Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020. The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can...

Read More »Why has euro inflation stayed so low?

Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can legitimately ask why inflation remains so low in the euro area, with the underlying...

Read More »Rebound in inflation data brings some relief to the ECB

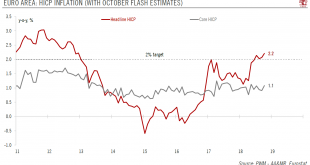

Strong wage growth should support the recovery of euro area inflation in the coming months. Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in...

Read More »Rebound in inflation data brings some relief to the ECB

Strong wage growth should support the recovery of euro area inflation in the coming months.Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October. Energy inflation rose to 10.6% y-o-y from 9.5% y-o-y in September. Food, alcohol and tobacco inflation eased, by 0.4 percentage...

Read More »Services dent euro area core inflation in June, but no reason to panic

We expect core inflation to rise gradually later this year.The final reading for headline inflation in the euro area (HICP) was confirmed at 2.0% y-o-y in June (up from 1.9% in May), reflecting higher energy price inflation. This is the highest rate of inflation since February 2017.However, core inflation (HICP ex-energy, food, alcohol and tobacco) was revised down to 0.95% y-o-y, (rounded down to 0.9%) from a flash estimate of 0.97%. By comparison, core inflation in May was 1.13% y-o-y. The...

Read More »Euro area core inflation to rise again after Easter

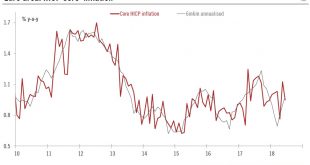

The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a potentially larger FX pass-through. We are not too worried, as weakness in non-energy...

Read More »Euro area core inflation to rise again after Easter

Euro area core inflation has been affected by a series of transitory factors in recent months, resulting in higher volatility in a number of HICP sub-components.The ECB’s Governing Council may have to wait a little longer to get a clearer view of where euro area core inflation is heading in the near term. The early timing of Easter this year has made travel-related services prices more volatile. Another reason is that an unexpected drop in core goods inflation has fuelled concerns over a...

Read More »ECB closer to the 2% inflation target than meets the eye

During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation. The key word was “confidence” – in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its mandate. That said, ECB President Mario Draghi...

Read More »ECB closer to the 2% inflation target than meets the eye

Euro area GDP growth and inflation forecasts have been revised up, reflecting growing confidence over the macro outlook.During an uneventful ECB press conference on Thursday, attention centred on the new staff projections. The headline projections were in line with expectations, albeit slightly higher on GDP growth and lower on inflation.The key word was “confidence”- in a strong expansion leading to a “significant” reduction in economic slack, as well as in the ECB’s capacity to meet its...

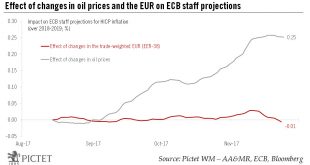

Read More »Oil prices to push ECB staff projections for inflation slightly higher

We also expect the ECB staff to revise higher its GDP growth forecast for the euro area in 2018 and 2019.This week was all about stellar euro area PMIs and hawkish nuances in the accounts of the October ECB meeting. However, the arrival at another deadline went unnoticed – the cut-off date for ECB staff projections, which implies that financial inputs will be derived from market expectations as at 23 November. Using elasticities derived from OECD and ECB models, the chart below shows the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org