closest it has been to ECB’s 2% target since Q1 2013, core inflation remained low at 0.9%. We continue to expect the ECB to wait until September before it announces a tapering of its asset purchases in 2018.A “sustained adjustment in...

Read More »Euro area headline inflation rises at fastest pace since September 2013

Nonetheless, the acceleration in headline figures in December masks subdued core inflation. We believe weak core prices will mean the rise in headline inflation will soon stall.Euro area flash HICP inflation rose from 0.6% in November to 1.1% year on year (y-o-y) in December, while core inflation increased slightly to 0.9%, both above consensus expectations. The breakdown by components showed that the main driver of the increase was energy prices.In the next few months, euro area inflation...

Read More »Euro area core inflation lacks momentum

Macroview Headline inflation in the euro area doubled in September as the impact of weaker energy prices declined, but core inflation was stable. As expected, euro area flash HICP inflation rose to 0.4% year on year (y-o-y) in September, from 0.2% in August as the impact of weak energy prices continued to fade. But measures of core inflation were slightly weaker than expected, remaining stable at 0.8% y-o-y against expectations of a small rise.Weaker industrial goods inflation in particular...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org