High yield bonds are vulnerable to a rise in spreads from their current low levels. Default levels could also rise for US high yield.US and euro high yield have performed strongly between Donald Trump’s election as US president and the end of June. However, our analysis of fair value suggests there is potential for a widening of spreads and a rise in default rates ahead.Our multi-factor model of high-yield corporate spreads enables us to forecast US and euro high-yield spread levels based on four broad factors. These are:Trends in equities, as high yield shows a significant positive correlation with the performance of equities.Sector exposure (US high yield has large exposure to the energy sector, including US shale oil producers), while euro high yield is largely exposed to

Topics:

Laureline Chatelain considers the following as important: Bond market volatility, Euro high-yield spreads, High yield default rate, Macroview, US high-yield spreads

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

High yield bonds are vulnerable to a rise in spreads from their current low levels. Default levels could also rise for US high yield.

US and euro high yield have performed strongly between Donald Trump’s election as US president and the end of June. However, our analysis of fair value suggests there is potential for a widening of spreads and a rise in default rates ahead.

Our multi-factor model of high-yield corporate spreads enables us to forecast US and euro high-yield spread levels based on four broad factors. These are:

- Trends in equities, as high yield shows a significant positive correlation with the performance of equities.

- Sector exposure (US high yield has large exposure to the energy sector, including US shale oil producers), while euro high yield is largely exposed to banking.

- Economic momentum, as high-yield spreads tighten when the economy accelerates and widen when it slows.

- Monetary policy, with changes in lending conditions a significant leading indicator of the default rate.

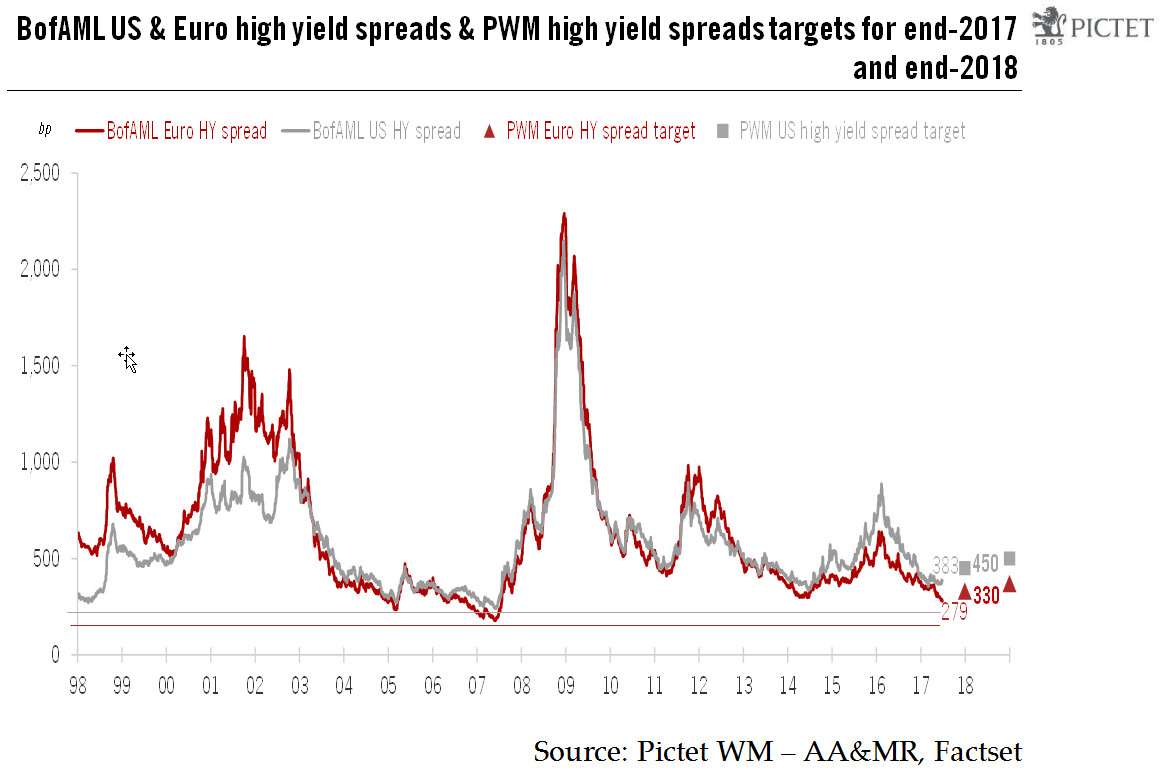

Assuming that the VIX remains at its current low level of around 10, our multi-factor model suggests that the US high-yield spread could widen from its 26 June level of 383 basis points (bp) over Treasuries to a range of 430–450 bp by end of 2017 and to 500 bp by end 2018. This is higher than our previous target of 400 bp. Euro high-yield spreads could widen from its current level of 279 bp to 320-340 bp by end of 2017 and to 370 bp by end 2018, figures that remain in line with our previous target.

However, should the level of implied volatility rise to around 14, high-yield spreads could widen even more. Given our expectations for US Treasury yields to rise, such widening would lead to negative total returns on US high yield. And investors also have to remember that the high-yield market becomes particularly illiquid in times of market stress, making the unwinding of positions extremely difficult.

We also believe that US high yield in particular is vulnerable to subdued oil prices, given the large proportion of the market occupied by energy producers. By contrast, relatively orderly resolutions in European banking have contributed to what in our view is a durable improvement in investors’ perception of the risks linked to euro area banks in that sector. For this reason, we think the euro high-yield default rate should stay around its current low level of 2% into 2018.