The general improvement in hard data holds out the possibility of a positive surprise when preliminary GDP figures are announced next week.Next week will be a busy one for Europe, with lots of data releases: European Commission business survey (April); advance GDP (Q1); M3 money supply (March); HICP flash estimate of inflation (April); and final manufacturing purchasing manager indices (PMIs, April). The advance Q1 GDP will be especially closely watched. No euro area GDP breakdown will be...

Read More »Euro slides against the dollar on ECB dovishness

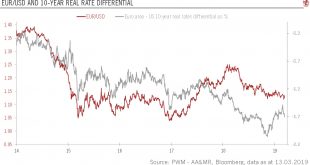

The euro has declined further against the dollar but should strengthen over next 12 months The euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months. That being said, recent euro area PMI surveys tend to...

Read More »Euro slides against the dollar on ECB dovishness

The euro has declined further against the dollar but should strengthen over next 12 monthsThe euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.That being said, recent euro area PMI surveys tend to favour a stabilisation of economic activity (after a relentless decline since...

Read More »Innovation shock reshapes economic dynamics

Head of Asset Allocation & Macro Research and Chief Strategist with Pictet Wealth Management, Christophe Donay shares his thoughts on the perennial relationship between innovation and economic growth.When analysing the current economic regime and assessing the potential for a shift in that regime, it is vital to take innovation into account. Demographic trends and productivity gains are commonly identified as the two main drivers of real economic growth. And innovation is a critical...

Read More »Euro area PMIs: still little good news below the surface

We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast.Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q...

Read More »Euro Area PMIs: Still Little Good News Below the Surface

We see little evidence of a rebound in business taking shape, reinforcing our revised 2018 GDP growth forecast. Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in...

Read More »Euro area: The sky is the limit

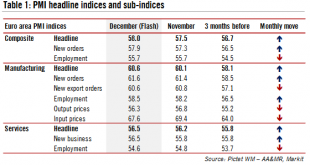

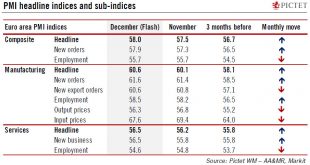

Momentum in the euro area picked up further at the end of the year. The flash composite purchasing managers’ index (PMI) increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2). The improvement was once again broad-based across sectors. Both the manufacturing (+0.5 to 60.6) and services (+0.3 to 56.5) indices improved in December, with the former reaching its highest level since the...

Read More »Euro area: The sky is the limit

The latest flash purchasing managers index surveys showed robust momentum for the euro area. We maintain our GDP growth forecast of 2.3% for 2017.Flash purchasing managers’ indices (PMIs) for the euro area ended the year on a strong note. The composite PMI increased to 58.0 in December, from 57.5 in November, above consensus expectations (57.2).The robust momentum was led by a booming manufacturing sector, while services sentiment also improved.The breakdown by sub-indices was pretty strong,...

Read More »Watch out for a rebound in euro area core HICP in November

The surprising fall in euro area core inflation in October was largely driven by one-off factors we expect will be partly reversed.This week’s final euro area HICP report has provided us and the ECB with greater clarity over the drivers of the surprisingly large fall in core HICP inflation, from 1.11% to 0.89% year-on-year in October. The drop was largely led by one-off moves in Germany (airfares, package holidays) and by education prices in Italy. Although the latter will weigh on the...

Read More »The euro area recovery is continuing to broaden out

Latest growth data indicate continuation of a strong and stable recovery. Our GDP forecasts remain unchanged.Euro area headline GDP growth was confirmed at 0.6% q-o-q in Q3.At the country level, Germany surprised to the upside, posting GDP growth of 0.8% q-o-q in Q3 and beating consensus expectations. The impressive performance was driven by exports and investment in equipment and machinery. Turning to Italy, economic activity strengthened in Q3. After a rise of 0.3% q-o-q in Q2, real GDP...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org